|

|

|

After having been a member for forty-seven

years

Martins Bank divided Europe into

region of up to four countries, and then produced a Pocket Guide that was

tailored to each of these regions. By 1969 the leaflets had the same unform

“in house” style of presentation as other product and services leaflets

published by Martins’ Advertising department.

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

How the Common Market started

In 1946, when much of Europe was in ruins and people were

still bitter after years of war. Sir Winston Churchill made a speech calling

for “an act of oblivion against all the follies and crimes of the past”, and

advocating some form of union in Europe. The idea caught on. In 1948 eighteen

countries formed the Organisation for European Economic Co-operation

(O.E.E.C.). This was so successful that in 1951 six of these countries agreed

to further co-operation by co-ordinating their basic industries—coal and

steel—and formed the European Coal and Steel Community (E.C.S.C.). The

experience they gained from this was so encouraging that an association with

much wider implications was proposed, and as a result the European Common

Market—officially called the European Economic Community (E.E.C.)—was set up

by the signing of the Treaty of Rome in March, 1957.

What is the Common Market ?

It is the group formed by Belgium, France, Holland, Italy,

Luxembourg and West Germany (sometimes known as “the Six”) who have agreed to

abolish, by stages over several years, all Customs duties and restrictions on

trade between each other. Duties will still be charged on imports from

outside the area: these will be co-ordinated into a single Customs structure

common to all the six countries. To strengthen the association there are to

be common policies for agriculture, transport, labour, social services,

capital and finance.

What will be the effect of this ?

The provisions of the Treaty will create complete freedom for

trade and commerce throughout the area. Eventually there will be one huge

market, enjoying economies of large-scale production and sales. The

co-ordination of economic and social policies within the Common Market will

create uniformity of business conditions in each country. Anyone in the

Common Market will be free to set up and carry-on business in any part of the

area, while within the Community any person will be free to seek employment

anywhere, he wishes. Co-operation amongst the Common Market countries will be

far-reaching. Joint industrial enterprises are already being planned; other joint

ventures—in education and research, public works, taxation, currency

reform—are already under discussion. Many people foresee an inevitable

movement towards political union in Europe.

What are the advantages of the Common Market

?

Already living standards in the six countries arc rising

rapidly. A dynamic spirit is apparent, industrial output is expanding, and

trade is increasing. A rich and powerful community is being created, whose

industries arc highly competitive both at home and in world markets. Although

Europe has always been split up into a number of states, the influence of its

civilisation dominates the whole modern world. Unified, Europe could assume the

economic and political leadership which is now vital for the survival of

civilisation. How would the Common Market affect Britain

if we did not join ?

A large proportion of Britain’s exports go to Europe, but when

tariffs between the countries of the Six disappear the huge market will

enable their own industries to produce more efficiently and cheaply and to

develop along new lines. British industry would then be at a great

disadvantage, not just in Europe but in competition with Common Market goods

all over the world. Overseas business and investment would tend to be

attracted to the progressive Common Market in preference to the United

Kingdom. Indeed, some people believe that unless she joins the Common Market

Britain will become a relatively backward country in a few years. What would happen if Britain joined the

Common Market ?

Provided British industry met the challenge by successful

competition in Continental markets and in the British home market, this

country could enjoy a full share of the prosperity of the Community if she

were to join. Why did Britain not join in the first place

?

For

three important reasons Britain has until now felt unable to join the Common

Market. First, there is the effect on the Commonwealth countries, many of

whom are dependent on the preferential market which Britain provides for

their trade, and on the whole financial and commercial structure of the

Commonwealth. These seem to be incompatible with Britain’s unconditional

membership of the Common Market. In the second place, Britain’s system of

agricultural subsidies cannot be reconciled with the Continental system,

which will presumably form the basis of the Common Market’s proposed

agricultural policy. In the third place, Britain is a member of the European

Free Trade Association (E.F.T.A.)—known as “the Seven”. The rules of this organisation arc not altogether compatible

with those of the Common Market. In addition, Britain's reluctance to join

the Common Market has undoubtedly been reinforced by the traditionally

insular outlook of the British people. What is the present

position ?

After lengthy controversy, Britain has now officially started

negotiating to join the Common Market. The difficulties over the

Commonwealth, E.F.T.A., and agriculture, will be discussed during these

negotiations. How will membership of

the Common Market affect Britain ?

