|

From this point on, things will

move quickly – a proposed merger of Barclays, Lloyds and Martins Banks,

whilst thoroughly researched and feasible, is turned down by the Monopolies

Commission, who prefer a merger on a smaller scale. Eight months after announcing

its decision to seek a buyer, Martins reaches the first important date in its

irrevocable marriage to Barclays, 1 November 1968. This leaves just thirteen

months in which both Banks will have to compare Branches and services, so

that the best of each can be retained for the combined business. There is

also the task of informing the customers of both Banks not only about the

merger itself, but also of the perceived benefits…

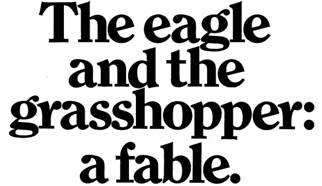

Are you sitting comfortably? Then we’ll begin…

An eagle, out for a walk, came

to a pleasant stream. Beside it stood a grasshopper, plump and chirpy.

‘Glorious day,’ said the grasshopper, vaulting behind a stone. ‘Indeed,’

replied the eagle. ‘Delightful part of the world, this,’ said the

grasshopper. ‘Must confess I don’t know it all that well,’ replied the eagle.

‘Not half as well as you do. Dashed clever, you grasshoppers. Ear close to

the ground, I suppose?’ ‘Oh, very,’ said the grasshopper, looking out

warily. ‘Perhaps we ought to get together—some sort of

amalgamation. Why, with my local knowledge and your fine feathers . .

.’ ‘That’s a thought,’ said the eagle.

Taking a step forward. ‘But not any sort of amalgamation, said the grasshopper, I’ve

noticed worms becoming amalgamated with starlings every morning at breakfast

time.’ ‘Fiddlesticks,’ said the eagle, ‘do you take me for a fool? What could

I gain by gobbling you up ?’ ‘Well’—the grasshopper

sounded

piqued—'I dare say I’m very tasty.’ ‘Piffle! ‘Said the eagle.

‘Look, if I ate you, you’d be gone, wouldn’t you ‘ ‘That’s very true.’ - ‘But

if we amalgamated, you could tell me all about this enchanting stream you

know so well.’ The grasshopper was half-way out of hiding now. ‘And I could give you lifts to all sorts of

places—I travel a lot, you know,’

continued the eagle.

‘Would you take me soaring?’ ‘Frequently.’ ‘And introduce me to some of your

large friends?’ ‘That would be my pleasure.’ They both stood thinking for a

long time. ‘And I could teach you to jump!’ said the grasshopper with sudden

cheerfulness. ‘A thing I’ve never really mastered,’ said

the eagle.

‘And I have a trick way of rubbing my legs together. Listen . . .’ ‘I doubt

if I’ll ever manage that,’ said the eagle, ‘but I’d love to try.’ And off they went together, ironing out the

formalities. And so it was that Barclays and Martins decided to join forces. An eagle, out for a walk, came

to a pleasant stream. Beside it stood a grasshopper, plump and chirpy.

‘Glorious day,’ said the grasshopper, vaulting behind a stone. ‘Indeed,’

replied the eagle. ‘Delightful part of the world, this,’ said the

grasshopper. ‘Must confess I don’t know it all that well,’ replied the eagle.

‘Not half as well as you do. Dashed clever, you grasshoppers. Ear close to

the ground, I suppose?’ ‘Oh, very,’ said the grasshopper, looking out

warily. ‘Perhaps we ought to get together—some sort of

amalgamation. Why, with my local knowledge and your fine feathers . .

.’ ‘That’s a thought,’ said the eagle.

Taking a step forward. ‘But not any sort of amalgamation, said the grasshopper, I’ve

noticed worms becoming amalgamated with starlings every morning at breakfast

time.’ ‘Fiddlesticks,’ said the eagle, ‘do you take me for a fool? What could

I gain by gobbling you up ?’ ‘Well’—the grasshopper

sounded

piqued—'I dare say I’m very tasty.’ ‘Piffle! ‘Said the eagle.

‘Look, if I ate you, you’d be gone, wouldn’t you ‘ ‘That’s very true.’ - ‘But

if we amalgamated, you could tell me all about this enchanting stream you

know so well.’ The grasshopper was half-way out of hiding now. ‘And I could give you lifts to all sorts of

places—I travel a lot, you know,’

continued the eagle.

‘Would you take me soaring?’ ‘Frequently.’ ‘And introduce me to some of your

large friends?’ ‘That would be my pleasure.’ They both stood thinking for a

long time. ‘And I could teach you to jump!’ said the grasshopper with sudden

cheerfulness. ‘A thing I’ve never really mastered,’ said

the eagle.

‘And I have a trick way of rubbing my legs together. Listen . . .’ ‘I doubt

if I’ll ever manage that,’ said the eagle, ‘but I’d love to try.’ And off they went together, ironing out the

formalities. And so it was that Barclays and Martins decided to join forces.

Moral: Marriage is to politics what the lever is to engineering.

The

state is not founded upon single individuals

But

upon couples and groups.

Novalis

Text and Images ©

Barclays 1968

Special Note from the Editor

Whilst singing

the praises of Martins Bank and looking back with fondness upon its life,

times, and achievements, it is not our place either to over-praise or to

judge history harshly. The

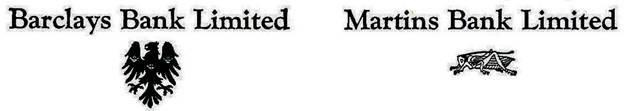

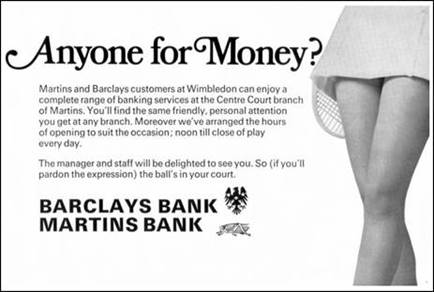

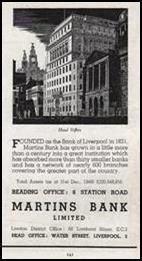

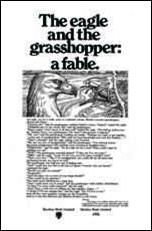

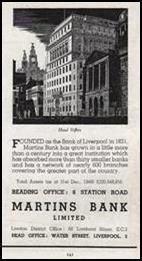

advertisement here (left) is published at the end of 1968, and is designed to

show customers of both Martins and Barclays, that there is much to be gained

from, and nothing to fear from “a merger”, or indeed “an amalgamation”.

Whilst compiling this part of the online archive, it has been impossible for

me to ignore the feelings of a large number of Martins staff who, even in

2009 when we launched, were still feeling betrayed over the 1969 merger. Whilst singing

the praises of Martins Bank and looking back with fondness upon its life,

times, and achievements, it is not our place either to over-praise or to

judge history harshly. The

advertisement here (left) is published at the end of 1968, and is designed to

show customers of both Martins and Barclays, that there is much to be gained

from, and nothing to fear from “a merger”, or indeed “an amalgamation”.

Whilst compiling this part of the online archive, it has been impossible for

me to ignore the feelings of a large number of Martins staff who, even in

2009 when we launched, were still feeling betrayed over the 1969 merger.

