|

Cardboard or Plastic?

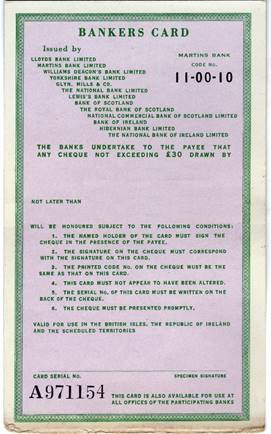

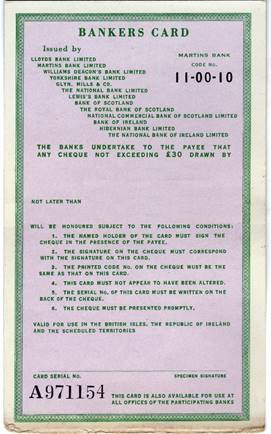

In the mid to late 1960s, the current account becomes

at last portable with the issue to customers of Martins Bank Bankers

Card. Remember, the number of CASH MACHINES in the UK is only just into

double figures, so if the holder of cheque card finds themselves in a town

without a branch of Martins, they are at least able to cash a cheque up to

the value of £30 (quite a useful sum at that time), at any of the participating

banks: Looking more like something you had carefully cut out from the back of

a breakfast cereal packet, these quaint yet perfectly functional cheque

guarantee cards are actually in use well into the early 1970s when they are

gradually replaced by the more familiar (clinical) plastic variety. As things have turned out, possibly every

plastic card ever made is still somewhere in the environment, whilst the

cardboard ones are long gone!

|

|

BANKERS CARD

ISSUED BY:

Lloyds Bank Ltd

Martins Bank Limited

Williams Deacon’s Bank Ltd

Yorkshire Bank Ltd

Glyn Mills and Company

The National Bank Ltd

Lewis’s Bank Ltd

Bank of Scotland

Royal Bank of Scotland

National Commercial Bank of Scotland Ltd

Bank of Ireland

Hibernian Bank Ltd

The National Bank of Ireland Ltd

|

|

Shame indeed, but thinking about it logically, why

did no-one think of making a plastic cheque card, at a time when plastic credit and charge cards were already in use in the UK?

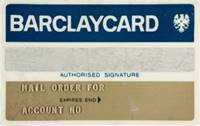

For Barclays, the smart move is into a

small piece of plastic – one which will outlast any cardboard counterpart,

and more importantly come to revolutionise the way we spend (or, more

accurately BORROW) our money for decades to come. The BARCLAYCARD is invented, and the idea

of a credit card that can also be used to guarantee cheques is born. Another crucial step is to ADVERTISE the

new concept of Barclaycard on TV – but how? For Barclays, the smart move is into a

small piece of plastic – one which will outlast any cardboard counterpart,

and more importantly come to revolutionise the way we spend (or, more

accurately BORROW) our money for decades to come. The BARCLAYCARD is invented, and the idea

of a credit card that can also be used to guarantee cheques is born. Another crucial step is to ADVERTISE the

new concept of Barclaycard on TV – but how?

A gentleman’s agreement amongst all eleven English Clearing Banks means

that NO bank will Advertise alone on TV.

As we find out now from John Dalton, Former Barclaycard Advertising

Manager, the dithering over being the first bank to advertise on TV went on

into the 1970s, with Barclays believing they had succeeded in 1972. Then in

1989, a somewhat embarrassing discovery is made….

A

Gentleman’s Agreement?

To say that “Barclaycard ‘A piece of Plastic’” was a TV commercial

isn’t strictly true and it obscures a

fascinating aspect of early bank television advertising history. That film

was used only in cinemas and at promotional events. Until the 1970s, all the English banks honoured an

agreement that none of them would advertise

on television; the only bank advertising being screened in those days was the

famous “Bank Manager in the

Cupboard” screened by the Committee of London Clearing Banks. In 1972 Barclays believed that another bank might break

the agreement. For a competitor to be able to say that they were first on

television was a prospect (that Barclays general managers couldn’t possibly

contemplate – (neither did they want to be the Villains’ who broke the

agreement). Barclaycard was the perfect

solution; we were given a hefty supplementary budget of £93,000 just to get on the air first. Les

Priestley and I supervised the production of two commercials during our lunch

break one day. They were made at ITN’s West End studios and the whole job was

done in less than 20 minutes; in later years I would go overseas with Alan

Whicker for a whole two weeks, spend three times as

much on production and come back with three

commercials! Serious planned television

advertising from Barclaycard didn’t begin until 1978 when we made jewellers Shop with Dudley Moore.

Having said all that, it was not until 1989 that we

discovered that the very first Barclaycard television commercial wasn’t by

Barclays at all. It was made in about 1967 by the British Linen Bank (who at

that time offered Barclaycard to their Scottish customers) and was shown only

North of the Border. To say that “Barclaycard ‘A piece of Plastic’” was a TV commercial

isn’t strictly true and it obscures a

fascinating aspect of early bank television advertising history. That film

was used only in cinemas and at promotional events. Until the 1970s, all the English banks honoured an

agreement that none of them would advertise

on television; the only bank advertising being screened in those days was the

famous “Bank Manager in the

Cupboard” screened by the Committee of London Clearing Banks. In 1972 Barclays believed that another bank might break

the agreement. For a competitor to be able to say that they were first on

television was a prospect (that Barclays general managers couldn’t possibly

contemplate – (neither did they want to be the Villains’ who broke the

agreement). Barclaycard was the perfect

solution; we were given a hefty supplementary budget of £93,000 just to get on the air first. Les

Priestley and I supervised the production of two commercials during our lunch

break one day. They were made at ITN’s West End studios and the whole job was

done in less than 20 minutes; in later years I would go overseas with Alan

Whicker for a whole two weeks, spend three times as

much on production and come back with three

commercials! Serious planned television

advertising from Barclaycard didn’t begin until 1978 when we made jewellers Shop with Dudley Moore.

