|

November

1968: “A member of the Barclays Group”…

|

|

A

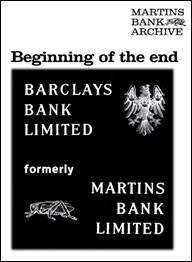

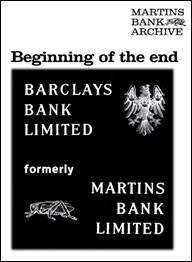

rather curious thing happens between the two official merger dates of 1

November 1968 and 12 December 1969 – Martins still exists under its own name albeit as

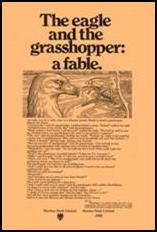

“A member of the Barclays Group of Companies”. The press is provided with a

number of advertisements such as “The Eagle and the Grasshopper – a Fable”

and “The End of the Beginning” which are designed specifically to soften up

those who might still oppose the takeover of Martins. Despite all that, for

one last time Martins is allowed its own branded customer leaflet campaign,

designed to promote just about every product that Martins can still sell at

this time. A

rather curious thing happens between the two official merger dates of 1

November 1968 and 12 December 1969 – Martins still exists under its own name albeit as

“A member of the Barclays Group of Companies”. The press is provided with a

number of advertisements such as “The Eagle and the Grasshopper – a Fable”

and “The End of the Beginning” which are designed specifically to soften up

those who might still oppose the takeover of Martins. Despite all that, for

one last time Martins is allowed its own branded customer leaflet campaign,

designed to promote just about every product that Martins can still sell at

this time.

|

WHY NOT ALSO VISIT THESE

PAGES

|

|

|

|

|

|

“Everyone Needs a Bank

Account” is one of these - a glossy 26 page brochure, which is reproduced

here, and evokes perfectly in words and pictures this optimistic – but

sadly short-lived – period in the late 1960s. Look out for the major plug for American

Express Cards which is another surprise from Martins – Barclaycard is well

established at this time, and has even been marketed on television in

Scotland to customers of another Barclays subsidiary – The British Linen

Bank. (You can read more about this and watch the TV ad on our YouTube®

Channel by clicking on ‘Bankers Card’ above).

The special arrangement

with American Express to charge Martins Bank customers a lower

subscription, might at first seem to be biting the hand that feeds –

Barclaycard’s exponential growth in its few short years of life will soon

make it the dominant UK credit card, proving that Barclays has its eagle

eye on the bigger picture…

|

|

|

|

|

|

MORE AND MORE PEOPLE TODAY REALISE THE ADVANTAGES OF HAVING A BANK

ACCOUNT. THIS BOOKLET EXPLAINS HOW

AN ACCOUNT WITH MARTINS BANK COULD HELP YOU.

How a bank account can help you

Current Accounts are

the most common and widely used kind of bank account A Current Account can

be opened with only a pound or two and enables you to pay in money you

receive, draw cash on demand whenever you require it, pay your outgoings by

cheque, and

make use of the Bank's other money transfer

services as well.

For example, you can pay in

your salary or wages, or have them paid in direct by your employer, and you

can pay in other cash, cheques, postal orders or dividends you may receive.

Bills,

insurance premiums, hire purchase instalments, rent rates and other

outgoings can be paid by cheque or by the Bank's money transfer services.

If you are a housewife, you can pay in your housekeeping allowance and

settle your accounts at the shops by cheque. Your 'paid' cheques—those

which have passed through the banking system and have been returned to your

branch—are available if you wish to retain them and can be used as proof of

payment.

|

|

|

Two or more people can share a bank account by opening a

'joint account'. A husband and wife may find a joint account convenient as

arrangements can be made for either of them to draw cheques independently. The Bank keeps a record—called a Statement-showing the

amounts paid in and drawn out and the current balance in your account Your

Statement is readily available to you; you can ask for it to be sent to you

at any time or the Bank will send it to you at regular intervals if you

prefer.

Deposit Accounts are generally used for

keeping money which is surplus to your immediate needs, or for your regular

savings, or when you have no need of a cheque book. Money in a Deposit

Account earns interest the rate varying with general interest rates,

Technically, money in a Deposit Account is placed 'on deposit' for a

minimum of seven days, but it is usually possible to withdraw sums without

notice by foregoing seven days' interest.