To many, a fundamental promise –

that the name of Martins Bank will live on – is broken even before the

act of Parliament that brings about the new Bank. The token gesture “Martins

Branch” which appears on some Barclays stationery until the early 1980s is

also not enough to calm the genuine anger and hurt. As an observer who never

worked for Martins, and given that time is usually such a great healer, I am

genuinely shocked and saddened by the comments we regularly receive on this

matter, and I completely understand and sympathise with those who thought one

thing, but witnessed another.

With a brand as successful as Barclays, there is

never any real doubt that the name of Martins will have to disappear, and the campaign to wipe Martins from the

memory is, in its own way, as sophisticated as any seen today when major

companies are brought together. Thanks however to the “Martins Branch” logo,

the changes do at least take until 1982 to fully complete, and the legacy of

Martins’ own “Branch Accounting” computer program remains with Barclays until

at least 2005. The articles in this section look at the various parts of the

process of subtle change that go into what Barclays refers to as “The end of

the beginning”, but which many, from the outset, see as the exact opposite…

Jonathan, May 2013

1967/8 – A Merger is announced…

After one too

many late nights, it is time for the activities of that teenage upstart,

Martins Bank to be reigned in by a somewhat nervous Bank of England. The cost

of servicing the accounts of a number of the UK’s largest companies, whilst

still bent on a lavish expansion southwards is finally going to put paid to

the dreams of the Liver Bird and the Grasshopper, a divorce takes place (the

removal of the Liver Bird and any further mention of Liverpool) and a shotgun

marriage is proposed that is eagerly entered into by Barclays. The prize?

Well, it goes without saying. Barclays will gain huge representation in the

North of England, with hundreds of branches, many of them new or refurbished,

and for the bank that is in the main an amalgamation of a large number of Southern

banks, this opportunity is too good to miss. The cake comes with extra icing

in the form of a network of branches on the Isle of Man, and in the Channel

Islands, and the recently acquired Unicorn Securities, which on its own will

help Barclays pay the bills for decades to come. The liver bird has laid a

golden egg, and Barclays is first in line with a plate of bread soldiers and

a spoon. Dip in! The

beginning of the end starts innocently enough with MERGER NEWS, a publication

in which Martins naïvely seeks to reassure its staff on the aspects of what

is, to all intents and purposes, a full blown takeover of their employer.

Looking now at some of the articles printed in “Merger News”, it is sad to

note the optimism and naïvity with which questions such as “what will happen

to the Martins name”, are asked. This is one of the last publications to be

produced by Martins Bank’s own Information Department. After one too

many late nights, it is time for the activities of that teenage upstart,

Martins Bank to be reigned in by a somewhat nervous Bank of England. The cost

of servicing the accounts of a number of the UK’s largest companies, whilst

still bent on a lavish expansion southwards is finally going to put paid to

the dreams of the Liver Bird and the Grasshopper, a divorce takes place (the

removal of the Liver Bird and any further mention of Liverpool) and a shotgun

marriage is proposed that is eagerly entered into by Barclays. The prize?

Well, it goes without saying. Barclays will gain huge representation in the

North of England, with hundreds of branches, many of them new or refurbished,

and for the bank that is in the main an amalgamation of a large number of Southern

banks, this opportunity is too good to miss. The cake comes with extra icing

in the form of a network of branches on the Isle of Man, and in the Channel

Islands, and the recently acquired Unicorn Securities, which on its own will

help Barclays pay the bills for decades to come. The liver bird has laid a

golden egg, and Barclays is first in line with a plate of bread soldiers and

a spoon. Dip in! The

beginning of the end starts innocently enough with MERGER NEWS, a publication

in which Martins naïvely seeks to reassure its staff on the aspects of what

is, to all intents and purposes, a full blown takeover of their employer.

Looking now at some of the articles printed in “Merger News”, it is sad to

note the optimism and naïvity with which questions such as “what will happen

to the Martins name”, are asked. This is one of the last publications to be

produced by Martins Bank’s own Information Department.

Martins’ petition to

the High Court to allow changes in the structure of its capital by means of

the Scheme of Arrangement was approved in the Chancery Court on Monday,

October 28.

As a result Martins will now be able to cancel its

existing shares, at the same time creating a similar amount of capital out of

the reserves arising from the cancellation. The new capital will then be

issued to Barclays Bank. Martins will close

the register for its old shares on October 31. On November 1, the operative date for the merger by the Scheme of

Arrangement, Martins’ solicitors in London will file the Court Order at the

Companies Registry. On the same day Martins’ Board will meet to approve the

creation of the new capital from the bank’s reserves, and the allotting of

those shares to Barclays. Because of the

legal requirements calling for no less than seven shareholders to appear in

the registers, the new shares will be split and placed in the name of

Barclays Bank and other nominated holders. Simultaneously,

a meeting of Barclays’ Board will create the Ordinary Stock and Loan Stock

that will be allotted to former Martins shareholders. Martins’ petition to

the High Court to allow changes in the structure of its capital by means of

the Scheme of Arrangement was approved in the Chancery Court on Monday,

October 28.

As a result Martins will now be able to cancel its

existing shares, at the same time creating a similar amount of capital out of

the reserves arising from the cancellation. The new capital will then be

issued to Barclays Bank. Martins will close

the register for its old shares on October 31. On November 1, the operative date for the merger by the Scheme of

Arrangement, Martins’ solicitors in London will file the Court Order at the

Companies Registry. On the same day Martins’ Board will meet to approve the

creation of the new capital from the bank’s reserves, and the allotting of

those shares to Barclays. Because of the

legal requirements calling for no less than seven shareholders to appear in

the registers, the new shares will be split and placed in the name of

Barclays Bank and other nominated holders. Simultaneously,

a meeting of Barclays’ Board will create the Ordinary Stock and Loan Stock

that will be allotted to former Martins shareholders.

|

Talks between the two banks about

amalgamation of their overseas business have proceeded extremely well,

says Mr. A. R. W. Wetherell, Chief Overseas Manager of Martins. Discussions

have been carried on in a cordial and co-operative atmosphere. Although it

is too early to state precisely the changes that will come about, the

prospects for working together in fields wider than Martins has known

before are ‘intriguing and exciting’, Mr. Wetherell said.

|

The two banks have formed a Coordinating

Team, whose job will be to work out a time-scale for the coordination of

the businesses. The team will work within policy lines set down by the

General Managements of the banks.

Martins’ representative in the team is

Mr. A. K. Bromley (Assistant General Manager). His colleagues from Barclays

will be Mr. R. J. H. Gillman (Secretary) who will be the team’s chairman,

and Mr. K. A. Ebbs and Mr. J. G. Quinton (Assistant General Managers)

|

|

|

What will happen to

the name of Martins Bank under the merger ? To this question, much discussed

just now, there is so far no definite answer. Many

Martins people—staff and customers—take

the firm view that so much goodwill attaches to the name that it should

continue to appear outside our branches even though, behind the scenes,

there were administrative integration with Barclays. Others hold the equally

strong opinion that for the merger to be really effective the name of Martins

should vanish completely, and Barclays’ titling should appear above our

doors. In a recent BBC interview our Chairman, Sir Cuthbert Clegg, said

that though Martins eventually would become a completely integrated bank with

Barclays its identity would not disappear immediately. He felt sure that

Martins’ name would never be lost sight of, because of the bank’s great

history. What will happen to

the name of Martins Bank under the merger ? To this question, much discussed

just now, there is so far no definite answer. Many

Martins people—staff and customers—take

the firm view that so much goodwill attaches to the name that it should

continue to appear outside our branches even though, behind the scenes,

there were administrative integration with Barclays. Others hold the equally

strong opinion that for the merger to be really effective the name of Martins

should vanish completely, and Barclays’ titling should appear above our

doors. In a recent BBC interview our Chairman, Sir Cuthbert Clegg, said

that though Martins eventually would become a completely integrated bank with

Barclays its identity would not disappear immediately. He felt sure that

Martins’ name would never be lost sight of, because of the bank’s great

history.

|

|

Only one dissenting hand was raised

against the merger of Martins and Barclays Banks at the extraordinary

general meeting of Martins’ shareholders held at Head Office on October

10. A special meeting of shareholders, as required by the High Court, had

earlier approved the merging of the two banks by the Scheme of Arrangement.