Having said all that, it was not until 1989 that we

discovered that the very first Barclaycard television commercial wasn’t by

Barclays at all. It was made in about 1967 by the British Linen Bank (who at

that time offered Barclaycard to their Scottish customers) and was shown only

North of the Border.

John’s comments were orignially written in a letter to

Barclays Connection Magazine in 2000 and are reproduced here by kind

permission of Barclays Connection Magazine.

Advertisement and

Barclaycard Name and Logo © Barclays and all other rights holders 1966 to

date.

Martins Bank is first

on TV in England!

The story above solves another

minor mystery in Martins Bank’s history – their 1968 TV advertisement for

Martins Unicorn is shown by three ITV companies – Granada, Yorkshire and

Southern. These areas have the largest

concentrations of Martins Bank Branches and customers. By perhaps taking

notice of the British Linen Bank’s lead for advertising in Scotland the

product of a Barclays SUBSIDIARY company,

Martins too is able to circumvent the special agreement, and in the process

it becomes the first bank to advertise on TV in England, AND without looking

like the villain of the piece! Our

search for a copy of the Martins ad continues, but you can see stills from

it, and read more about how it was made, by clicking HERE.

The long and winding

road to credit scoring…

|

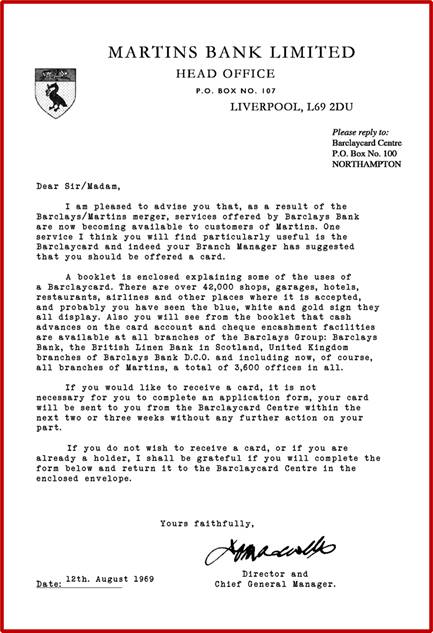

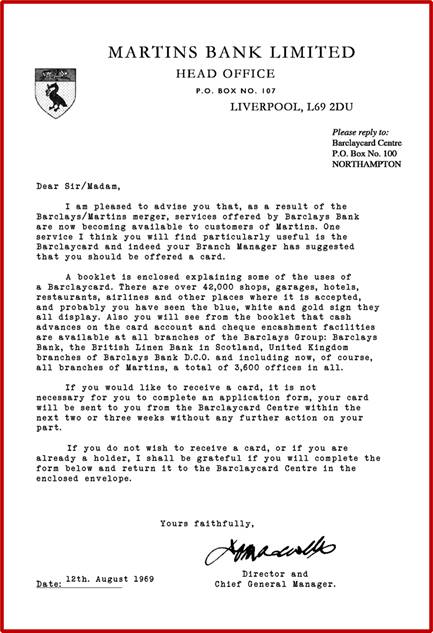

As preparations for the merger of Martins Bank and Barclays Bank gain

pace, Barclays spots an early opportunity to offer its still new Credit

Card facility to the customers of Martins Bank. Not EVERY customer of course, mostly just

those with a particularly high “net worth”.

This fairly innocent looking letter turns up on the doormats of the

fairly well to do, inviting them on an opt-OUT only basis to enjoy the use

of their very own BARCLAYCARD.

It is

interesting to note, that since its arrival in 1966, the Barclaycard was

capable by 1969 of offering credit via 42,000 outlets – nothing close to

the many millions that are today shared amongst thousands of card issuers

around the World, but nevertheless hugely impressive for the time. In the late 1960s, religion and a very

“British” state of mind meant that many would shy away from the thought of

using credit, “never a borrower, nor a lender be” uppermost in their minds. It is

interesting to note, that since its arrival in 1966, the Barclaycard was

capable by 1969 of offering credit via 42,000 outlets – nothing close to

the many millions that are today shared amongst thousands of card issuers

around the World, but nevertheless hugely impressive for the time. In the late 1960s, religion and a very

“British” state of mind meant that many would shy away from the thought of

using credit, “never a borrower, nor a lender be” uppermost in their minds.

However,

the credit bug became irresistible, and, helped by a clarification of

customer rights in the 1974 Consumer Credit Act, we’ve been borrowing on

the “never never” ever since. It is

however a somewhat sad and sobering thought that in the 2020s we are

encouraged to build a CREDIT rating,

rather than to save for the things we need.

The

invention by Barclays of the DEBIT card in the early 1980s was greeted with suspicion by many, who

could not separate out in their minds the difference between a plastic

cheque and a credit card. Now, debit cards are indispensable, and along

with being able to pay by mobile phone, watches and other devices, the days

of cash itself are numbered, along with those of most Bank Branches. Credit

alone is no longer enough – you must also stay permanently wired into your

own “credit score”, otherwise, it would seem, you are not a very good

person at all…

|

|

M M

R

|

![]()

![]()