|

|

|

|

WHY NOT ALSO VISIT THESE PAGES |

|

|

|

|

|

|

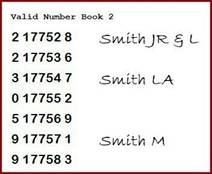

Here, we examine how numbers take over British banking, and

also quickly take away from us the kind of personal service that involves

knowing the customer by his or her face, and most importantly by NAME…

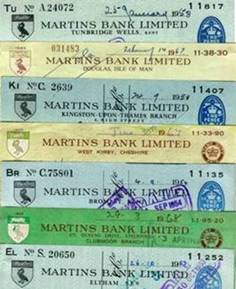

The National Number

METROPOLITAN BRANCHES cover Greater

London and consist of two digits after the 11. e.g. 1124 COUNTRY BRANCHES make up the rest of the country, and

bear three digits after the 11. e.g. 11056. Martins Branches in the Channel Islands and Isle of Man are allotted a

range of special numbers between 79001- and 79199. In the examples on the

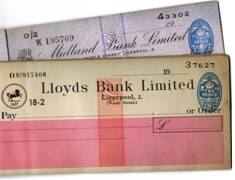

left, the Bank Number for Lloyds is 3, and 4, for Midland Bank. When Sorting Code Numbers arrive, the bank

numbers will be changed slightly, to 30 and 40.

The Sorting Code Number and the Account Number…

The British bank account number is nowadays almost

universally EIGHT digits,

although Martins uses seven until merging with Barclays, and Lloyds Bank uses

seven until is takes over the TSB in 1991. At the time of Barclays merger,

Martins numbers will change to temporary eight digit account numbers, and

later be replaced by Barclays’ eight digit numbers. Now comes the clever bit. All bank computers run a special algorithm

that performs a calculation against both the sorting code and the account

number. The outcome of the calculation

determines whether an account number is correct and issued for use with a

particular sorting code. Each account

number contains a common set of digits, which usually advance numerically

upwards, and one or two digits which are used to compare the number against

the sorting code of the branch. The

branch computer checks the account number on input, and the mainframe

computer checks it again on receipt. Before the advent of the more powerful

banking computers, account numbers are issued from printed books (valid

number books) which in theory contain far more account numbers than any

branch is ever likely to need – therefore even the major branches with

thousands of accounts should never run out.

Some banks will continue to issue account numbers in this way until

the early 1990s. The numbers are

allocated by imposing alphabetical

order onto numerical order,

as follows: ·

The account

numbers are printed with the numerical order running upwards in value – in

this case through the rightmost six digits.

·

The first and

last digits have been pre-determined to enable the computer to compare them

with the branch sorting code to ensure that the account number “belongs” to a

particular branch.

·

At this point

in the development of computerised accounting, the programming skills and memory

capabilities are just not able to have every account sorted into alphabetical

order each day by the computer.

·

So, a simple

but clever method is devised to enable accounts to remain in alphatical order

for the benfit of staff looking at lists and reports, but also to remain in NUMERICAL

order to allow the computer to work more efficiently and quickly: Just as the

account numbers run upwards in value, they are allocated to account name

upwards in both numerical AND alphabetical order. Our example simplifies this procedure for

presentation – Normally much more space would be left between names,

particularly in the case of common surnames such as “Smith” for which there

might be a large number of accounts held.

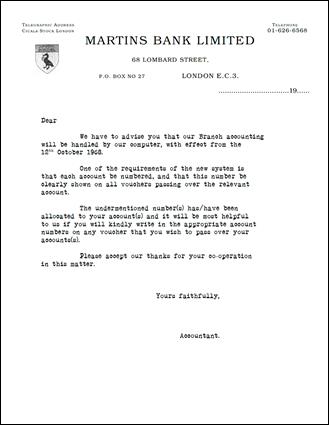

The letter shown here was used by Martins Bank in 1968 to

communicate to customers of 68 Lombard Street Branch that their accounts were

to be given numbers. It was

accompanied by the leaflet “Computers and Your Account”. You can tell by the language used in the

letter, that the Bank is all too aware of how contentious this issue of

account numbers is for customers, and that some careful “tiptoeing” is

required so as not to upset those with large amounts of money in their bank

accounts - Back then, it was the bank that served the customer, a far cry

from the twenty-first century, where if you don’t like what your bank is

doing, they will be happy to see you go somewhere else, rather than accommodate

your needs! Where previously all that was required of you by your bank was

your name, you are now to be known also by your number. This does not of course, not go down well

with everyone, and customers claiming they do not know or even have any idea

where to find their account number, is something bank cashiers have to put up

with for DECADES to come!

That’s probably quite enough about numbers for now, save

to note with some sadness that it is these innocent strings of quite cleverly

arranged digits that are instrumental in replacing the cashier’s personal

knowledge of the customer, and will bring about today’s delay in recognition

of you, by many bank staff until the moment your details appear on the screen

in front of them. At which point,

suddenly, they seem to know everything about you…

|

||