Savings Accounts combine the benefits of

Current and Deposit Accounts. You can open a Savings Account with as little

as 1 s. and interest is paid on your money. Interest is fixed at 4£% on the

first £250: on amounts over £250 the rate is the same as on a Deposit

Account. With a Savings Account you do not have a cheque book. Instead you

are given a savings book and, if you wish, a special money box to help you

save money at home. You can pay money into your Savings Account, or

withdraw money from it, by taking your book to any branch of Martins Bank.

|

|

|

At branches other than your own, withdrawals are limited to a

maximum of £20 at a time, unless previous arrangements are made for larger

sums to be available

Grasshopper Savings

Accounts for Children

are designed to encourage children to save. When a Grasshopper

Savings Account is opened —the initial deposit can be as little as 1 s.—

the child is given an attractive money box in the shape of a grasshopper, a

colourful savings book, and a special paying-in and withdrawal book. The

child also receives a gilt grasshopper lapel badge. This scheme is run on proper banking lines. Children

aged seven and over can open their own account: for those under seven the

account is opened by a parent or guardian. The rates of interest and

withdrawal arrangements are the same as for ordinary Savings Accounts, but

if the child is under seven the parent or guardian signs the withdrawal

slips.

Opening an account

Opening a bank account is a straightforward affair. Simply

call at your nearest branch of Martins and explain that you wish to open an

account: any member of the staff will be pleased to discuss which types of

account will suit your needs and to make the necessary arrangements for

you.

|

|

A word about charges

People sometimes think that it will cost them a lot of money to

have a bank account. This certainly isn't so at Martins, where charges are

kept to a minimum. Because of widely differing circumstances it is not

possible to indicate here what the cost would be, but the Manager will be

pleased at any time to discuss the likely charges in your own particular

case.

Bank

Money transfer Services

The 'Money Mark' is the

symbol of the banks' money transfer services, it stands for a range of

services based on years of experience and which, with the increasing use of

computers, will offer the speediest possible money transfer… The 'Money Mark' is the

symbol of the banks' money transfer services, it stands for a range of

services based on years of experience and which, with the increasing use of

computers, will offer the speediest possible money transfer…

From the time when the early bankers began using a London

coffee house in which to exchange or 'clear' cheques drawn on each other,

the 'Clearing Banks', as they became known, have provided their customers

with an efficient means of paying and receiving money without the need to

use cash. But the money transfer needs of today's sophisticated society

cannot be satisfied by the cheque alone. Consequently, the banks have

developed other methods for money transfer, now known as Bank Giro. 'Giro',

which is derived from the Greek, is a short, convenient word widely used on

the continent to describe the circulation of money.

|

|

From the time when the early bankers began using a London

coffee house in which to exchange or 'clear' cheques drawn on each other,

the 'Clearing Banks', as they became known, have provided their customers

with an efficient means of paying and receiving money without the need to

use cash. But the money transfer

needs of today's sophisticated society cannot be satisfied by the cheque

alone. Consequently, the banks have developed other methods for money

transfer, now known as Bank Giro. 'Giro', which is derived from the Greek,

is a short, convenient word widely used on the continent to describe the

circulation of money.

Bank Giro Credits

Bank Giro credits (formerly known as credit transfers) are a

convenient means of paying money direct to the bank account of any person

or business. By using the Bank Giro credit form, several payments can be

made at one time with a single cheque, saving the cost of cheques and

postage. Payments by Bank Giro credits are free to customers of the Bank.

Standing Orders

Regular outgoings, such as insurance premiums, rent hire

purchase instalments and similar items can be paid with a minimum of

trouble by means of Standing Orders. These authorise the Bank to make

regular payments on your behalf automatically, saving you the trouble of

remembering when payments fall due and avoiding the need to write and post

cheques.

|

|

|

Direct

Debiting

A Direct Debit is like a Standing Order in reverse. With your

agreement, the company or undertaking to which you are due to make regular

payments claims the amount from your account on the due dates. By this

system periodic bills of variable amounts, which could not be paid by

Standing Order, can be settled without any action on your part,

As well as providing the basic facilities outlined so far,

Martins Bank provides many other useful services for its customers. These

are described in the following pages; if you would like any of the services

explained to you in more detail, your local branch will be very pleased to help you.

|

|

|

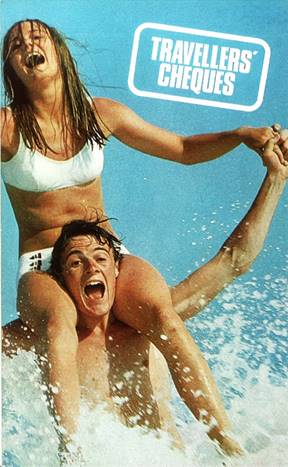

Travel

If you are away from home on holiday or business, arrangements

can be made for you to cash cheques at any branch of Martins or at any

other convenient bank anywhere in this country or abroad. Martins Bank

travellers' cheques, which can be used both abroad and in this country,

provide a safe, convenient means of carrying money.