The extraordinary meeting was needed to give effect to this Scheme.

Presiding over both meetings, the Chairman, Sir Cuthbert B. Clegg, said

that proxy votes already received gave substantial support for the merger.

|

Sir Cuthbert was asked

to explain why Martins’ shareholders were to get Loan Stock in Barclays Bank

in part replacement of their Martins ordinary shares. The questioner was

protesting at having some of his ordinary shares changed to fixed-interest

stock. Sir Cuthbert explained that the takeover situation had inflated the

price of Martins shares: a market price of about 21 shillings would have been

more realistic. It must be appreciated that Barclays had to be fair to both

their own and Martins’ shareholders. The proportion of Barclays ordinary

shares our shareholders were to get was properly related to Martins’ assets

and the earning capacity of the capital. With the Scheme of Arrangement

approved by an overwhelming majority of Martins’ shareholders the bank had

then to seek the High Court’s approval to the Scheme. This would give effect

to the merger by early November. Sir Cuthbert was asked

to explain why Martins’ shareholders were to get Loan Stock in Barclays Bank

in part replacement of their Martins ordinary shares. The questioner was

protesting at having some of his ordinary shares changed to fixed-interest

stock. Sir Cuthbert explained that the takeover situation had inflated the

price of Martins shares: a market price of about 21 shillings would have been

more realistic. It must be appreciated that Barclays had to be fair to both

their own and Martins’ shareholders. The proportion of Barclays ordinary

shares our shareholders were to get was properly related to Martins’ assets

and the earning capacity of the capital. With the Scheme of Arrangement

approved by an overwhelming majority of Martins’ shareholders the bank had

then to seek the High Court’s approval to the Scheme. This would give effect

to the merger by early November.

The main executive body within Barclays Bank comprises five

members of the ‘Chair’ (the Chairman, two Deputy Chairmen and two

Vice-Chairmen) and the six General Managers. They meet daily in the

Chairman’s Committee and act together as a team. Each

of the six General Managers is nominally responsible for specific aspects of

the business but all are interchangeable so that they can act for one another

during absences. In this way decisions are not delayed pending the return of

the appropriate General Manager. In addition

there are 13 Assistant General Managers, each with a special sphere of

responsibility (lending, automation, premises, staff, etc.). A number of

heads of departments have Assistant General Manager status: these include the

Chief Accountant, Chief Inspector, Investment Manager, Secretary, Staff

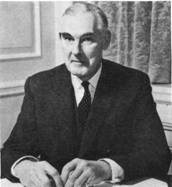

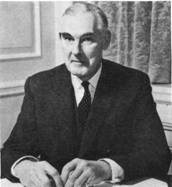

Managers and Principal of the Staff Training Centre. Mr. John Thomson has been Chairman of Barclays Bank since 1962. He was

educated at Winchester College and Magdalen College, Oxford, and joined Barclays’

81 Fleet Street office in 1929. After five

years at the Peterborough Local Head Office he was appointed a Local

Director at Oxford in 1935. His appointment

as a director of Barclays Bank came in 1947, Vice-Chairman in 1956 and Deputy

Chairman in 1958. The main executive body within Barclays Bank comprises five

members of the ‘Chair’ (the Chairman, two Deputy Chairmen and two

Vice-Chairmen) and the six General Managers. They meet daily in the

Chairman’s Committee and act together as a team. Each

of the six General Managers is nominally responsible for specific aspects of

the business but all are interchangeable so that they can act for one another

during absences. In this way decisions are not delayed pending the return of

the appropriate General Manager. In addition

there are 13 Assistant General Managers, each with a special sphere of

responsibility (lending, automation, premises, staff, etc.). A number of

heads of departments have Assistant General Manager status: these include the

Chief Accountant, Chief Inspector, Investment Manager, Secretary, Staff

Managers and Principal of the Staff Training Centre. Mr. John Thomson has been Chairman of Barclays Bank since 1962. He was

educated at Winchester College and Magdalen College, Oxford, and joined Barclays’

81 Fleet Street office in 1929. After five

years at the Peterborough Local Head Office he was appointed a Local

Director at Oxford in 1935. His appointment

as a director of Barclays Bank came in 1947, Vice-Chairman in 1956 and Deputy

Chairman in 1958.

Mr. Thomson is

married and lives in Oxford. He is closely connected with many charitable

organisations and other activities in the county where he has been

Lord-Lieutenant since 1963. He has also many close ties with Oxford

University.

He was a member of the Royal Commission on Trade

Unions and Employers’ Associations. Mr. Derek Wilde is the bank’s senior

General Manager. He joined Barclays in 1929 at Sheffield, where he was

educated at King Edward VII’s school, and spent a year on the Local Head Office

staff before moving in 1938 to London and the banks’ City Trustee Department. Mr. Thomson is

married and lives in Oxford. He is closely connected with many charitable

organisations and other activities in the county where he has been

Lord-Lieutenant since 1963. He has also many close ties with Oxford

University.

He was a member of the Royal Commission on Trade

Unions and Employers’ Associations. Mr. Derek Wilde is the bank’s senior

General Manager. He joined Barclays in 1929 at Sheffield, where he was

educated at King Edward VII’s school, and spent a year on the Local Head Office

staff before moving in 1938 to London and the banks’ City Trustee Department.

He continued in the ’rustee department after war service, first

at Birmingham and then at Bournemouth, returning in 1954 to the City Trustee

Office as Manager. Two years later he became Deputy Manager of all Barclays’

Trustee Departments.

He left the Trustee side in 1957 to be Deputy Chief

Accountant from which post he became an Assistant General Manager in 1960 and

a General Manager the following year. He has been senior General Manager

since 1966. Mr. Wilde is married and lives

at Penshurst, Kent

Barclays’ men and

women have a wide range of sporting activities available to them. In London

everyone from the newest junior to the senior manager can take advantage of

the excellently equipped Sports Club through which the Bank takes a prominent

part in all amateur sports. Individual members of Barclays’ staff have won

their places in international and Olympic events.Separate sections cover

football, rugby, hockey, cricket, netball, golf, athletics, rifle-shooting,

fencing, badminton, lawn and table tennis, chess, bridge, swimming, motoring

and judo. In addition to large sports grounds at Norbury in south London and

at Haling to the west, a fine boathouse was recently opened on the Thames at

Putney for rowing and sailing enthusiasts. In provincial centres, too, there

is provision for sport, assisted and encouraged by the management. All the

bank’s local districts compete each year in fourteen sports. A highlight of

the year is Sports Day, held at Baling in June, which takes in the inter-district athletic team championship,

the tennis finals, and a concert and dancing.

