|

Saturday mornings will

never be the same again…

Cash machines

are so much a part of our lives today that it is hard to imagine life

without them, or even remember what it was like before them. Now, we face the very real prospect of

the extinction of cash itself, and the notion of a cash machine will soon

be consigned to the history books.

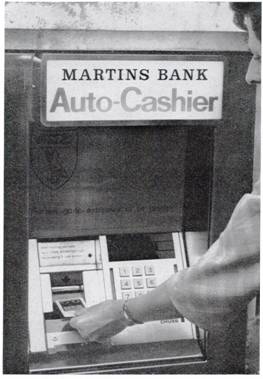

By the Summer of 1969, British Banks were under pressure to close on

Saturdays, and necessity became once more the mother of invention. Scotsman James Goodfellow patented the

World’s first system for using a card with a PIN Number in 1965, and the

cash machine was developed by the CHUBB Safe and Lock Company. It is this machine and James Goodfellow’s

system that Martins was first to use in the North of England in 1967. The BARCLAYCASH machine

can be rightly said to be the first of its kind - it is no secret that Barclays operated the first cash dispenser

not only in the UK, but also in the World, just four months before Martins

launched its own machine. In fairness, it must be noted that BARCLAYCASH, which was phased out by 1980 was not the kind of cash machine

we know today. A special cheque,

perforated with a code of dots needed to be read by the machine and

compared to a personal code number (PCN) which consisted of three pairs of

digits, unlike the PIN used from the start by Martins, and, of course, by

all of us in the twenty-first century.

BARCLAYBANK, launched in 1975 was the

first real attempt to provide other services as well as the withdrawal of

cash. In

the Autumn of 1967, Martins Bank was not actually sure that a Cash

Dispenser would be likely to catch on. Nevertheless, at great expense, is

went ahead and purchased one which was fitted into the wall of Liverpool

Church Street Branch, and turned out to be one of only three that the Bank

was be able to install before the merger with Barclays. In this

feature we examine both Martins Auto Cashier and the BARCLAYCASH Machine, each of which we believe should rank as EQUAL in terms of World Firsts… Cash machines

are so much a part of our lives today that it is hard to imagine life

without them, or even remember what it was like before them. Now, we face the very real prospect of

the extinction of cash itself, and the notion of a cash machine will soon

be consigned to the history books.

By the Summer of 1969, British Banks were under pressure to close on

Saturdays, and necessity became once more the mother of invention. Scotsman James Goodfellow patented the

World’s first system for using a card with a PIN Number in 1965, and the

cash machine was developed by the CHUBB Safe and Lock Company. It is this machine and James Goodfellow’s

system that Martins was first to use in the North of England in 1967. The BARCLAYCASH machine

can be rightly said to be the first of its kind - it is no secret that Barclays operated the first cash dispenser

not only in the UK, but also in the World, just four months before Martins

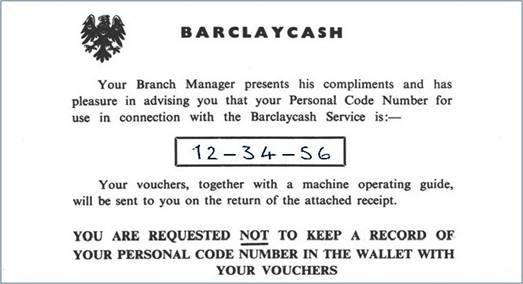

launched its own machine. In fairness, it must be noted that BARCLAYCASH, which was phased out by 1980 was not the kind of cash machine

we know today. A special cheque,

perforated with a code of dots needed to be read by the machine and

compared to a personal code number (PCN) which consisted of three pairs of

digits, unlike the PIN used from the start by Martins, and, of course, by

all of us in the twenty-first century.