They are exchangeable for cash at banks and are accepted in

most hotels, large stores, airports and bureaux de change. For your

overseas travel the Bank can supply foreign currency. They will also advise

on United Kingdom Currency regulations and on any regulations which may

apply in the countries you plan to visit.

Payments to and from overseas countries

If you need to send money abroad, or if you receive money from

overseas, the Bank can make all the necessary arrangements, including

applying for Bank of England permission on your behalf where necessary.

Supplying a reference

As a customer of the Bank you can use the Bank's name as a

reference—a useful facility when opening a shopping or credit account for

example.

|

|

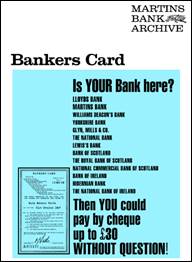

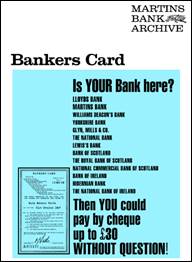

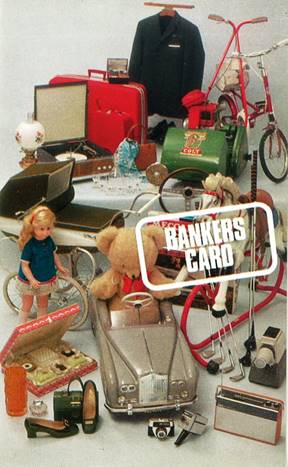

Bankers Card

Customers of Martins Bank can apply for a Bankers Card, which

enables them to draw up to £30 in cash on demand at any of more than 12,000

branches of Martins and other banks throughout the country which operate

similar schemes. The Card offers a guarantee of payment to a shopkeeper or

other person who accepts your cheque for up to £30 on production of your

Card. This is an extremely valuable facility when you are shopping,

travelling, or on holiday, and wish to pay by cheque.

American Express Credit Cards

|

|

Through Martins Bank you can apply for an American Express

Sterling Credit Card which enables you to obtain goods and services from

many airlines, hotels, restaurants and shops without using cash. You show

your card and sign the bill—then, when you receive your monthly statement

from American Express, you send a cheque to them in settlement. There are

advantages in applying for your American Express Sterling Credit Card

through Martins Bank: - Your manager may be able to dispense with the

formality of taking references and so speed up the issue of your Card; and

in the first year Martins gives you a rebate of £1 from the normal annual

subscription of four guineas.

Financial help

At one time or another most people need financial assistance

and there are many ways in which Martins Bank can help. Your Manager will

always be glad to consider granting an overdraft or loan in appropriate

circumstances or to discuss other means of financing your requirements.

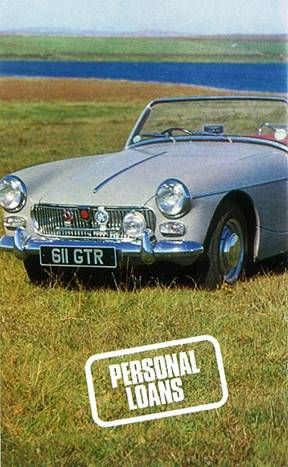

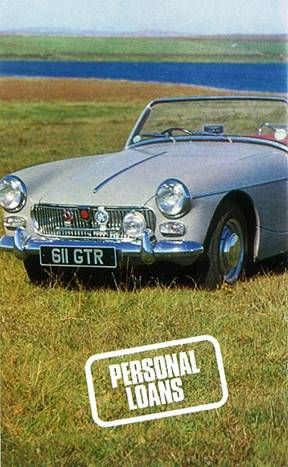

Personal Loans

A Martins Bank Personal Loan is a convenient, simple and

inexpensive way of raising money for various important items of

expenditure. Loans are available in suitable cases to pay for items such as

a car, new furniture, household appliances, insurance premiums, and

similar requirements.

|

|

|

|

The fixed interest rate and regular equal monthly repayments make

budgeting easier, and interest on personal loans is allowable against

income tax. Any outstanding balance is automatically cancelled if you

should die before the loan is repaid and there are special arrangements if

you are unable to work because of illness or accident. The provision of Personal Loans may, from

time to time, be restricted or prevented by Government measures to control

the national economy.

|

|

|

Income Tax

Martins Bank Trust Company, a subsidiary of the Bank, has a

special Income Tax Division to help customers with their Income Tax and

Surtax problems.