Already the possibility has been raised of Martins’ staff taking part in a

Barclays sporting event. Barclays’ men and

women have a wide range of sporting activities available to them. In London

everyone from the newest junior to the senior manager can take advantage of

the excellently equipped Sports Club through which the Bank takes a prominent

part in all amateur sports. Individual members of Barclays’ staff have won

their places in international and Olympic events.Separate sections cover

football, rugby, hockey, cricket, netball, golf, athletics, rifle-shooting,

fencing, badminton, lawn and table tennis, chess, bridge, swimming, motoring

and judo. In addition to large sports grounds at Norbury in south London and

at Haling to the west, a fine boathouse was recently opened on the Thames at

Putney for rowing and sailing enthusiasts. In provincial centres, too, there

is provision for sport, assisted and encouraged by the management. All the

bank’s local districts compete each year in fourteen sports. A highlight of

the year is Sports Day, held at Baling in June, which takes in the inter-district athletic team championship,

the tennis finals, and a concert and dancing.

Already the possibility has been raised of Martins’ staff taking part in a

Barclays sporting event.

… music, drama

For those whose talents are singing, acting or playing a musical

instrument there are Barclays Bank’s Dramatic, Musical and Operatic

Societies, all of which stage regular productions in London. This November

the talents of these three bodies will combine to present a Festival

Entertainment to celebrate the opening of the bank’s sumptuous new Great

Hall in the 54 Lombard Street Head Office. The occasion will also be taken to

hold the sixth Triennial Art Exhibition and a photographic show. Another body

which Barclays Bank staff are welcome to join is the Barclays D.C.O.

Horticultural Society which presents regular exhibitions at Goodenough House

in the City of London.

How has the bank’s business

been affected by the uncertainty since, earlier this year, Martins announced

its wish to merge with another bank? According to the Districts, hardly at

all. One District General Manager spoke of business in his District ‘growing

like mad’. How has the bank’s business

been affected by the uncertainty since, earlier this year, Martins announced

its wish to merge with another bank? According to the Districts, hardly at

all. One District General Manager spoke of business in his District ‘growing

like mad’.

Building

projects shelved

The bank’s building programme is one sphere greatly affected by the

merger situation. Work already well advanced is going ahead but several

projects have been shelved. No action is being taken over sites acquired for

new premises until a policy for the new group is decided. Even at one branch

virtually completed the merger has raised a complication—whether or not to drill holes in an expensive piece of granite

to take the name ‘Martins Bank’. The solution has been to fix the letters in

a less permanent way.

Adapting

branch systems

Among the staff there are many who feel they will be at a

disadvantage until both banks are operating common systems. Already a

committee has been set up ‘to consider branch book-keeping systems and other

procedures’ and much information about their systems has been exchanged by

the two banks. The widespread

attitude of the staff to the merger is: ‘If there is to be change, the sooner

it comes the better’…

Customers’

fear

Foremost in customers’ minds has been the fear that the

engulfing of Martins by the huge Barclays’ organisation will mean an end to

the personal service they value so much. Managers have been quick to reassure

their customers that the same individual service, backed by a local District

Office, will remain. In fact, the wider facilities of the merged bank will

mean an enhanced service.Concern or sorrow at the disappearance of a small,

independent bank has been expressed by many customers. At the same time they

accept that a merger was inevitable and that their feelings are based mainly

on sentiment. While formal talks between the banks have continued at General

Management and department-head levels, some managers and District officials

have met their Barclays counterparts informally. Local directors of Barclays

Bank have called at several of our branches to make themselves known.

The merger has meant

a gigantic task for Secretary’s Department at Head Office—the department which among other things has responsibility for

the register of the bank’s shareholders. When the form of the proposed Scheme

of Arrangement had been agreed, copies had to be dispatched to all Martins’

43,000 shareholders. With these were notices of the meetings on October 10,

and proxy forms by which, if they wished, shareholders could authorise the

Chairman and two Deputy Chairmen to vote on their behalf at these meetings.

No fewer than 35,645 proxy forms were received back. Each of these had to be

examined, checked against the register of shareholders, marked and recorded.

This work was started on September 19 and continued to ever-increasing

pressure for a fortnight. Evenings and weekends the work went on, with the

department’s staff being supplemented by volunteers from other departments

and branches. When the work was completed on time, Mr. J. E. Deyes, Secretary

of the bank, was full of praise. ‘Everyone worked very hard indeed,’ he said.

‘For two weeks they dedicated themselves to it. They did a terrific job.’

And the forms ? They had to go to the bank’s auditors to be checked all over

again. The merger has meant

a gigantic task for Secretary’s Department at Head Office—the department which among other things has responsibility for

the register of the bank’s shareholders. When the form of the proposed Scheme

of Arrangement had been agreed, copies had to be dispatched to all Martins’

43,000 shareholders. With these were notices of the meetings on October 10,

and proxy forms by which, if they wished, shareholders could authorise the

Chairman and two Deputy Chairmen to vote on their behalf at these meetings.

No fewer than 35,645 proxy forms were received back. Each of these had to be

examined, checked against the register of shareholders, marked and recorded.

This work was started on September 19 and continued to ever-increasing

pressure for a fortnight. Evenings and weekends the work went on, with the

department’s staff being supplemented by volunteers from other departments

and branches. When the work was completed on time, Mr. J. E. Deyes, Secretary

of the bank, was full of praise. ‘Everyone worked very hard indeed,’ he said.

‘For two weeks they dedicated themselves to it. They did a terrific job.’

And the forms ? They had to go to the bank’s auditors to be checked all over

again.

Within

the general merger arrangements there is the ‘mini-merger’— nevertheless of gigantic proportions —of the

trust business of the two banks. In fact, our Trust Company business,

combined with similar activities in various departments of Barclays Bank,

will form one of the largest investment operations in this country,

comparable in size with some of the very large American organisations.

Discussions will continue in the coming months regarding the shape and

structure of the trust side. Mr. D. G. Hanson, Director and General Manager

of Martins Bank Trust Company, believes the outcome will be new and

developing opportunities for the staff of both Barclays and Martins. Within

the general merger arrangements there is the ‘mini-merger’— nevertheless of gigantic proportions —of the

trust business of the two banks. In fact, our Trust Company business,

combined with similar activities in various departments of Barclays Bank,

will form one of the largest investment operations in this country,

comparable in size with some of the very large American organisations.

Discussions will continue in the coming months regarding the shape and

structure of the trust side. Mr. D. G. Hanson, Director and General Manager

of Martins Bank Trust Company, believes the outcome will be new and

developing opportunities for the staff of both Barclays and Martins.

1968 - An editorial

Change?

In Winter 1967 the staff magazine logo is, as it

has been for much of the sixties, simple, clean and still indicative of the

independence of the bank. The next edition of the magazine will bring

complete change, along with a more subliminal conversion of the staff

themselves.

