|

![]()

|

IS INCOME TAX

A PROBLEM? |

![]()

|

In an

attempt to make things a little bit clearer than mud, Martins offers this

handy guide, along with the services of its tax departments, whose charges –

by today’s standards at least – appear to be something of a bargain! |

WHY NOT ALSO VISIT THESE PAGES |

|||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

Taxing

times ahead… HOW do I know my Code Number is right? Can I be

certain that I get all the allowances I am entitled to? If I sell my holiday bungalow,

how much Capital Gains Tax will I have to pay? How much tax will I have to

pay on my wife's part-time earnings? Can I recover any tax on my dividends

from the USA? Very likely you have

wondered yourself about questions like these. With Income Tax becoming more

complicated every year, thousands of ordinary people in every walk of life

find themselves faced with similar problems. And a great many of these

problems are solved with the help of Martins Bank. Pay As You Earn

Many people believe that deduction of

tax from wages and salaries under P.A.Y.E. means that there is no need for

them to concern themselves about their Income Tax. But the taxpayer’s Code

Number is simply an instruction to an employer g to enable the weekly or

monthly tax deductions to ; be calculated. The Inland Revenue arrive at the

Code Number from the Income Tax Return which you submit, and it is very

desirable to make sure that the Return includes claims for all the allowances

to which you are entitled and that the Notice of Coding takes account of them

all in arriving at your Code Number. Many factors

can affect the Code Number, and, as a result, the amount of tax you have to

pay. For example, changes in domestic circumstances can affect your tax

liability, and since the Inland Revenue do not automatically ask for an

Income Tax Return every year, you could pay too much tax if you do not tell

the Inland Revenue about such changes. In matters like these, expert,

friendly assistance is particularly valuable, and never more so than with

today’s high rates of taxation. Claims for allowances

and repayment of tax

It is possible to claim for a large

number of tax allowances which are intended to prevent the burden of taxation

from falling too heavily on people with moderate incomes. These allowances

are also designed to take account of differing family circumstances. The

following are some of the allowances and reliefs at present available under

the Income Tax Act and various Finance Acts. Personal Allowances

earned income

relief This is a further allowance granted on earned

income. The amount of the allowance can be affected by various factors such

as mortgage interest or payments under a Deed of Covenant.

children’s

allowances These vary according to the age and

income (if any) of the child. When the child is over 16 and is receiving

full-time education, account must also be taken of part-time earnings the

child may have during holiday periods.

dependent

relatives An allowance can be granted when a

taxpayer helps to maintain a relative of himself or his wife when the relative

has only a small income. It may be desirable to obtain advice regarding the

conditions which enable a taxpayer to qualify for such an allowance.

other allowances

A number of other allowances may be claimed, covering, for

example, adopted children, a housekeeper, daughter’s services, life

insurances, and relief for taxpayers whose total income is small and is

derived entirely from investments. Martins can advise on all these.

Dividends

Taxpayers who receive income from

dividends may well be eligible for a refund of Income Tax. Such claims are

not as straightforward as they may at first seem, and there are rules to be

applied which can make it difficult for the taxpayer to be certain that he is

receiving the full refund to which he is entitled. It is quite commonly believed that because Income Tax is

deducted at the standard rate from dividends, there is no need to declare the

income from dividends on the Income Tax Return. This is incorrect: the Return

calls for a complete statement of income from all sources. By not giving

information about dividends, the taxpayer may lose certain reliefs and

allowances which he might otherwise receive. Double Taxation

The legislation governing tax payable on

income received from certain overseas countries makes it particularly

desirable that those receiving such income make sure they are obtaining the

full relief due to them. The final tax liability of residents in the Channel

Islands and the Isle of Man calls for special consideration. It is also

important that the tax liability on income from Commonwealth and foreign

dividends is carefully verified in view of the various taxation agreements

which exist between Great Britain and many overseas countries. Rents

Capital Gains Tax

The Finance Act of 1965 greatly extended

the field of Capital Gains Tax and the application of the provisions of this

Act is complicated, affecting as they do a wide range of everyday

transactions. Considerable research is necessary when investments are sold in

order to arrive at the correct profit or loss figure, and taxpayers who have

investments, whether large or small, should seek professional advice

regarding the tax position when contemplating changes in their portfolios.

Many people believe that Surtax is not

payable unless the taxpayer’s income exceeds £5,000. This is true only where the whole of

the income is from earnings. A “mixed income”, consisting of salary and

dividends, may well attract Surtax where the total income is above £2,000. Foreign Residence

The tax position of a British subject who

is not resident in the United Kingdom is seldom fully understood and in most

cases expert advice should be obtained. In particular, the question of remittances

from salaries earned abroad presents difficulties which can prove costly if

advice is not sought at an early Claims by Residents Abroad

British subjects (and certain foreign

nationals) who live abroad can claim some repayment of United Kingdom Income

Tax which has been deducted from their United Kingdom dividends. Specialist

assistance is often valuable with such claims, as involved correspondence may

arise, presenting considerable problems for a resident abroad. It’s surprising what Martins will do

to help you

When a customer seeks the advice of

Martins Bank on tax matters, the Department’s experts have the unique

advantage of ready access to almost all the information needed for the

returns and claims of a private client—the banking account for details of payments and receipts under

various headings, dividend counterfoils, Security Registers and Stock

Exchange transactions—as well as having an understanding of the customer’s

financial position. When the Bank is entrusted with the tax

affairs of an individual, details of investments and financial matters in

general are recorded year by year and are readily available when required.

These records may be invaluable in other ways. In the case of death, for

example, they can be of great help to executors, who are relieved of the need

to trouble the family and beneficiaries with many enquiries. Deeds of Covenant

The Bank can assist in the administration

of Deeds of Covenant schemes in connection with recognised Charities. Fees

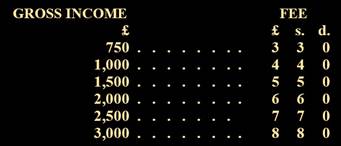

Where this fee would be disproportionate

to the work involved, an adjustment may be made. This table may provide a general indication of the level

of fees charged. For incomes in excess of £3,000 the fee will be fixed by arrangement. If you would like to know more about how Martins Bank

could help you, the Manager of your Branch will be pleased to advise you. Martins Bank Income Tax Departments

HEAD OFFICE: 4 WATER STREET, LIVERPOOL 2

MAY

1967

M

|

||||||||||||||||||||||||||