|

Although Martins is the first bank – in 1959 - to use

a computer to handle the day to day processing of customers’ accounts, the

rollout of the necessary equipment and the conversion of accounts by the

allocation of account numbers is very slow.

Experiments take place at several branches up and down the land to

measure the impact of computer accounting on the workload of branches, but

sadly Martins never quite reaches the stage of full conversion to computer

operation before the merger with Barclays.

Computer centres are established at Liverpool Head Office and in

London, with Liverpool Heywoods, and London South Audley Street Branches

processing their day’s work directly onto computer using punched paper tape.

In 1966 Martins opens what for that time is the state of the art LONDON

COMPUTER CENTRE at Bucklersbury House in Wallbrook, London. The above image shows the

machine accounting room at Liverpool Heywoods Branch in 1963. The process of

computerisation requires a number of time consuming clerical stages to

complete - Account numbers must be allocated to every account of every

customer. The numbers must be recorded on every voucher that passes through

every account. The account number and transaction details have to be punched

onto paper tape which is then read by the computer. Transactions are added on

to or taken away from the running balance of the customer’s account. The

computer also records statistical information that will help staff with the

calculation of bank charges and interest. Although Martins is the first bank – in 1959 - to use

a computer to handle the day to day processing of customers’ accounts, the

rollout of the necessary equipment and the conversion of accounts by the

allocation of account numbers is very slow.

Experiments take place at several branches up and down the land to

measure the impact of computer accounting on the workload of branches, but

sadly Martins never quite reaches the stage of full conversion to computer

operation before the merger with Barclays.

Computer centres are established at Liverpool Head Office and in

London, with Liverpool Heywoods, and London South Audley Street Branches

processing their day’s work directly onto computer using punched paper tape.

In 1966 Martins opens what for that time is the state of the art LONDON

COMPUTER CENTRE at Bucklersbury House in Wallbrook, London. The above image shows the

machine accounting room at Liverpool Heywoods Branch in 1963. The process of

computerisation requires a number of time consuming clerical stages to

complete - Account numbers must be allocated to every account of every

customer. The numbers must be recorded on every voucher that passes through

every account. The account number and transaction details have to be punched

onto paper tape which is then read by the computer. Transactions are added on

to or taken away from the running balance of the customer’s account. The

computer also records statistical information that will help staff with the

calculation of bank charges and interest.

|

|

|

|

Image © Martins Bank

Archive Collections

|

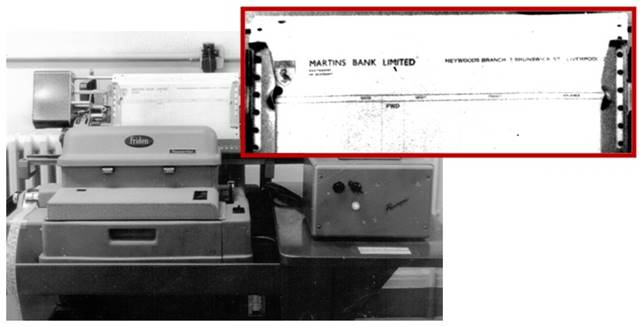

The Friden “Flexowriter” at

Liverpool Computer centre, with (inset) a statement ready to print for

Heywoods Branch.

Images © Martins Bank Archive Collections - Ron Hindle

Estate

|

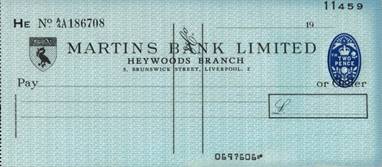

This is a very early example of a Heywoods cheque

encoded with an account number. Later,

the branch sorting code number, and a cheque number will also be encoded

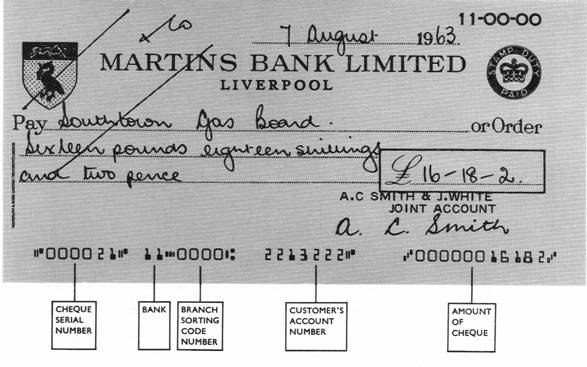

along the bottom edge of the cheque, as in the example below. In 1968 customers of 68 Lombard St Branch

receive letters explaining that they are next for automation… Best of all, the age of “error free” banking has finally arrived -

Thanks to READER/SORTER technology, machines can now read the information printed on cheques,

and sort each cheque according by any part of that information. This ensures (in theory) that YOUR account

and nobody else’s will be debited. But

how does it work? The process of

developing special characters that can be read by machines and humans alike

was long and labourious, but finally Banks in Britain and America have settled upon a common ‘code’ that is used

to represent customers’ information in the form of the magnetic E13B

typeface. For an in-depth look at how these numbers work, click HERE This is a very early example of a Heywoods cheque

encoded with an account number. Later,

the branch sorting code number, and a cheque number will also be encoded

along the bottom edge of the cheque, as in the example below. In 1968 customers of 68 Lombard St Branch

receive letters explaining that they are next for automation… Best of all, the age of “error free” banking has finally arrived -

Thanks to READER/SORTER technology, machines can now read the information printed on cheques,

and sort each cheque according by any part of that information. This ensures (in theory) that YOUR account

and nobody else’s will be debited. But

how does it work? The process of

developing special characters that can be read by machines and humans alike

was long and labourious, but finally Banks in Britain and America have settled upon a common ‘code’ that is used

to represent customers’ information in the form of the magnetic E13B

typeface. For an in-depth look at how these numbers work, click HERE

M M

|

![]()

![]()

![]()

![]()