In Spring 1968 the magazine’s

new logo is produced with the addition of the grasshopper, but NOT the liver

bird, which has sadly been dropped from all Martins’ publications and

leaflets. The subtle use of a BARCLAYS typeface heralds the intricate merger of

the two banks’ cultures – whether you use a Barclaycash Machine, or do

a little Martinplanning for your holiday, the logos are strikingly

similar: In Spring 1968 the magazine’s

new logo is produced with the addition of the grasshopper, but NOT the liver

bird, which has sadly been dropped from all Martins’ publications and

leaflets. The subtle use of a BARCLAYS typeface heralds the intricate merger of

the two banks’ cultures – whether you use a Barclaycash Machine, or do

a little Martinplanning for your holiday, the logos are strikingly

similar:

|

|

1968

- Two sides to the story…

Having all but given away the full meaning of the word

“merger” as it applies to Martins and Barclays, the process of takeover gets

underway. The extremely

helpful bank now carries an extra slogan in its leaflets and guides –

“a member of the Barclays group”, and references to the merger begin to

appear in Martins Bank Magazine from Autumn 1968 onwards. The magazine itself

will survive until Autumn 1969, with a ‘farewell’ edition printed in place of

the Winter one. The magazine carries

two articles for the benefit of staff, which attempt to show that there are

to be “no secrets”, and that everyone will therefore be walking into the

process with their eyes wide open… “Lifting the Veil” applauds the

transparency of the issue to all staff of copies of Merger News. “Something

to Add” likens any sentimentality surrounding the merger, to a mother crying

on the eve of her daughter’s wedding. Sophisticated propaganda, or

condescending waffle? At least our Staff are free to make up their own minds. Having all but given away the full meaning of the word

“merger” as it applies to Martins and Barclays, the process of takeover gets

underway. The extremely

helpful bank now carries an extra slogan in its leaflets and guides –

“a member of the Barclays group”, and references to the merger begin to

appear in Martins Bank Magazine from Autumn 1968 onwards. The magazine itself

will survive until Autumn 1969, with a ‘farewell’ edition printed in place of

the Winter one. The magazine carries

two articles for the benefit of staff, which attempt to show that there are

to be “no secrets”, and that everyone will therefore be walking into the

process with their eyes wide open… “Lifting the Veil” applauds the

transparency of the issue to all staff of copies of Merger News. “Something

to Add” likens any sentimentality surrounding the merger, to a mother crying

on the eve of her daughter’s wedding. Sophisticated propaganda, or

condescending waffle? At least our Staff are free to make up their own minds.

Lifting the veil

Bank people are secretive. They need to be:

secrecy is part of a bank's’stock-in-trade. Yet how easy it is for this banking

virtue to creep so unfortunately and so unnecessarily into the sphere of

staff communications. Never was it more important, now that the Bank is to

merge its interests with those of Barclays, that there should be frank and

open exchanges of information at all levels within this Bank. Never was it

more vital that the proverbial grapevine should not be allowed by needless

rumour and counter-rumour to assume the proportions of an oak tree.

For these reasons we welcome wholeheartedly

the Bank's’decision to introduce and circulate to every member of the staff

the news-sheet, Merger News. By appearing at frequent intervals Merger News

will go some way towards lifting the veil of needless secrecy and keeping the

staff— and their families—informed. The complete

removal of that veil remains a task calling for conscious effort by every one

of us.

Something to add

Committees are sitting, pilot schemes are

afoot, systems are under investigation. All reflect the loss, after 137

years, of the independence of Martins Bank. As a mother weeps at her

daughter's’wedding it would be easy to shed tears at the events of recent

months—until we remember not to confuse sentiment

with sentimentality. After all, Martins is itself an amalgam of a dozen or

more smaller banks and what we think of as the personality of Martins Bank is

nothing more than a fusion of the character of each of those acquired banks.

But can we speak of a bank having character

or personality? Is it not the generations of bank people, from clerks to

general managers, who, through a singleness of purpose, have impressed a

collective personality on their bank? And if, through their staffs, those

constituent banks of Martins have added something to the combined bank, is

this not the time to think what we, the staff of Martins, are capable of

contributing to the Barclays Group?

Any means of getting to know our colleagues in Barclays

is welcome and Barclays Bulletin, the quarterly newspaper of the Barclays

Group which is now being sent to every member of our staff, is one such

medium. As, however, it will be a little while before integration affects the

majority of our staff Martins Bank Magazine will continue to appear

throughout 1969.

Winter 1968 – Barclays Bulletin…

News of Barclays’ newest wholly owned subsidiary is communicated to the

staff of both Banks shortly after the key date of 1 November 1968 – this is

when Martins Shares become officially those of Barclays. “Barclays Bulletin”

provides a detailed look at what should be happening next…

|

|

MARTINS Bank is now a wholly-owned subsidiary of Barclays Bank

and new Barclays' ’hares and Loan Stock have been allotted to the former

shareholders of Martins under the terms of the Scheme of Arrangement for

the merger of the two companies. Martins will continue to trade in its own

name for the time being as a member of the Barclays Group, but in order to

obtain full benefit from the merger it is planned that the two banks should

become one by 1970.

|

WHY NOT ALSO VISIT

|

|

|

This will be achieved by means of a private Act of Parliament,

which it is hoped will receive Assent about the middle of next year, and

become effective on or before January 1, 1970. Meanwhile several measures are

being taken to help pave the way to complete integration. They include:

The appointment of two Directors from each bank to serve also on

the Board of the other. Mr. W. G. Bryan and Mr. A. L. Grant will serve on the

Board of Martins, and Sir Cuthbert Clegg and Mr. J. H. Keswick join the Board

of Barclays.

A Co-ordinating Team has been formed consisting of three

Barclays representatives, Mr. R. J. H. Gillman (Secretary) and Mr. K. A. Ebbs

and Mr. J. G. Quinton (Assistant General Managers), and Mr. A. K. Bromley

(Assistant General Manager of Martins).

Working parties have been set up to harmonise the systems,

procedures and stationery of the two banks, and alterations will be

introduced gradually.

Some Head Office Departments are to be brought together almost

immediately.

It is planned to conduct the executor, trustee, income tax, new

issue, registration and unit trust work of the combined banks through Martins

Bank Trust Company Ltd., which will be renamed.

Control of some

Martins branches will shortly be transferred to Barclays. A pilot scheme will

begin this month in some Barclays Districts where only a few Martins branches

are situated. It is hoped that the experience gained will enable the scheme

to be extended throughout the rest of the country during 1969.

Eventually the present

Barclays Local Head Offices, with one addition, will control all the branches

of the combined bank.

A new Local Head

Office will be established in Preston, controlling all branches in

Cumberland (with the exception of Martins, Alston), Westmorland and Lancashire

north of a line drawn south of Lytham, Leyland, Chorley, Darwen, Accrington

and Burnley, and Martins, Bentham.

The Welsh branches at present under Liverpool Local Head Office

will be transferred to the control of Shrewsbury L.H.O. The situation in

London is still being considered and there may be minor boundary changes

elsewhere, but the policy is that Martins branches will come under the Local

Head Office in whose District they are situated.

Chairman's Message

Mr. John Thomson,

Chairman of Barclays Bank Limited, stresses that the objective is the

creation of a single, integrated organisation with equal opportunities for

all. Mr. Thomson writes: “The merger of Martins with Barclays is an event of

great significance in our histories and I extend a warm welcome to Martins

Bank and every member of its staff on behalf of the Barclays Group. At the

same time I would like to try and answer some of the questions which must be

uppermost in your minds. This has been the ‘year of the merger’ for British

industry, and our own merger is part of the general drive for increased

efficiency through the creation of larger, more economic units. At the same

time we are, in order to reap the full benefits of the merger, taking a fresh

look at our organisational structure.