BARCLAYBANK, launched in 1975 was the

first real attempt to provide other services as well as the withdrawal of

cash. In

the Autumn of 1967, Martins Bank was not actually sure that a Cash

Dispenser would be likely to catch on. Nevertheless, at great expense, is

went ahead and purchased one which was fitted into the wall of Liverpool

Church Street Branch, and turned out to be one of only three that the Bank

was be able to install before the merger with Barclays. In this

feature we examine both Martins Auto Cashier and the BARCLAYCASH Machine, each of which we believe should rank as EQUAL in terms of World Firsts…

|

Image © Trinity

Mirror Image created courtesy of THE BRITISH LIBRARY BOARD. Image

reproduced with kind permission of The British Newspaper Archive

|

|

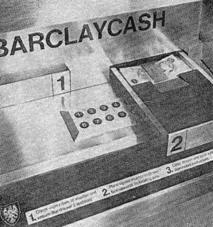

1967 – FROM HUMBLE PROTOTYPE….

THE MD1 Cash Dispenser

Image – Martins Bank

Archive

Ref MBM-Wi67P12

|

Could

this crude arrangement really be

the future of cash on demand? Well,

yes it actually was - we must remember that £10 went a long way in 1967,

and being able to obtain ten one-pound notes through the wall of the bank

whilst still a novelty, is a serious first step towards the convenience we

all take for granted in the twenty-first century! Now you can see this exact model in

action in Sydney Australia in 1969, thanks to a TV report preserved by ABC NEWS.

|

…1969 – TO BAUHAUS AWARD WINNER!

Image

© University of Brighton

-

Design Archives

Ref

GB-1837-DES-DCA-30-7-1969-1-1

|

|

The Martins Bank Auto Cashier is the first cash

dispenser to use a plastic card in conjunction with a PIN. To

produce its BARCLAYCASH machine, Barclays goes for a

design by De La Rue, a well established company whose products are the

watchword for security. Martins Bank Auto Cashier is made by CHUBB, also

famous for security products, and from the prototype onwards, the design is

sleek, easy to use, and extremely good looking. So much so in fact, that

the designer, Jack Howe, wins the prestigious Prince Philip Design Award

for 1969. Is this a case of style over substance? Not at all, Jack Howe’s design is popular

even before his award, and its practicality and simplicity means

there are already around four hundred CHUBB machines in service around the

country, when he receives it. The following report from the Design Council,

sums up this achievement, and you see will more of the original

Martins Bank CHUBB design, a little later in this feature… The Martins Bank Auto Cashier is the first cash

dispenser to use a plastic card in conjunction with a PIN. To

produce its BARCLAYCASH machine, Barclays goes for a

design by De La Rue, a well established company whose products are the

watchword for security. Martins Bank Auto Cashier is made by CHUBB, also

famous for security products, and from the prototype onwards, the design is

sleek, easy to use, and extremely good looking. So much so in fact, that

the designer, Jack Howe, wins the prestigious Prince Philip Design Award

for 1969. Is this a case of style over substance? Not at all, Jack Howe’s design is popular

even before his award, and its practicality and simplicity means

there are already around four hundred CHUBB machines in service around the

country, when he receives it. The following report from the Design Council,

sums up this achievement, and you see will more of the original

Martins Bank CHUBB design, a little later in this feature…

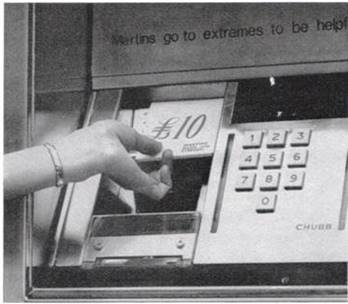

The

Design Council – Prince Philip  Award

for 1969 was awarded to Jack Howe for his design – The MD2 cash dispenser for Chubb