Many industries in Britain are highly efficient and will be

well-placed to compete in the new market; some others will have to overcome

severe competition from Continental producers; while some may well have to

meet serious difficulties through competition from Continental manufacturers. Our balance of payments may initially come under pressure, as

restrictions on imports of goods from the Continent are removed. All sections

of the community must become conscious of the necessity to eliminate

inefficiency and high costs, which will tend to divert business to the

Continent. In time, it may become necessary to accept nationals of European

countries into employment in British industry. Among many other changes which

will take place will be the universal adoption of the principle of equal pay

for men and women. Nevertheless, all these changes will be made gradually, so

that the country will have time to adapt itself to the new conditions. How

Britain fares in the Common Market will depend on how effectively this

adaptation takes place. Countries of the

European Common Market (“The Six”)

In addition, Greece has been granted a form of associate

membership.

Countries of the

European Free Trade Association (“The Seven”)

Finland is also a member on special terms.

Populations:

The population of the Common Market countries, together with

those countries now considering joining, is 231 millions.

National Incomes (total values of all goods and services produced).

For the Common Market together with countries now considering

joining, the figure is 112.

Index of the volume of

industrial production (1952=100).

|

|

The items shown below are not part of the Common market

Leaflet but they do illustrate some of the services and advertisments offered

or produced by the Bank for the traveller…

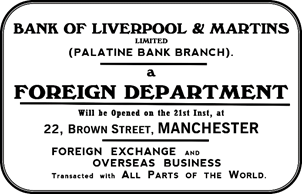

18 June 1920 Bank of Liverpool and

Martins Ltd Manchester Foreign Branch

opens

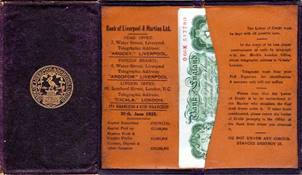

1920s – Leather Wallet, Bank of Liverpool and

Martins Ltd. For

letters of credit, currency and personal papers

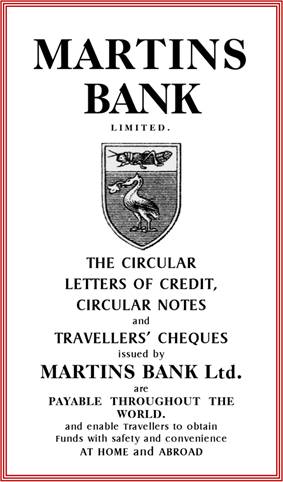

1930 – Martins Bank Ltd Advertisement for Foreign

Services

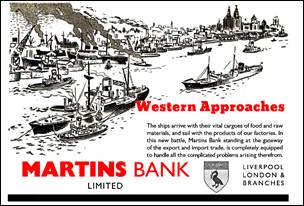

1939 – Martins Bank Ltd Pre-War Advertisement:

Foreign Trade

1945 – Martins Bank Ltd Post War Advertisement: for

Foreign Trade

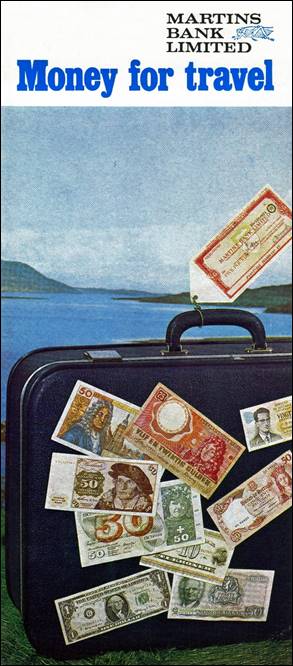

1960s – Martins Bank Ltd Leaflet: Money for Travel 0

1968 – Martins Bank Ltd Martinplanning Means a

Gorgeous Holiday |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Ultimately, on 1 January 1973, Britain DID join the

European Economic Community. This came too late for Martins Bank, whose

merger with Barclays had been over and done at least four years before

that. At least we can say that Martins

was discussing Europe as early as 1960, and that with its dedicated Foreign

branches offering every kind of assistance to those who traded with Europe,

as well as those who went there on holiday, the Bank certainly played its

part…

|

||||||||||||||||||||||||||||||||||||||||||||||||||