|

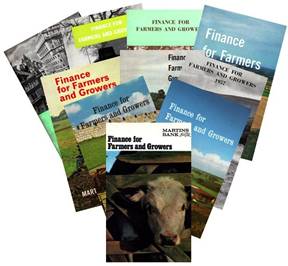

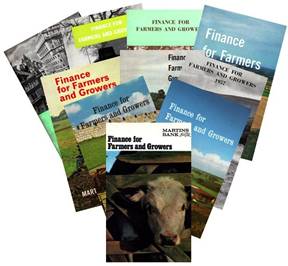

From 1955 until the late

1980s, Finance for Farmers and

Growers is a hit publication and a great legacy for Martins Bank, as it

continues to be published well beyond the merger with Barclays. Each new edition is eagerly anticipated, and the

key to its success is that the advertising message is subtly and almost

humbly underplayed. From 1955 until the late

1980s, Finance for Farmers and

Growers is a hit publication and a great legacy for Martins Bank, as it

continues to be published well beyond the merger with Barclays. Each new edition is eagerly anticipated, and the

key to its success is that the advertising message is subtly and almost

humbly underplayed.

In fact, NO

advertising is allowed within the pages of this publication, save for a

small amount of generic advertising copy for the Bank itself, within or

near to the inside front and back covers.

|

WHY NOT ALSO VISIT THESE FEATURE PAGES

|

|

|

|

|

|

|

|

Issue

No 1 -1955

Image

© Martins Bank Archive Collections

|

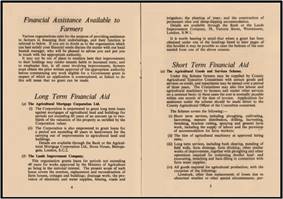

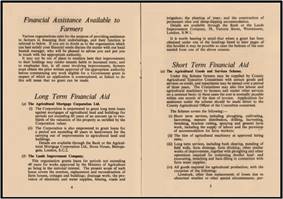

The real meat of this booklet

is its attention to detail - reviewing just about everything a Farmer or

Grower will need to think about that will help them succeed

financially. Working closely with

the Ministry of Agriculture, Fisheries and Food, the Advertising and

Economic Information Department of Martins Bank is able to supply up to

date details of agricultural finance available in the United Kingdom. The real meat of this booklet

is its attention to detail - reviewing just about everything a Farmer or

Grower will need to think about that will help them succeed

financially. Working closely with

the Ministry of Agriculture, Fisheries and Food, the Advertising and

Economic Information Department of Martins Bank is able to supply up to

date details of agricultural finance available in the United Kingdom.

The effects of

the latest changes in taxation and allowances are also provided, and clearly

set out to help the farming community find the best and most tax efficient

ways of funding their operation.

As each

edition of the booklet builds upon the last, the back copies have become a

useful historical record of how agriculture in Britain is run and

regulated, and with more than thirty

years’ worth of Finance for Farmers

and Growers to look back on, we can also trace developments innovations

and changes in farming and growing methods over the 1950s, 60s, 70s, and

80s.

|

|

How it

all begins…

|

|

1955

|

At first the booklet is called simply - Finance for Farmers - twenty pages

long, and directing its readers to external

sources of information that will actually, in time, become part of the

booklet itself. We can see here that

from a few headings and no contents page in 1955, the guide has built year

on year to a large contents menu by 1969 (by which time the booklet has

also grown four times to almost eighty pages).

|

1969

|

|

|

|

|

|

|

|

In 1955, rationing, which has been in place since the end

of the Secon d World War, has only just been abolished, and this is a new

beginning for most farmers, whose focus will now predominantly be on the

supply of crops and meat for the home market, rather than having to meet the

Government’s post-war commitment to feed the starving peoples of Europe. The

first edition of Finance for Famers has a very long foreword, which sets the

scene for the publication and its aims, and includes examples of the Bank’s

advertising to farmers…

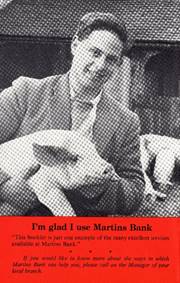

Maybe you are a farmer's son or daughter

or an agricultural worker saving up to start on your own. Perhaps you are a

smallholder, a pig breeder or a small farmer ready and able to work more

acres, or a large farmer looking for more stock, a merchant, a seedsman, a

machinery stockist needing finance for a growing business, or you are just

“In Agriculture”. The purpose of this booklet is to put in simple terms the

ways and means open to farmers to meet their financial problems in the best

interest of themselves and of their great industry in general. In doing so we

would emphasise that changes are constantly occurring and even in one season

certain particulars may become out-of-date. The most we can do is to ensure

that the information contained herein is correct at the time of going to

press. Whatever your financial problem may

be, we invite you to call on the manager of any one of our 600 branches. You

will find him helpful and understanding. Maybe you are a farmer's son or daughter