Ltd. Chubb narrowly

lost out to De La Rue in the race to launch the UK’s (and the World’s)

first cash dispenser in 1967, but their

version’s steel-clad good looks and simple controls were enough to ensure

that 400 were operating nationwide by the time Howe received his award. The

one-time employee of Bauhaus founder Walter Gropius was praised for ‘an

elegant solution to the problem of security for banks’. Customers used a

card and PIN — also new technology, developed in the UK in 1965 — to

withdraw a plastic pack containing ten £1 notes. The machine kept the card,

which the bank posted back after debiting the customer’s account. Award

for 1969 was awarded to Jack Howe for his design – The MD2 cash dispenser for Chubb

Ltd. Chubb narrowly

lost out to De La Rue in the race to launch the UK’s (and the World’s)

first cash dispenser in 1967, but their

version’s steel-clad good looks and simple controls were enough to ensure

that 400 were operating nationwide by the time Howe received his award. The

one-time employee of Bauhaus founder Walter Gropius was praised for ‘an

elegant solution to the problem of security for banks’. Customers used a

card and PIN — also new technology, developed in the UK in 1965 — to

withdraw a plastic pack containing ten £1 notes. The machine kept the card,

which the bank posted back after debiting the customer’s account.

The Chubb MD2 Cash Dispenser

Image © University of Brighton Design

Archives

Ref GB-1837-DES-DCA-30-7-1969-1-2

Now,

Martins Bank Magazine reflects - somewhat wryly - upon its latest

investment, and seems almost bemused by the possible uses of a cash

dispenser. This is apparent from the

various stereotypes used by the magazine as it tries to predict just who

might use the machine, and why… ( To read the Bank’s Press Release

for Martins Auto Cashier, click HERE )

local rather than

national publicity was an introductory feature of the Bank's first cash

dispenser, brought into use on 31 October at Church Street branch,

Liverpool.

This is, of course, the first dispenser in the

North and others will follow shortly but it is essentially an experiment—simple to operate, attractive, apparently thief-proof and is

possibly the forerunner of even bigger innovations. It is this last aspect

which the staff will find intriguing. The machine provides

ten £1 notes for each

plastic card inserted by the customer who keys a number known only to

himself or herself—not necessarily a Church Street customer but any

customer who thinks he may have a sudden need for ready cash while in the

Liverpool shopping and entertainment centre.

The first point to be remembered is that for its comparatively

limited capacity the machine is costly. But what price bigger and better

dispensers in large centres or in the shopping precincts ? Would the housewives

use them before doing their Saturday shopping? Could built-in dispensers

become one of the features of the populous areas in big cities and at

airports and railway termini? To be

an economic proposition the dispenser of the future will, ideally, not only

supply a variety of cash round the clock but take the place of one or more

cashiers. It could then reduce the counter queues in banks, and perhaps

pre-debiting as for travellers' cheques could reduce book-keeping, for if

it were to bring additional and complicated records it would defeat much of

its purpose. What intrigues us just now is whether the customers will show

they want it. Will they provide us with proof that the chequeless or

cashless society is not just a dream ? Many

people may think there is an element of danger in collecting one’s cash in

the street, but how dangerous has the use of the night safe proved to be

when, like a dispenser, available round the clock? In a prominent site like Church Street it will be

interesting to see whether every cosh-bearing Merseyside yob takes to standing all innocent-like on the pavement hoping

to pull off a snatch in multiples of £10. More probably he will prefer the big

money grabs between 10 and 3 which at least he can plan and thereby avoid

standing about in the cold. Maybe we will not

learn a lot about this new dispenser for some months. It may catch on

quickly or it may not appeal. That some other banks have also taken up the

idea is an indication that no matter how much one may hope for a cashless

society this may be a long time coming, and meanwhile the late-night taxi

driver will insist on something more than the sight of a credit card.