“Some training in

different systems and routines will be necessary, but I am confident that

this will not present a serious problem and that we can move smoothly towards

integrated systems common to all staff. 'Obviously some of you will be

wondering whether you will have to move as a result of the merger. So far as

branch staff are concerned, there will be little or no change in the existing

standards of mobility. In other cases moves will be kept to a minimum, and

adequate notice will be given to those concerned. Finally, a word about

promotion prospects. No member of the staff of either bank need feel that his

or her abilities will be neglected. The two Staff Departments are now working

in close liaison in order to ensure that the staff of both banks are

henceforth treated as one for the purpose of promotion. There will therefore

be equal opportunities for all, with a unified structure for recruitment and

training. A merger inevitably means change -but there can be no progress

without it. Fortunately both Barclays and Martins have similar traditions,

structures and philosophies and I am confident that with patience, understanding

and co-operation, the adjustments can be achieved smoothly and painlessly”.

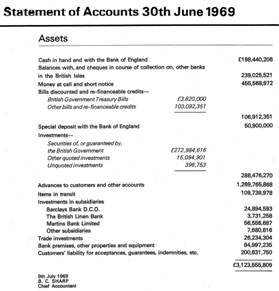

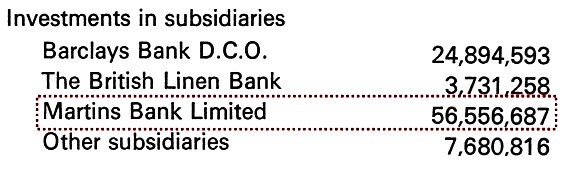

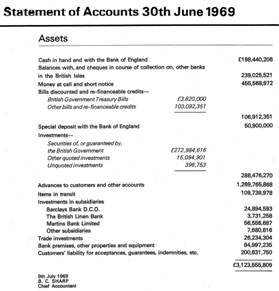

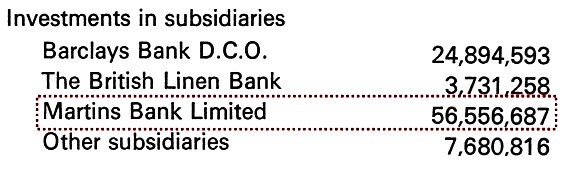

June 1969 - On the books at last…

|

|

In

Barclays’ half year accounts for 1969, its subsidiaries, including Martins

are listed under assets. Martins is worth a cool £56.5million, more than

fifteen times the value of The British Linen Bank, and more than twice that

of Barclays’ successful Dominion and Colonial arm. Acquiring Martins

strengthens Barclays’ position in England and Wales, control of the British

Linen Bank gives Barclays a good foothold in Scotland. Barclays also has

ties with The Bank of Scotland and the Royal Bank of Scotland (formerly

Williams and Glyn’s Bank) which will last well into the 1980s.

|

|

1969 – Spread Eagle - End of the beginning?

Just as Martins Bank Magazine itself caters for

the staff of LEWIS’S BANK, following Martins’ acquisition of their

branches, Barclays’

‘Spread Eagle’ magazine must now begin to welcome colleagues from Martins.

The difference of course, is that Lewis’s Bank, whilst under the ownership

of Martins always kept its name and style of operations. It is no

exaggeration to state that Martins Bank Magazine has been cherished by uge

numbers of the Staff of martins Bank. Born out of the Wartime Lifeline

Newsletters, nothing shows better the true family spitir of the Bank.

Spread Eagle is a similar publication to Martins Bank Magazine, in that it

too makes the most of everyday stories about the staff of the Bank, and

keeps everyone informed as the world of banking changes. Sport, amateur

dramatics, fashion, the usual stuff… The Staff of Martins are introduced to

Spread Eagle in a feature in the final full edition of their own Magazine

in the Autumn of 1969. By this time, much of Martins has been absorbed into

Barclays, all that remains is for the 700+ Branches and Subbranches of the

Bank to be officially handed over on the Appointed Date, 15 December 1969.

As the merger itself progresses, Barclays prints what is meant to be a

reassuring customer leaflet, the slightly patronising text proclaiming that

the situation is in fact simply nothing worse than “the end of the

beginning”. What is abundantly obvious from the leaflet, as shown below, is

that against the wishes of Martins’ Staff and customers, the name of the

new bank will be Barclays and ONLY Barclays, and this is therefore,

the beginning of the end…

|

|

|

|

Barclays /

Martins merger

Martins Bank joined up with Barclays last

November. Since then we've been getting on with the business of

integrating. A special Act of Parliament has been passed to simplify many

of the details involved You'll start noticing the differences around Christmas.

Martins will begin to call itself Barclays. Martins customers will become

customers of Barclays. Barclays name will start replacing Martins on

branches and cheque books. These are the unmistakable signs that the two

great banks with their traditions of progressive thinking and personal

service, are getting together to strengthen

even further Barclays’ position as one of the world's leading banking

groups with over 5000 branches in 50 countries. Yet December marks only the end of the beginning, the technicalities of the merger. With

these out of the way. the enlarged Barclays can begin to make full use of

the benefits of amalgamation. Bigger resources and wider facilities will

allow us to provide a service to meet every foreseeable future need -

whether it's for a multi-million-pound public company or a small private

business, a surtax paying executive or a school leaver in his first Job There’s a Barclays branch near you - though it may

still be called Martins. But whatever the name over the door, you’ll find

the same service (and welcome) inside. Why not call in and see for yourself

exactly what we’re so enthusiastic about?

|

|

|

|

|

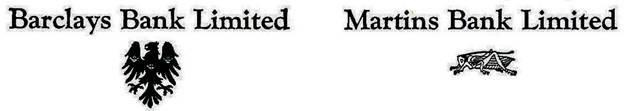

BARCLAYS BANK MARTINS BANK

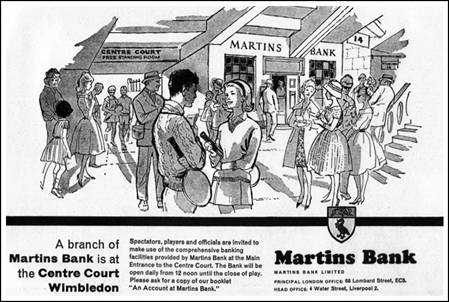

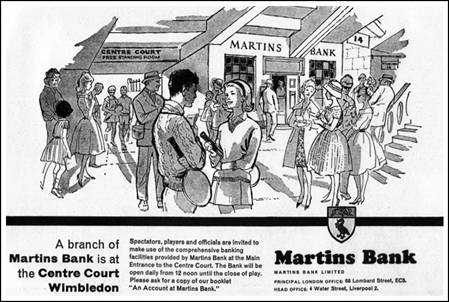

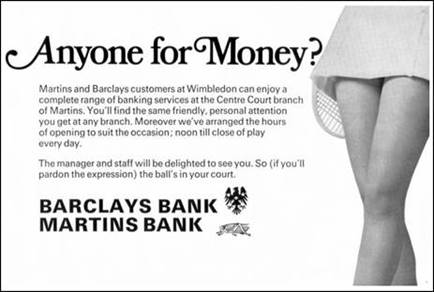

June

1969 - Game, set, and match.