or an agricultural worker saving up to start on your own. Perhaps you are a

smallholder, a pig breeder or a small farmer ready and able to work more

acres, or a large farmer looking for more stock, a merchant, a seedsman, a

machinery stockist needing finance for a growing business, or you are just

“In Agriculture”. The purpose of this booklet is to put in simple terms the

ways and means open to farmers to meet their financial problems in the best

interest of themselves and of their great industry in general. In doing so we

would emphasise that changes are constantly occurring and even in one season

certain particulars may become out-of-date. The most we can do is to ensure

that the information contained herein is correct at the time of going to

press. Whatever your financial problem may

be, we invite you to call on the manager of any one of our 600 branches. You

will find him helpful and understanding.

surprising though it is, we still hear of people who keep their

savings in their houses, despite the risk of loss through fire or theft. At one time it used to be

the practice to stress the use of a bank for reasons of safety but with the

spread of the banking habit the use of a banking account has come to be

regarded as an ideal and indispensable method of dealing with business

affairs by providing an orderly and systematic method of recording financial

transactions. For a farmer a banking

account is essential. Into it can be paid direct, for example, the monthly

sums from concerns such as the Milk Marketing Board and, of course, all

cheques received from sales. From it the farmer pays his various accounts and

arrangements can be made by the signing of standing instructions whereby the

bank will attend to the payment of regular outgoings such as insurance

premiums, The bank statement, which can be obtained on demand, thus forms a

record of income and expenditure.

The receipts you collect may be needed by your accountant

or Income Tax adviser, but so far as you are concerned the record of the payments

will appear on your bank statement as evidence of payment. In addition to the

account described above, which is a current or “running” account, you may

like to have a certain sum readily available for emergencies which will,

nevertheless, show you some interest in the same way as an investment. To do

this you open a deposit account and the rate of interest and any procedure

regarding withdrawal will be arranged with you at the time of deposit. A banking account is also

of benefit in creating an incentive to save and special provision is made for

small savings by the issue of Home Safes, which are particularly suitable as

a means of developing the habit of thrift in the younger generation. The receipts you collect may be needed by your accountant

or Income Tax adviser, but so far as you are concerned the record of the payments

will appear on your bank statement as evidence of payment. In addition to the

account described above, which is a current or “running” account, you may

like to have a certain sum readily available for emergencies which will,

nevertheless, show you some interest in the same way as an investment. To do

this you open a deposit account and the rate of interest and any procedure

regarding withdrawal will be arranged with you at the time of deposit. A banking account is also

of benefit in creating an incentive to save and special provision is made for

small savings by the issue of Home Safes, which are particularly suitable as

a means of developing the habit of thrift in the younger generation.

There

are other useful services also available to account holders. Every branch of

the' Bank has a safe or strong-room as a matter of course and customers may,

if they wish, deposit their own valuables therein free of charge. We like

customers to have a deed box but we can accept valuables in other properly

sealed containers. Sometimes a farmer may have a transaction involving

business with another country or maybe he wants to take a holiday on the

Continent. The Bank can obtain foreign currency, issue Travellers' Cheques

and through its Overseas branches attend to all the procedure connected with

foreign trade and travel. Arrangements can also be made for your cheques to

be cashed anywhere in these islands where there is a bank.

Another

very important service which the Bank renders is to act as Executor or

Trustee. The Will or Trust Deed is drawn up by the customer's solicitor after

the Bank has been told of the provisions, to make sure that they are such as

can be undertaken by the Bank; no fees are payable to the Bank until after

the death of the testator. The advantages over naming a friend or other

private person as Executor or Trustee are that the Bank goes on year in and

year out and skill, secrecy and continuity of management are ensured at very

moderate cost to the estate. We have left until the last the mention of

the important services a bank can render its customers by way of overdraft.