Various manufacturers, we understand, are already interested in further

developments and when one thinks of all the things obtainable today from

slot machines and dispensers it is surprising that only in England in 1967

have some of the banks come out with machines which can produce what

everybody wants, all the time, more than anything else — money! The first point to be remembered is that for its comparatively

limited capacity the machine is costly. But what price bigger and better

dispensers in large centres or in the shopping precincts ? Would the housewives

use them before doing their Saturday shopping? Could built-in dispensers

become one of the features of the populous areas in big cities and at

airports and railway termini? To be

an economic proposition the dispenser of the future will, ideally, not only

supply a variety of cash round the clock but take the place of one or more

cashiers. It could then reduce the counter queues in banks, and perhaps

pre-debiting as for travellers' cheques could reduce book-keeping, for if

it were to bring additional and complicated records it would defeat much of

its purpose. What intrigues us just now is whether the customers will show

they want it. Will they provide us with proof that the chequeless or

cashless society is not just a dream ? Many

people may think there is an element of danger in collecting one’s cash in

the street, but how dangerous has the use of the night safe proved to be

when, like a dispenser, available round the clock? In a prominent site like Church Street it will be

interesting to see whether every cosh-bearing Merseyside yob takes to standing all innocent-like on the pavement hoping

to pull off a snatch in multiples of £10. More probably he will prefer the big

money grabs between 10 and 3 which at least he can plan and thereby avoid

standing about in the cold. Maybe we will not

learn a lot about this new dispenser for some months. It may catch on

quickly or it may not appeal. That some other banks have also taken up the

idea is an indication that no matter how much one may hope for a cashless

society this may be a long time coming, and meanwhile the late-night taxi

driver will insist on something more than the sight of a credit card.

Various manufacturers, we understand, are already interested in further

developments and when one thinks of all the things obtainable today from

slot machines and dispensers it is surprising that only in England in 1967

have some of the banks come out with machines which can produce what

everybody wants, all the time, more than anything else — money!

|

|

Announcing: BARCLAYCASH… Announcing: BARCLAYCASH…

Alright, credit where credit’s due and all that,

but so what if Barclays does

get there first, by unveiling the world’s first cash dispenser at the end

of June 1967? At least Martins,

being only four months behind, is the first bank to unveil a cash machine

in the North of England, AND the first to use the concept of card

and PIN that we all know today – That is still a major achievement…

|

|

|

< Left: the crowds gather in amazement in Enfield to see TV Star

and Comedian Reg Varney become the first ATM customer in the world. (Pictures © de la Rue Ltd and Barclays)

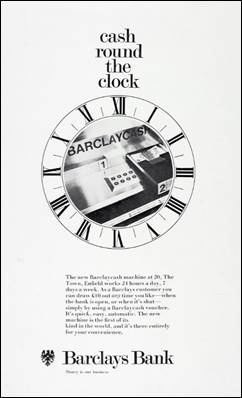

Right: The new service is advertised in the press. This somewhat minimalist ad tells us all

we need to know – that from now on , our cash will forever be at our

fingertips…>

|

|

|

|

|

BARCLAYS Bank Limited,

which recently ordered 75 automatic cash dispensing machines from De La Rue

Instruments Limited for its Barclaycash Service, has increased the order to

250 machines. Delivery of these 'robot cashiers' started last month and it

is planned to have the majority installed and in operation by the end of

June next year. These machines, which enable customers to withdraw cash

from their accounts 24 hours a day, 7 days a week, will be sited to cover

areas with the largest population and the greatest number of accounts,

giving the best possible geographic coverage', said Mr. D. M. Taylor, a

General Manager of Barclays Bank. BARCLAYS Bank Limited,

which recently ordered 75 automatic cash dispensing machines from De La Rue

Instruments Limited for its Barclaycash Service, has increased the order to

250 machines. Delivery of these 'robot cashiers' started last month and it

is planned to have the majority installed and in operation by the end of

June next year. These machines, which enable customers to withdraw cash

from their accounts 24 hours a day, 7 days a week, will be sited to cover

areas with the largest population and the greatest number of accounts,

giving the best possible geographic coverage', said Mr. D. M. Taylor, a

General Manager of Barclays Bank.