Amongst the treasures inherited by Barclays, is

the sub branch on the Centre Court at the All-England Tennis Club, Wimbledon,

SW19. Martins advertises this special service in the official Wimbledon

souvenir programme each year. The following examples show the change from

1961 to 1969 when the merger becomes part of the message…

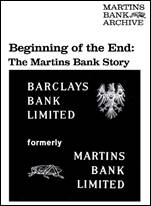

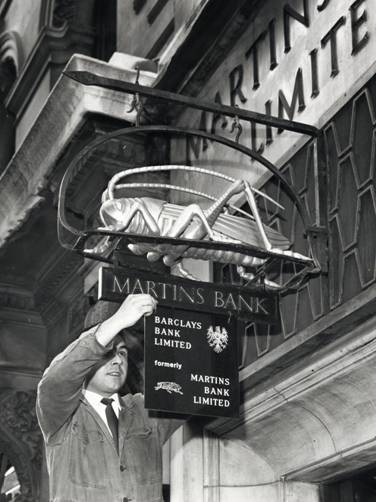

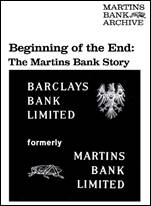

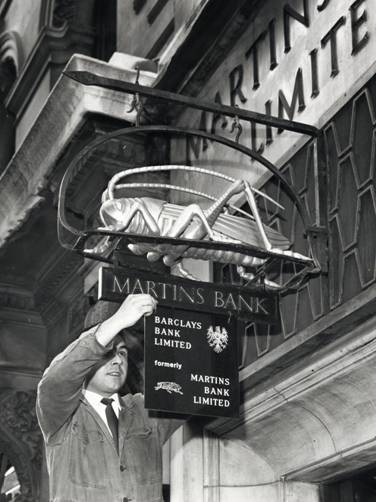

December

1969 - It’s a sign of the times…

The signs they are a changing, in what

becomes a familiar ritual up and down the land, as the Eagle takes over from

the Grasshopper – “Barclays Bank Limited, formerly Martins Bank Limited”

signs are displayed in over seven hundred locations to announce the demise of

Martins. Our picture shows the sign being hung outside our London Chief

Overseas Branch, at 80 Gracechurch Street. The signs they are a changing, in what

becomes a familiar ritual up and down the land, as the Eagle takes over from

the Grasshopper – “Barclays Bank Limited, formerly Martins Bank Limited”

signs are displayed in over seven hundred locations to announce the demise of

Martins. Our picture shows the sign being hung outside our London Chief

Overseas Branch, at 80 Gracechurch Street.

Martins’ glory days are fantastic. From making the

outrageously bold statement of building a palatial head office completely

away from London in the 1930s, to opening dozens of modern new branches

finished to exacting standards and built from the most expensive materials in

the 1960s, Martins has made a big splash in the ocean of banking, and all

this in the days when banks, in return for responsible lending and financial

management, are rewarded with the trust and loyalty of their customers.

A reputation for friendly, high

quality service has attracted wealthy and/or loyal customers to the Bank from

the ranks of young AND old, thanks to Martins’ constant quest to be modern

whilst still managing to retain some traditional values. It comes as no

surprise then, that this collection of banks, built up over 400 years is a

highly desirable target for takeover or merger, and Barclays’ overtures to

Martins lead to the full marriage of the two banks at the end of 1969. The changeover will need to be

handled as sensitively as possible, for Martins Bank is loved both by its

customers and staff, many of whom are vehemently opposed to their bank

jumping into bed with a rival. A reputation for friendly, high

quality service has attracted wealthy and/or loyal customers to the Bank from

the ranks of young AND old, thanks to Martins’ constant quest to be modern

whilst still managing to retain some traditional values. It comes as no

surprise then, that this collection of banks, built up over 400 years is a

highly desirable target for takeover or merger, and Barclays’ overtures to

Martins lead to the full marriage of the two banks at the end of 1969. The changeover will need to be

handled as sensitively as possible, for Martins Bank is loved both by its

customers and staff, many of whom are vehemently opposed to their bank

jumping into bed with a rival.

This has been a time when Martins has opened many

new branches, and shown that it is in touch – not only with the youth of the

day, but also with individual areas of the country and their banking needs.

Its regional structure, based on local decision making and Managers who know

their towns, villages and people inside out, are what we are crying out for

in the twenty-first century.

It’s not ALL doom and

gloom… It’s not ALL doom and

gloom…

Despite the views of many that the merger is

nothing more than a takeover, Martins does actually have some influence over

the future of the combined business. In total Barclays will acquire just shy

of 700 Branches and sub Branches. The business of Martins Bank Trust Company

Limited is also a highly desirable prize, and it remains the view of many who

worked for the Company, that it was Martins who effectively took over

Barclays’ interests in the same field. Looking at the overall network of

Branches and Departments, and in the North of England in particular, Barclays

will gain dozens of Branches that are newer, larger or better placed than

existing Barclays offices. A number of Barclays outlets will actually close

in favour of their Martins counterpart being used. These are identified in a

Merger Report issued on 15 December 1969 – the date by which the two Banks’

businesses must by law be brought fully together. We list here the details

from that report, of the Barclays Branches that had to fall on their sword,

either by closing altogether or by being downgraded to sub-Branch status…

|

BARCLAYS

BRANCHES CLOSED

Bristol Broadmead

Cockermouth

Consett

Darwen

Gateshead

Guisborough

Keynsham

Kirkby Stephen

|

Leicester Charles Street

London Fenchurch Street Station

Monkwearmouth

Moreton

Ramsey Isle of Man

Skelmersdale

Swanley

Ulverston

Urmston

|

Wallasey New Brighton

West Kirby

Widnes Victoria Road

BARCLAYS BRANCHES DOWNGRADED

Hebburn

Newcastle upon Tyne Jesmond Road

Sale

Wallsend

Whitefield

|

A good innings for Old trafford?

|

1

|

2

|

|

3

|

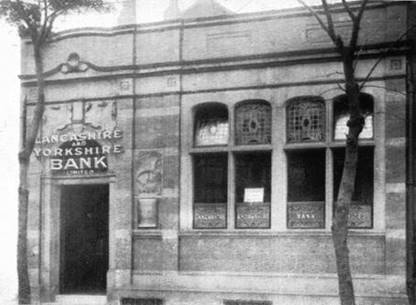

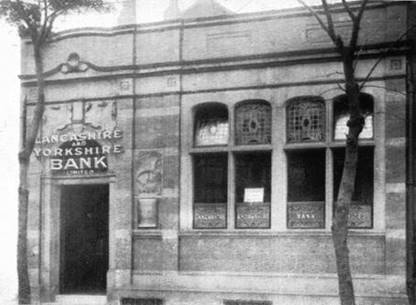

1.

Proud and beautifully appointed: The Lancashire

and Yorkshire Bank Branch at old Trafford, seen here in 1922, with six

years still to go before it merges with Martins.

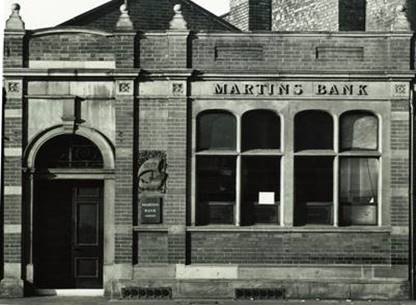

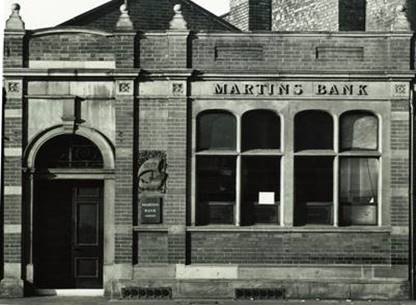

2.

