|

|

![]()

|

MARTINS BANK AT YOUR SERVICE – FOREIGN

EXCHANGE & TRAVEL |

![]()

|

The

provision of international services in branch banking has come full circle.

At Martins Bank it begins with a select few offices whose work seems almost

secretive to those who do not work in them (see “Foreign to You “article

below). The service rolls out to all

branches through the provision of currency and travellers’ cheques, and in

the twenty-first century it has largely disappeared, with currency shops

widely found on high streets and in supermarkets. To say that the Bank operates “OVERSEAS BRANCHES” is perhaps a little misleading, as it implies some kind of network of offices

abroad. |

WHY NOT ALSO VISIT THESE

FEATURE PAGES |

|

||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||

|

What it

actually refers to, is three key branches in England that process

international payments, stocks and shares and securities, Martins’

Cross-Channel Branch, which operates on the Dover to Calais sailings, and an

office in Paris which gathers statistical information on European and World

trade and reports directly to the Bank’s Information Department at Head

Office in Liverpool. From 1966

Martinplanning is rolled out as the way to save and plan for that trip of a

lifetime. Alongside the specialist provision of international trade and

travel services in Liverpool Manchester and London, every one of Martins

Bank’s Branches and sub-Branches is able to deal with the issue of foreign

currency and travellers’ cheques to holidaymakers and

business travellers, and forty-one of them are designated “SPECIAL

FOREIGN BRANCHES”

including the somewhat unlikely yet exotic sounding “BRADFORD

OVERSEAS”! Originally Martins Bank’s

three overseas offices were known as “Foreign” branches. Whilst they do much

more than simply handling travellers’ cheques, it is worth noting that the

payment of these cheques is the first and only part of Martins clearings to be

fully automated and handled by computer.

The work of the Overseas Branches is complex, varied and integral to

projecting and maintaining a good image of the Bank around the World…

|

||||||||||||||||||||||||||||||||

|

MARTINS BANK’S MAIN OVERSEAS

TRAVEL AND TRADE BRANCHES |

||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

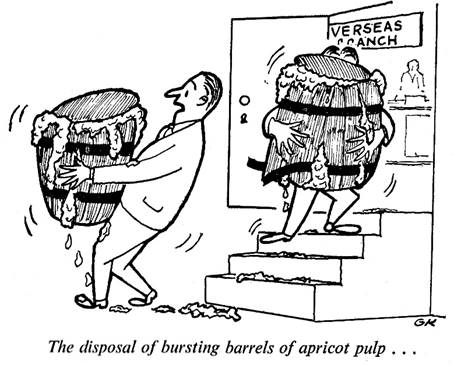

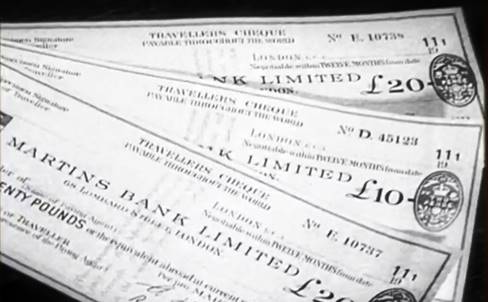

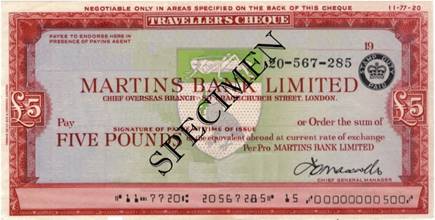

But it's

quite simple; when I found I had signed it wrongly I tore it up.' Though not

quite the normal treatment to accord a Travellers' Cheque this was, in fact,

one of the many explanations offered last year in support of a refund

application. Over five million pounds worth of Travellers' Cheques were

issued in 1965, to say nothing of currency notes, but this formed only a

small part of the Bank's total overseas business, some of which could hardly

be termed 'banking'. We heard, for

example, of the appeal from a very worried customer whose daughter, living in

New York, had just advised her family that she was getting married in a few

days' time. Naturally they were anxious to know something of the prospective

bridegroom, and who better to turn to than the Bank ? Their fears were soon

dispelled by a cable from one of our banking friends in New York showing the

groom to be a 'good catch'. One of the most important functions of the

Overseas management is to foster close personal connections with our foreign

correspondents and to keep up to date with the ever changing political and

economic conditions throughout the world, thus providing current information

for the use of customers and important data when considering facilities for

overseas correspondents. Clearly it would be folly to grant excessive

facilities to a bank in a country whose economy is weak or whose government

is unstable, or to maintain large balances in, or stocks of notes of, a

country whose currency is likely to be devalued. Both situations call for

appropriate protective measures.