With the growing complexity of tax law, more and more people

are finding it worthwhile to make use of the Company's experience in this

field, and in many cases the modest charge made is more than offset by tax

recovered for the customer.

Looking after investments

If you do not have the time you would wish to devote to

looking after your investments, or if, perhaps, you feel the need for

skilled advice about their management Martins can help you through the

Trustee and Investment Division of Martins Bank Trust Company. The investments remain your own property

and the Company manages them in accordance with your particular wishes. Generally, recommendations regarding

investments are submitted for your approval, but if you wish the Company

will manage investments in accordance with wider terms of reference. In addition the Company will undertake

the collection of dividends, deal with 'rights* issues and attend to all

necessary documentation in relation to your investments.

|

|

Martins Unicorn Group of Unit Trusts

Unit trusts enable you to invest in a large number of public

companies without the bother of the many separate transactions needed to

acquire the stocks and shares.

You can buy units of the Martins Unicorn Group of Unit Trusts

at any branch of Martins and your Manager will help you to select the Trust

best suited to your investment needs.

You do not need a large amount of money to invest in Martins

Unicorn Trusts. There is a savings plan to enable you to buy units month by

month, and Martins Unicorn Bonds, in units of £20, provide a simple and convenient

way of investing in the Martins Unicorn Trust of your choice.

|

|

Wills and Trusts

You can deposit your Will for safe-keeping with the Bank, and

Martins Bank Trust Company will act as Executor or Trustee if desired,

There are many advantages in appointing the Trust Company as Executor

under your Will, either alone or jointly with others. These are set out

fully in the booklet Taking Care of Your Affairs', a guide to the

Investment and Trustee services of the Company, which is available from

your local branch.

Looking after valuables

The Bank offers the facilities of its strongrooms and safes

for the safe-keeping of deeds, share certificates and other documents of

value, as well as for locked boxes or sealed parcels containing jewellery

or other valuables.

Advice and information

Your Martins Manager is always ready to give you the benefit

of his experience in banking and financial matters. Where necessary, he can

obtain for you detailed information and written reports from the Bank's

specialist departments.

Confidential service

All dealings between Martins Bank, its subsidiaries and its

customers are conducted on a confidential basis. Details of your accounts

will not be divulged to anyone, not even a relative, without authority.

|

|

|

|

A word about Martins

Martins started as the Bank of Liverpool over 130 years ago,

but the old private Martin's Bank of London, which became part of the

present organisation in 1918, dates back to 1563. The Grasshopper symbol is

the emblem which Sir Thomas Gresham, the famous Elizabethan financier,

displayed outside his premises in Lombard Street, where Martins' principal

London Office now stands and where banking business has been conducted

without a break since the sixteenth century.

Today Martins Bank, a member of the Barclays Group, has well

over 700 branches throughout England and Wales, the Channel Islands and the

Isle of Man. At all of them you will

receive the same friendly, helpful service which we have made our byword.

Call in and have a word with the Manager of your nearest branch of Martins.

He will be delighted to meet you and to explain in more detail the services

which we offer, and how an account with Martins could help someone like

you.

|

|

|

|

|

|

|

|

|

|

HEAD OFFICE:

4 Water Street Liverpool, 2

DISTRICT OFFICES:

Leeds 28-30 Park Row, 1

Liverpool 4 Water Street 2

London 68 Lombard Street EC3

Manchester 43 Spring Gardens, 2

Midland 98 Colmore Row, Birmingham, 3

North Eastern 22 Grey Street Newcastle upon

Tyne, 1

South Western 8 Corn Street Bristol, 1

Over 700 branches throughout the country

November 1968

Martins Bank Publications

As well as a series of leaflets which explain many of the

services described here, Martins Bank publishes annual editions of the

following guides for business people, exporters and farmers:

|

|

|

|

|

|

|

|

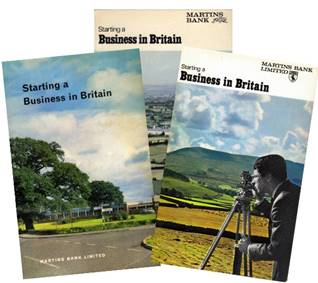

Starting a Business in Britain

A wealth of information about

business in this country.

|

The World is your Market

A guide to overseas trading.

|

Finance for Farmers and Growers

A comprehensive guide to the

grants and loans available from various sources, written in collaboration

with the Ministry of Agriculture.

|

M M

|