In a business such as farming where so much depends upon the weather and

where seasonal outgoings drain the ready cash, the time generally comes when

the farmer needs financial help to tide him over these periods or to enable

him to expand his operations.

In view of the importance of farming to the

national economy the Bank will always give full and sympathetic consideration

to requests from farmers for overdrafts and will often lend without security

where the circumstances warrant it. It does happen, however, that sometimes

propositions are put to the Bank in which we just cannot help. For example,

banks do not like their money to be locked up indefinitely and when money is

lent a prime factor governing the decision will always be the method and time

of repayment. In view of the importance of farming to the

national economy the Bank will always give full and sympathetic consideration

to requests from farmers for overdrafts and will often lend without security

where the circumstances warrant it. It does happen, however, that sometimes

propositions are put to the Bank in which we just cannot help. For example,

banks do not like their money to be locked up indefinitely and when money is

lent a prime factor governing the decision will always be the method and time

of repayment.

You

may have a perfectly sound proposition for the improvement of your farm, for

extending your holding, increasing your stock, modernising your plant or

buildings, or for some other purpose, yet after examining all the relevant

factors we may feel unable to help owing to the long term prospect of the

required loan. In such cases, however, it may be that some other means of

obtaining the finance will appeal to you and we give in the following pages

brief particulars of financial assistance available to farmers and certain

other facts relating to farming finance.

Full

information about financial assistance available to farmers is contained in

the National Farmers' Union Guide to Prices and Services, which is supplied

by the Economics Department of the Union, and in official leaflets and

publications available from County Agricultural Executive Committees or from

Her Majesty's Stationery Office, or from other sources indicated in the

following pages which will form a useful introduction…

A legacy of information…

Finance for

Farmers and Growers becomes a mainstay of British Banking for more than

thirty years…

|

|

|

|

|

|

|

|

|

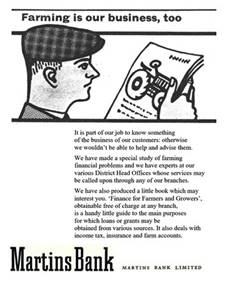

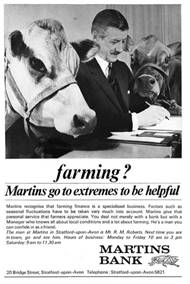

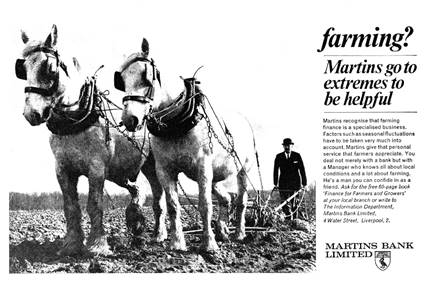

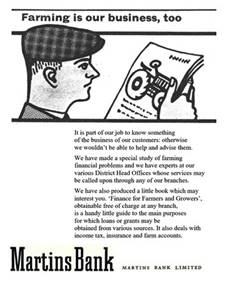

Getting the message across…

The Good Earth – “a bold peasantry their country’s pride…” It does

sound rather like something from a Soviet era manifesto, but no, this is

how Martins Bank views farming in the late 1940s - through rose-tinted, and

rather bucholic spectacles! From

this time onwards however, both Martins and Barclays recognise the

importance of finance for farmers and growers, and the value to the banking

sector and the economy of well run farms and smallholdings. In the 1990s Barclays will go on to

create dedicated Agricultural Banking Centres where specialist staff with a

knowledge of farming and growing put on their wellies and visit the

customer! We have compiled the

following display of advertisements which covers more than twenty years in

order to show just how the message changes with the times – from the

somewhat staid, bucholic and pompous, to the more practical, hands-on

approach… The Good Earth – “a bold peasantry their country’s pride…” It does

sound rather like something from a Soviet era manifesto, but no, this is

how Martins Bank views farming in the late 1940s - through rose-tinted, and

rather bucholic spectacles! From

this time onwards however, both Martins and Barclays recognise the

importance of finance for farmers and growers, and the value to the banking

sector and the economy of well run farms and smallholdings. In the 1990s Barclays will go on to

