|

|

![]()

|

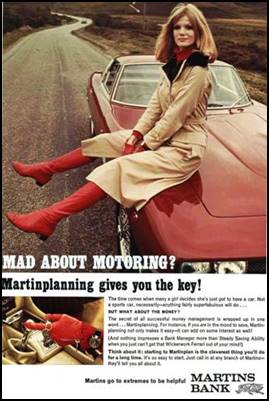

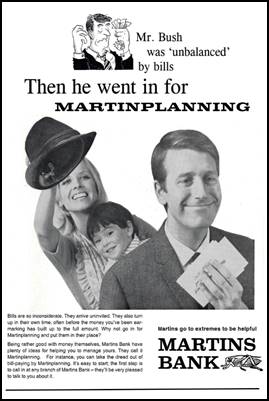

MARTINS BANK AT YOUR SERVICE – MARTINPLANNING |

|

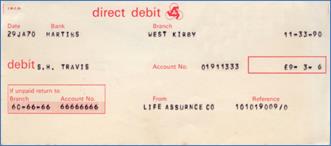

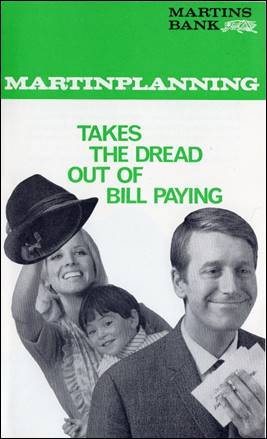

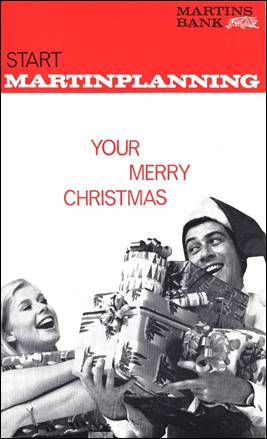

The drudgery and headaches of paying the regular

household bills can now be helped by use of standing orders, credit

transfers, and the newly invented direct debit. “Going Away”, in particular

to some foreign clime, can now be sold as a dream that has its own Martins

Bank solution. Despite the impending merger with Barclays, this particular

Martins product is marketed right until the very end…

Getting

away from it all . . . |

|

||||||||||||||||||||||||||||||||||

|

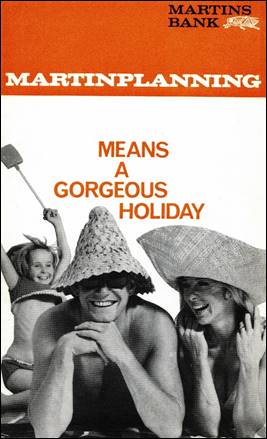

Holidays

are meant to be enjoyed. That's where Martinplanning comes in to make

those colourful travel brochures come true, Martinplanning is the way we have

of helping our customers make the most of their money. We draw on our years

of experience in managing money to help you get the best from yours.

Martinplanning covers every aspect of money for holidays. It can help you

save up for them, and earn good interest on your savings. It means help with everything to do with

foreign currency. There are Travellers' Cheques you can cash at home or

overseas, or you can have an arrangement enabling you to cash your own

cheques here or abroad where there's a bank. Martinplanning means help with

other things that go to make a carefree holiday, too. Seeing that your

valuables are kept safe and sound whilst you're away, for example. Or

supplying you with Travel Cards packed with all sorts of useful information

that's hard to find anywhere else.

Martinplanning, you see, is flexible and personal, tailored to the special needs of each individual

customer. Why not have a word with the Manager about it? He can help you to

make the holiday of your dreams a reality—without putting you in penury for

months afterwards.

|

|||||||||||||||||||||||||||||||||||

|

What is so radically different to

today’s hard-sell tactics, is that Martins is encouraging customers to SAVE

for what they want, and then make those savings work as hard as they can to

fulfil dreams. Martinplanning does also include personal loans, and on the

eve of the merger with Barclays, Martins offers the American Express Credit

Card at a preferential rate of interest – in direct competition with

Barclaycard.

|

|||||||||||||||||||||||||||||||||||