The

Overseas management make regular visits abroad and when visiting European countries

are accompanied by M. Francois Garelli, our Continental Representative, whose

office is in Paris and who keeps them in constant touch with happenings on

the Continent. To most of us the word 'work' may seem inappropriate when

talking of visits to such places as New York, Hong Kong, Bermuda or Mexico

City, but after seeing some of the itineraries and the number of calls made

we conceded that it might be justified. Before the trip starts there is a lot

of careful planning to be done: they do not launch themselves Bond-like into

the blue. Hotel reservations must be made; rail and plane bookings, often

entailing uncomfortable overnight travel, fixed; appointments arranged;

statistics and reciprocity figures studied. These trips tend to follow a

pattern averaging six or seven banking calls each day in addition to other

engagements. Discussions range over local conditions, the political and

economic climate, possible banking changes, local banking practice, and our

business relationship with the bank being visited. At the end of the day

reports on each of the visits must be completed for mailing back home—that

night if possible. Then there is the diary to be written up and, thanks to

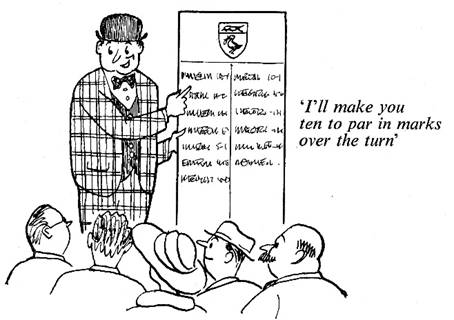

the advent of 'drip-dry', the laundry to be done. Mention of 'Exchange Dealers' conjures

up a vision of flashing lights, ringing phones, clattering Telex machines and

whirring calculators. We found this picture of the dealers' room real enough

and made more confusing by a continual patter containing such unintelligible

phrases as 'How would you swop 10th August against 14th December in

dollars?', 'We're looking for the bid for a few six months cross', 'How do

you deal in Paris over the weekend ?', and I’ll make you ten to par in marks

over the turn'. We asked for the translations and hope these will make everything clear. 1.

A

request for a dealing rate in U.S. dollars against sterling, purchasing or

selling the early date against a counter deal in the longer date. 2.

An

indication that the dealers are potential sellers of Canadian dollars for

delivery in six months' time against U.S. dollars and would welcome a firm

bid. 3.

An

enquiry as to how the market deals in French francs against sterling for

delivery on Friday against delivery on Monday. 4.

An

offer to deal in Deutsche Marks against sterling for delivery on the last day

of this month against the first day of next month at a rate of 1/10th

Pfennig to par. Underneath

the bustle and the jargon the dealers' smooth transactions total many

millions of pounds and play their part in maintaining London's position as

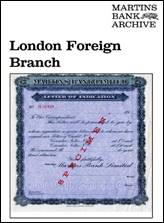

the major Foreign Exchange Market in the world. Although Exchange Control is

now less rigorous, 'Authorised Banks' are still heavily involved in its

administration. As well as authorising the more routine applications the

Overseas branches assist customers in preparing and submitting applicators to

be considered by the Bank of England. These may be fairly straightforward as,

for example, an application dealing with the purchase of a holiday villa in

Spain. But they may be more involved, concerned

perhaps with the giving of a guarantee in support of borrowing abroad by the

foreign subsidiary of a United Kingdom Company. In addition, the Overseas branches give a

considerable amount of advice and guidance to customers and branches on

Exchange Control matters in general, sometimes accompanying customers at

personal interviews at the Bank of England. Changes in Government policy such

as the imposition of

sanctions against Rhodesia can directly affect the work of the Overseas

branches and departments. Other changes, such as the import surcharge, have

an indirect effect through their influence on customers' business. All changes, however, bring their

quota of queries and calls for advice.

|

||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Going Away…

Going away couldn’t be easier with Martins

Bank! They have everything to help

you, from handy guides to your destination, to those all important travellers

cheques to spend when you get there… Martins Bank’s specialist OVERSEAS BRANCHES at Liverpool, Manchester and

London are at your disposal, and the Bank’s INFORMATION

DEPARTMENT regularly

reviews and reports on business trends in a number of countries.

“How

Martins Bank can help you when travelling either at home or abroad, is

described briefly in our leaflet “Money for Travel”. Any branch will gladly give you a copy,

whether you are a customer of Martins Bank or not.”

Money for Travel… If you are thinking of travelling, either in this country or

abroad, there are many ways in which the financial services provided by

Martins Bank can help you. These services are described briefly in the following

notes, but any further details which you may require will be gladly

supplied at any of our branches. Where travel is outside the Scheduled

Territories please be guided by the information given in the paragraph on

Exchange Control. |

|

|||||||||||||||||||||||||||||||

|

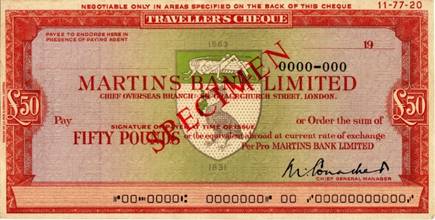

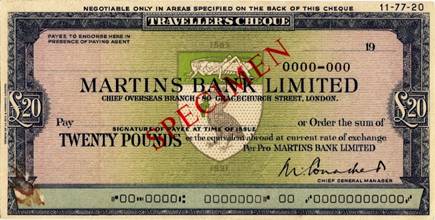

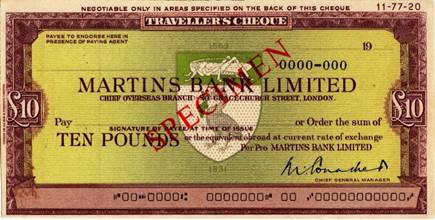

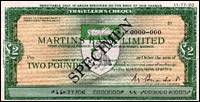

Travellers’ Cheques This is generally the safest and most convenient way of carrying money. Martins Bank

