|

|

![]()

|

MARTINS BANK AND THE TRADE

UNIONS |

![]()

|

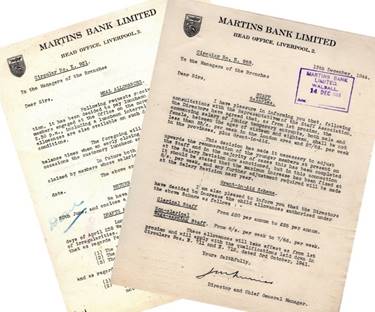

{BANK OFFICERS GUILD officials believe that

the newly formed Martins Bank Staff association is intended to thwart the

Guild’s struggle for recognition. Mr T G Edwards, general secretary of the

Guild, told the “Daily Herald” yesterday that he believed this was the first

of a series of similar bodies which the banks would set up. Heads of departments at Martins has been

asked to encourage their staff to join. One of the criticisms of the “company

unions” has been that they are non-contributory. The new Martins association announces a

subscription of 5s. a year for men and 2s. 6d. for women. A circular to the

staff stated that the new association would “continue the Sick and accident

fund”. This fund, Mr Edwards added,

was one which members of the staff could voluntarily join. The circular seemed to imply that the

membership of the fund and of the new staff association would in future have

to go together. He had therefore

written to the secretary of the Bank asking him to clarify the position. Early this month the Guild reported to the

minister of Labour that it was in dispute with the banks as they had refused

to negotiate with it on the question of salary increases to meet the higher

cost of living. The Minister, therefore,

has to decide whether the case is one which should be referred to the

National Arbitration Tribunal for settlement}.

Daily

Herald 22 August 1940 Image

© Trinity Mirror Image created courtesy of the British Library Board. Image

reproduced with kind permission of The British Newspaper Archive www.britishnewspaperarchive.co.uk

It’s an early start for

Martins Bank Staff Association…

The 1960s was a time of great change in the banking industry. The decade began with computer experiments, but ended

One advantage for Martins might have been that competition between the

different banks would not involve the vulgarity of having to harmonise pay across the

industry. The reason given by Martins

for the formation of the Staff Association, was to have a meaningful body to

carry forward the already established Staff sickness and accident fund, to

which staff paid a small subscription each year in return for healthcare

benefits - the National health service does not come into being until 1946,

so an employee sickness fund that could pay doctors’ and hospital bills made

perfect sense. The fund was still in

operation up to the merger with Barclays in 1969. At that point, it offered

cover from BUPA, which today still

provides private workplace sickness cover In any case, staff associations

were here to stay, and on the whole popular with their members.

Industrial unrest in Britain became strong in the early to mid-1960s,

and lasted until the late 1980s. In the 1950s and 60s, armed raids on banks

grew in number, and mental health care for staff affected by these raids was

non-existent. For many years, the idea

of a trade union for bank workers was frowned upon and actively suppressed by

some of the banks. Martins prided itself on being a “family”, especially as

new branches were being opened all over England, the staff who worked in them

being referred to – rather bucolically – as “pioneers”. The British government had made it known

that banks should be “ready” for decimalisation in 1971, and that did not

simply mean being able to count in pounds and pence instead of pounds SHILLINGS and pence. At this time, pay in banking is still quite

low and despite male and female salary scales being harmonised for the first

five or so years of a banking career, inequality of the sexes meant a

male-led banking industry, which in many respects lasted even into the early

1990s.

NUBE - The

National Union of Bank Employees…

NUBE’s “Discount Shopping Scheme” was aimed at members of the staff

who perhaps were NOT quite so “well to do”, and several offers gave discounts

on everyday products in local shops. Sadly, this is the only item in our

Archive that represents the National Union of Bank Employees, so we would

love to hear from Martins Staff who bucked the trend of what was the very

well subscribed and supported Staff

Association to instead join an actual trade union in the 1960s. Please do get in touch with us at the usual

address – martinsbankarchive@btinternet.com. By the late 1970s, the question “are you

going to join the union, or ‘just’ the staff association” was a familiar one

to new Barclays staff members, with NUBE colleagues keen to point

out that they felt it pointless to be “on the side of the Bank” – which is

how they saw a staff association. The

staff of some banks had no choice – the staff of the Trustee Savings Bank were

made either to join NUBE, or make a monthly

contribution of the union fees to a charity…

|

|

|

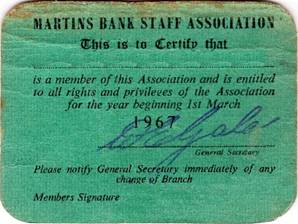

In the 1960s, Martins Bank Staff Association was flying high. Its general secretary, W “Eddie” Gale went

on to be at the helm of Barclays Staff Association, and our staff database

includes a special section for those staff who were seconded from their usual

work to serve the Staff Association.

An annual membership card is issued, which is personally signed by the

General Secretary, these being the days of cardboard, minimal printing, and

fountain pen ink! This piece of

cardboard is, nevertheless a serious one, reminding staff as it does that as

members of the Association, they are entitled to all rights and privileges of

the Association for the year beginning 1st March. Most of the rights and privileges referred

to are actually the terms of employment for the member of staff concerned,

and these are laid out in the Staff Association publication: “INSIDE INFORMATION”.

|

|

Shhh! Here is some

“Inside” Information...

The first few pages spell out an employee’s “service agreement with

the bank” a long and

|