|

|

,,

![]()

|

HOW A BANK ACCOUNT COULD HELP YOU |

![]()

|

|

||

|

Perhaps you are one of the many people who are

to be paid by cheque or by direct credit to a bank. If this is so you

will want a bank account. This leaflet explains the special

benefits of having an account at Martins… |

|

|

|

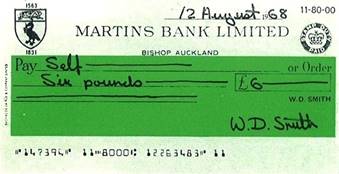

Opening an account This is a very simple matter. Call in at your

local branch of Martins and tell them that you would like to open an account The Manager or a member of the staff will explain the few simple formalities required. You certainly won't be expected to deposit a large sum of money to become a customer: in fact the account can be opened with your first pay credit. Martins have a reputation for being really helpful which you'll enjoy from the moment you go in the door. How much will it cost?

If

you keep a minimum of

£50 in your account the charge would be only 5s; and should your balance reach 100 minimum you would be charged nothing at all for up to thirty drawings in the half year. If you make more than this number of drawings the charge (if any) would still be very reasonable, and would be discussed

with you by the bank manager. Similarly attractive terms may be available to

you if you receive your pay by cheque. A bank account offers a lot of very

practical advantages in the every day managing of money, plus many useful

additional services. What is more, every customer of Martins is dealing with

a friendly, helpful bank whose experience and advice is his for the asking. |

||

|

|

||

|

The advantages of an

account at Martins

If you receive your pay by

Bank Giro

credit it will be paid automatically into your account. If you are paid by cheque, you can pay this in to your account yourself. You can also pay in any other money, cheques or postal orders that you receive, of course. Using a bank account in this way means that your money is completely safe and there is no risk of cash being lost or stolen. |

|

|

|

When

you need ready money, you simply cash a cheque,

usually at the branch of the bank where you have

your account but arrangements can be made

for your cheques to be cashed at other

branches, too. Then there is the great

convenience of being able to pay bills by

cheque, or by Bank Giro credits. Regular

payments like rent or H.P. instalments can

be taken care of by standing orders (sometimes

called Bankers' Orders) which save you the

trouble of remembering when the payments are

due.

Confidential All

your dealings with Martins Bank would be conducted on a

confidential basis.

Details of your account will not be divulged to

anyone - not even a relative, without authority. Why

not call in and talk things over soon at your local branch?

M |

||