'We are spending

over £1 million on the installation

of these machines in an effort to provide a compensatory service for the

Saturday closure of branches, due to come into operation on July 1 next

year. 'Every customer within the Greater

London area, and over half of those outside London, will have one of these

machines within three miles of their usual banking branch. For the remaining customers the nearest

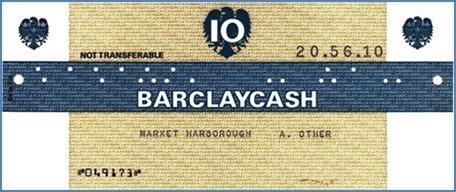

machine will be only a short car journey away.' The Barclaycash Service,

developed by the Bank's Management Services Department in conjunction with

De La Rue Instruments, is designed to dispense £10 against a special voucher which can be processed in the

same way as an ordinary cheque and debited to the customer's account. The

vouchers are valid for six months and do not have to be paid for in

advance. They are issued free to approved customers, each of whom is allocated

a personal code number. 'We are spending

over £1 million on the installation

of these machines in an effort to provide a compensatory service for the

Saturday closure of branches, due to come into operation on July 1 next

year. 'Every customer within the Greater

London area, and over half of those outside London, will have one of these

machines within three miles of their usual banking branch. For the remaining customers the nearest

machine will be only a short car journey away.' The Barclaycash Service,

developed by the Bank's Management Services Department in conjunction with

De La Rue Instruments, is designed to dispense £10 against a special voucher which can be processed in the

same way as an ordinary cheque and debited to the customer's account. The

vouchers are valid for six months and do not have to be paid for in

advance. They are issued free to approved customers, each of whom is allocated

a personal code number.

|

|

|

Barclays

makes the bold move of basing the use of its cash machines upon the

principle of the cheque. After all, customers are familiar with the idea of

exchanging a cheque for cash INSIDE the bank, so it follows that their

brain will not be too taxed by being asked to offer a similar voucher to a

machine OUTSIDE the branch, in order to receive a pre-approved amount of

money. As we can see in the example

above, special cheques worth £10 each are issued to “approved”

customers. The customer’s details

are coded into the special series of holes punched into each cheque, and

the corresponding personal code number issued to the customer allows the BARCLAYCASH machine to decide whether or not to make its drawer full of cash

available. Whilst this system does

seem a little complicated against the simplicity of the card and PIN we all

use today, it is nevertheless first in its field, and allows Barclays to

pull off, (and deservedly enjoy the limelight of) the World’s first cash

dispenser. By 1970, most Banks have

given in to pressure from the Trade Unions to end the six day week, and

when your smiling cashier starts to enjoy his or her new found freedom on a

Saturday, customers are still able to get their hands on cash. The rest is of course history - Saturday

closure lasts only about twelve years before Barclays are once again in the

habit of being first to throw open the doors to offer all the services that

BARCLAYCASH and

its offspring BARCLAYBANK,

cannot…

|

|

Special thanks to

Barclays Group Archives

|

|

![Design-Archives-Uni-Logo[1].jpg](Martins%20Auto%20Cashier_files/image053.jpg)

In response to our request for information and

images relating to the development of the CHUBB cash dispenser from the

original Martins design, our good friends at the University of

Brighton Design Archives dug deep and came up trumps with a wonderful set

of colour photographs taken in 1969 when the MD2 machine won the Prince

Philip Design Award. So pleased to

have found them, they decided to make them available to view in their

flickr® Photostream. They look as fresh today as when first taken and you

can see them in all their glory by clicking HERE. In response to our request for information and

images relating to the development of the CHUBB cash dispenser from the

original Martins design, our good friends at the University of

Brighton Design Archives dug deep and came up trumps with a wonderful set

of colour photographs taken in 1969 when the MD2 machine won the Prince

Philip Design Award. So pleased to

have found them, they decided to make them available to view in their

flickr® Photostream. They look as fresh today as when first taken and you

can see them in all their glory by clicking HERE.

|

|

|

|

|

|

|

|

|

![]()

![]()

![]()

![]()