create dedicated Agricultural Banking Centres where specialist staff with a

knowledge of farming and growing put on their wellies and visit the

customer! We have compiled the

following display of advertisements which covers more than twenty years in

order to show just how the message changes with the times – from the

somewhat staid, bucholic and pompous, to the more practical, hands-on

approach…

|

|

|

|

|

|

Images © Martins Bank Archive Collections and Barclays

Group Archives, and with special thanks to the late Beryl Creer

Getting the message out…

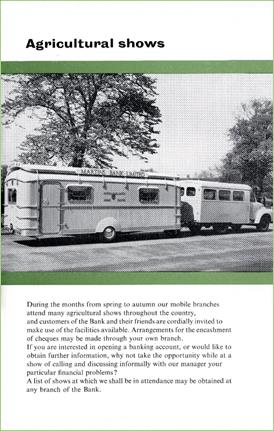

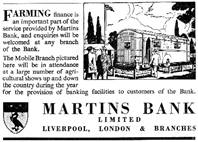

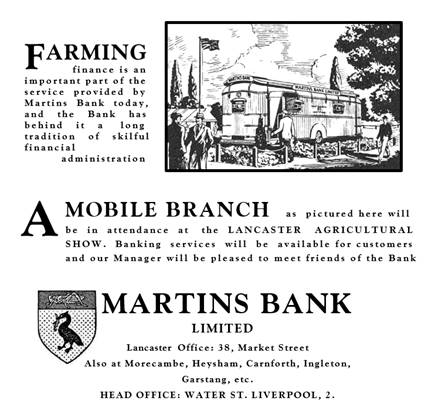

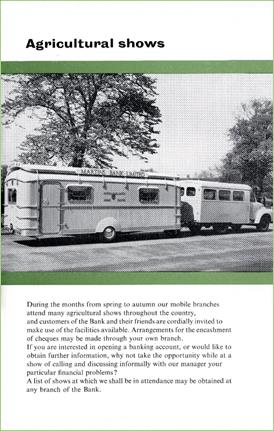

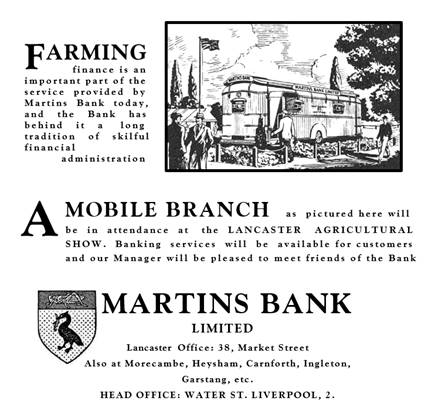

Whilst Martins Bank did not have Branches in ALL parts of

the United Kingdom, it did go to extremes to be represented by its fleet of

Mobile Branch caravans at Agricultural and other shows and events throughout

the land. For much of the 1950s a set advertisement style was used, featuring

an image of a Mobile Branch, some standard wording, and a sentence or two to

personalise the advertisement for the area in which a show or event was

taking place. We have dozens of

examples in the archive, and here we have attempted to display a good

cross-section of advertising styles AND show/event location…

|

1954 – Lancaster Agricultural

Show

Image

© Martins Bank Archive Collections

|

1950 – Lincolnshire

Agricultural Show

Image © Northcliffe Media Limited

Image created courtesy of

THE BRITISH LIBRARY

BOARD Image reproduced with kind

permission of The British Newspaper Archive

|

|

|

|

|

|

|

|

1961 – Royal Lancashire

Agricultural Show

|

1959 – Bath and West and

Southern Counties Show

Images

© Martins Bank Archive Collections

|

1956 – Royal Counties

Agricultural Show

|

|

|

|

|

The advertisement here for the

Great Yorkshire Show is from 1932. The Bank attends this particular event

every year, and by the early 1960s it is felt that a permanent sub-Branch

should be built at the Great Yorkshire Showground. Opened in 1962, the GYS

SUB-BRANCH is staffed by

arrangement with Harrogate Branch, and operated by the Bank’s centralised SHOW AND EXHIBITION BRANCHES DEPARTMENT.

Image © Northcliffe Media Limited

Image created courtesy of THE BRITISH LIBRARY BOARD Images reproduced with

kind permission of The British Newspaper Archive

|

|

|

|

|

M M

W W

|

![]()

![]()