Travellers' Cheques are issued in units of

£2, £5, £10, £20 and £50, and if

they should be lost or stolen you can obtain a prompt refund of their value, subject only to your signing a simple form of

declaration. The cheques can be

encashed not only at the branches

of all the main banks in the British Isles but also in most places abroad,

and are Frequently accepted in

payment at hotels and stores and on ships. Foreign Currency

Travellers’ Cheques Travellers' Cheques expressed in certain foreign currencies and

issued by our correspondent banks abroad can be ordered, if required, through any branch of

Martins Bank. When travelling in the United States of America,

particularly in areas away from the main centres, it is advisable to take at least

a part of one's requirements in the form of Travellers' Cheques in

dollar denominations. Circular letters

of credit Circular Letters of Credit are issued by Martins Bank for amounts

of up to £2,000, and enable the holder to obtain funds as required

from any of our branches and from numerous appointed offices of other

banks at home and abroad. Open Credits An Open Credit is useful for anyone likely to stay for some time in

one place, since it provides for encashment of one's own cheques, up to

an agreed limit, at a particular office of Martins Bank or of

another bank at home or abroad. Transfers by Air

Mail or Cable The Bank can make arrangements by either air mail or cable for

funds to be paid over through a bank abroad to a particular person on

application and after identification. This is useful for travellers already

abroad who find themselves in urgent need of money. Foreign

Currencies When you go abroad it is wise to carry some foreign currency

with you in addition to any other means of payment which you may have. This will ensure

that" you can cover your immediate needs on arrival at your destination, particularly if

you are likely to arrive outside banking hours—it should be noted, for

example, that banks abroad, and especially in Europe, are often closed on

Saturdays. Most foreign

currencies are available in this country

and can be obtained through any

branch of our Bank. When such foreign

currency is being obtained, it is

advisable to ascertain from the branch concerned what restrictions, if any, are in force in respect of the import and export of currency for the countries to be visited. Exchange Control If you are going abroad and your destination is within the

Sterling Area (technically known as “the Scheduled Territories”), there

are no Exchange Control regulations which limit the amount of money

you may take, although there

is a limit to the total which may be taken

in the form or sterling or other

bank-notes. This restriction,

however, does not apply to the Isle of Man, the Channel Islands or the Irish Republic. For

journeys to countries outside the Sterling Area the amount of monev which you may take with you in any form is governed be Exchange Control regulations. These regulations, of

course, also govern the amount of

money which may be transferred to

you when you are abroad. The total

amount of money which anyone is permitted

to have when abroad will depend on the purpose and duration of the journey concerned, and information about the current regulations

will gladly be given to you at any branch of Martins Bank. You can obtain

the official leaflet “Notice to

Travellers” at the same time.

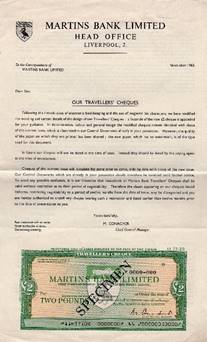

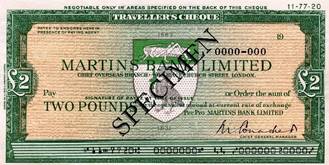

Martins

Bank Travellers Cheques…

1963: Electronic Book-keeping has

arrived…

There is also space for an account number (the seven digit

serial number of the cheque). A

transaction code – 44 – will be used to denote a Travellers’ Cheque. The

cheques no longer bear evidence of Stamp Duty paid, and they also become

open-dated for the first time. Previously the validity of the Cheques had to

expire twelve months from the date of issue.

When you

purchase your cheques, Martins’ friendly and helpful staff will go to

extremes to ensure that you are aware of the rules governing the use of the

cheques, and that you know just what to do in the event that cheques are lost

or stolen. So before your journey

starts, you should take a moment to remind yourself:

1.

Your cheques

will be issued in an attractive wallet. 2.

Please be sure

to keep your unused cheques in the wallet, as it also contains full

instructions for use. 3.

Please be sure

to read the Cautionary Notice - this is a step by step guide to using and

looking after your Travellers Cheques. 4.

Remember: As

the cheques themselves are as good as cash, you must treat them like any of

your other valuable personal property. 5.

Don’t forget

to record the details of the cheques that you use – this will help you keep

track of your spending, and is of particular use to the Bank if the other

cheques become lost or stolen. 6.

This sheet

also provides a reminder of how to call Martins from abroad if such a problem

arises. 7.

|

||||||||||||||||||||||||||||||||