In the 1960s we can only guess which famous

sporting types might have been popping in to cash a cheque before taking

part in a cricket or football match.

3.

Finally, in 2006 the same branch is seen empty

and frozen in time. A reminder of better times, when famous sporting types

popped in to Old Trafford to cash a cheque.

|

1970 to 1982 - Memorabilia…

|

|

Martins green is

replaced by Barclays blue in what is almost the last giveaway to feature

the Martins grasshopper. The Barclaytrust matchbook is given away to

customers of Barclays Bank Trust Company, which can now boast the

expertise, products and profitability of Martins Bank’s Trustee and Income

Tax offices and Martins Unicorn, the jewel in the crown of our Bank’s

services to investors. This piece of treasure will pay the bills at

Barclays for decades to come, and undergo several revamps and name changes

before becoming the Barclays Wealth we know today…

|

|

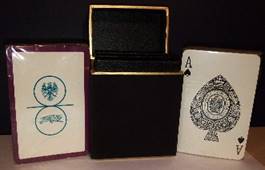

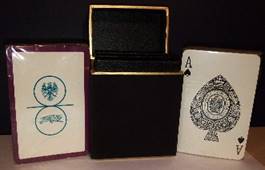

The symbol of the grasshopper,

dating back to the time of Thomas Gresham in 1563 will appear on the Barclays

cheques and statements of Martins customers as a kind of ‘heritage reminder’,

and will remain on some Barclays

stationery until 1982. The Liver Bird, will not however be seen again, even

though she still symbolises the Bank that dared to be different. The images

on these playing cards could well be the final assertion of the dominence of

the Spread Eagle over the Grasshopper, as another of Trust Company’s

giveaways is a small velvety box containing two packs. No longer afforded the

protection of the majestic and mysterious Liver Bird, our Grasshopper must

now roll over and accept defeat. The symbol of the grasshopper,

dating back to the time of Thomas Gresham in 1563 will appear on the Barclays

cheques and statements of Martins customers as a kind of ‘heritage reminder’,

and will remain on some Barclays

stationery until 1982. The Liver Bird, will not however be seen again, even

though she still symbolises the Bank that dared to be different. The images

on these playing cards could well be the final assertion of the dominence of

the Spread Eagle over the Grasshopper, as another of Trust Company’s

giveaways is a small velvety box containing two packs. No longer afforded the

protection of the majestic and mysterious Liver Bird, our Grasshopper must

now roll over and accept defeat.

All

good things must come to an end…

|

The doorway at

King’s Lynn is slightly recessed. Consequently

the doors have

remained

sheltered from

the elements.

|

The doors might be shut

forever, but the once mighty prescence of Martins is still felt all over

England and Wales. At 103a High street KING’S LYNN, (2008 left)

the Martins building was a chic fashion outlet. Ironically, having closed

its branch there, Barclays went on to swallow up The Woolwich and acquired

premises only four doors down at No 107!

At Barclays the Headrow, Leeds

(2007),and Heaton Chapel (2000) below, the unmistakable coat of arms

reminds everyone that this too is the home of the bank that went to extremes

to be helpful…

Pictures © : www.yorkshiredailyphoto.com and Michael

Alderson

|

Farewell

to Martins Bank Magazine…

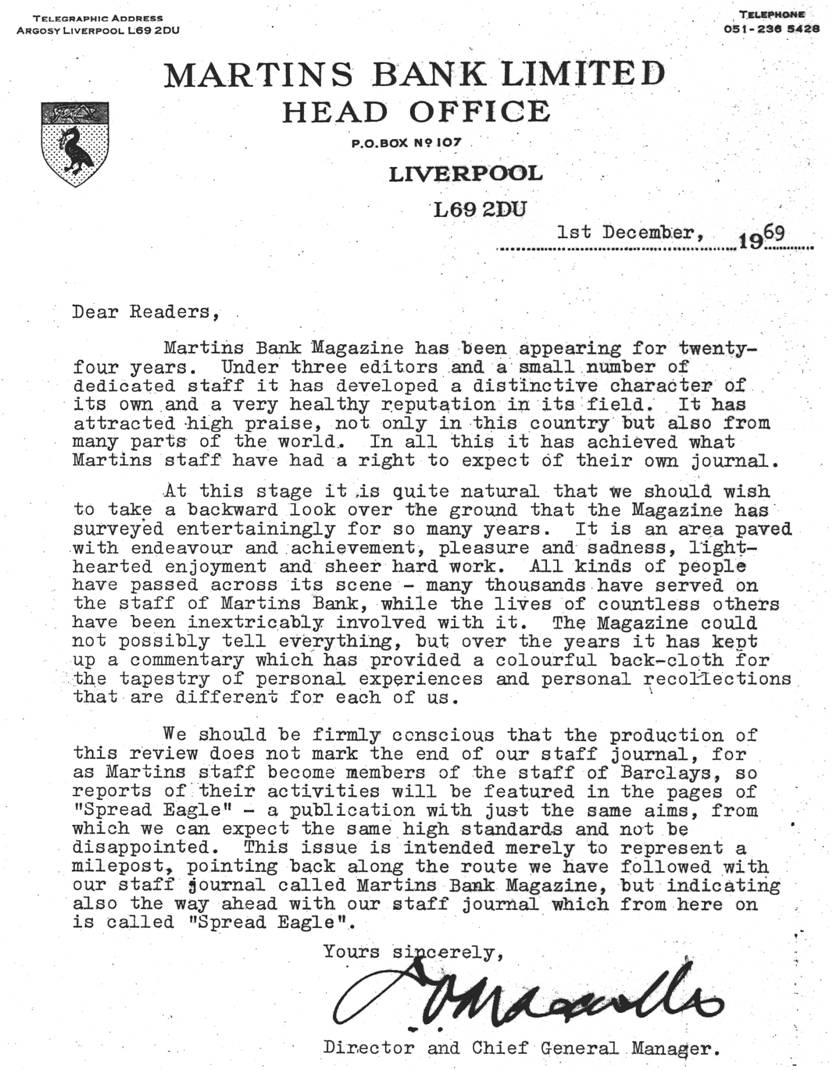

The final edition of Martins Bank Magazine is the

Winter 1969 commemorative issue, which looks back at hightlights of the

twenty four years – and therefore 96 issues – of the magazine’s existence.

The fawewell issue begins with this letter from Martins’ Chief General

Manager…

The song has ended, but

the melody lingers on…

The important of Martins Bank’s Operatic and

Dramatic Society, and its various regional offshoots, is recognised by

Barclays, and under the auspices of Barclays Bank Society of the Arts,

“Martins Operatic Society” ( minus the word “BANK”) continues to stage lavish

and sophisticated productions beyond the merger, until its own eventual

demise in 1980. You can read muchmore about this in our SONG AND DANCE feature.

Goodbye everybody…

x

BOARDROOM BLUES

The last ever

meeting of Martins Board, 9 December 1969…

M M

|

![]()

![]()