|

|

![]()

|

MARTINS BANK AT YOUR SERVICE –

BUSINESS BANKING |

|

It takes decades for many of the UK’s clearing

banks to package products specifically aimed at businesses, large and

small. Dedicated face to face staff

are first made available to PERSONAL

CUSTOMERS by

Barclays from the late 1970s, but it takes longer for a business or corporate

equivalent to emerge. In the case of banks who, like Martins and Barclays

operate a decentralised

service - with district or local head offices – the trends in local

business are picked up and dealt with according to local need.

Decentralisation is a source of pride for decades, as top down decisions are

by-passed by a team of people who know the local area and its business

needs. Until banking becomes more and

more streamlined, and the idea takes hold that wherever you are as a customer

you should be treated in the same

way as everyone else, there is no definable pattern of service or

products available to business customers.

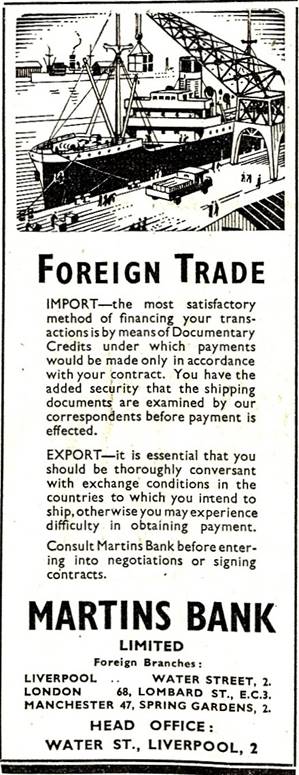

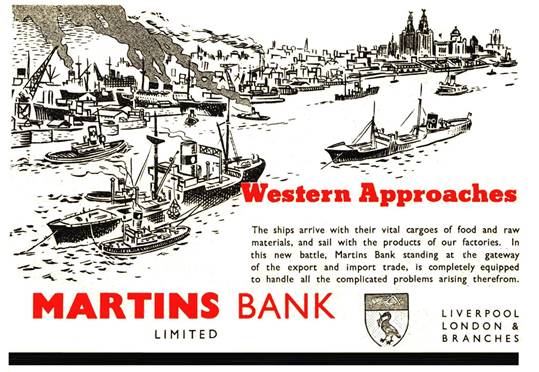

We must look to Martins’ own business advertising for clues, where we

find that foreign trade is a pre-occupation for many years… |

||||||

|

|

|

|||||

|

Images © 1939 Barclays (Left) and 1945 © Martins Bank Archive Collections (Above and below)

|

||||||

|

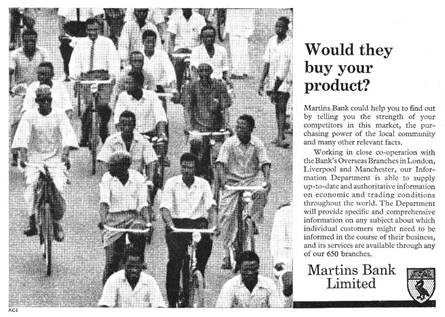

From here on,

the importance of exporting goods will never be far from the minds of

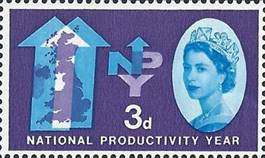

governments, businesses and the banking sector. Whether through adverts like these, initiatives

such as National Productivity year, or the “I’m Backing Britain” campaign of

the late 1960s, the need to trade with the World is always being pushed, and

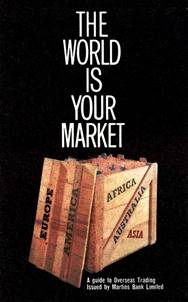

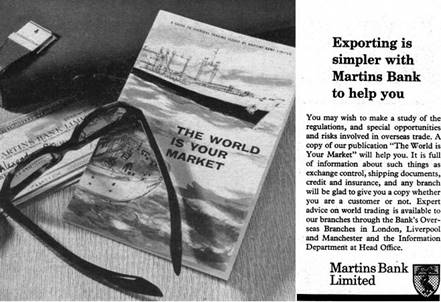

pushed hard. “The World is your

Market” was another of Martins Bank’s indispensible guides for business that

was available to customers and non-customers for a number of years. See also AGRICULTURAL

BANKING.

|

||||||

|

|

|

|

||||

|

The World is Your Market becomes an important annual publication |

The 1960s brings a new urgency to exporting with “National Productivity Year” (1963) |

|||||

|

Images © Martins Bank Archive

Collections

National Productivity Year and beyond…

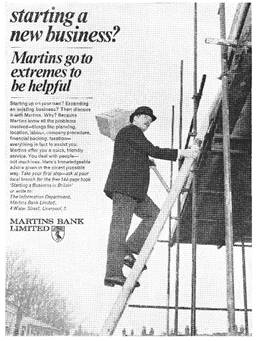

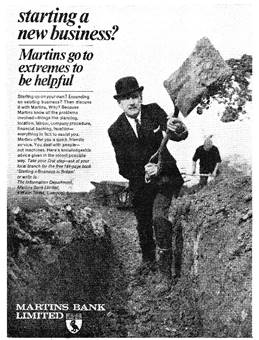

1965 onwards: Starting or building a business |

||||||

|

|

|

|

||||

|

Images © Martins Bank Archive

Collections

|

||||||

|

The introduction by the eleven

clearing Banks of the Credit Clearing system in 1962 paves the way for

smoother business transactions, and the ability to pay employees directly

into their own Bank Accounts. Martins Bank’s Advertising is based around the

success of its Information Department, whose perhaps unrivalled collective

knowledge produces literature that is of practical help to those already in

business and those who are just starting up.

The bank can also take pride in its decentralised structure, with

local head offices around the country able to make important decisions

without keeping the customer waiting.

Image © Martins Bank Archive

Collections

Image © Martins Bank Archive

Collections |

Image © Martins Bank Archive

Collections

Image © Barclays Ref 0025-0658-0005 |

|||||

|

As the swinging

sixties progress, EXPORTS are key both to

the success

The front cover

of The World is Your Market even features in the pages of Martins Bank’s

Annual Report and Accounts for 1960, which shows the commitment the Bank has

made to helping businesses succeed at home and abroad. Backed by the

expertise of Martins Overseas Branches at Liverpool Manchester and London,

The World is Your Market continues to be a successful publication right up to

the merger with Barclays…

So much for

small to medium business – Martins Bank also looks after the banking needs of

some VERY large business concerns, and we look in detail at this, and at how

it leads to the merger with Barclays in our CORPORATE

BANKING feature. We also examine Barclays’ own proposals for a

merger with Martins AND Lloyds Bank, and also at what might have been if

Martins Bank had survived into the twenty-first Century.

|

||||||

<,