|

|

Wanted: Industrious young men and intelligent girls…

|

|

In an industry which regularly sees people retire after

well over FORTY years of service, recruitment is still a serious

business. Martins Bank needs to

replace hundreds of staff each year, those who have reached retirement,

those who are made to leave as a consequence of getting married and, sadly those who die in service. In an industry which regularly sees people retire after

well over FORTY years of service, recruitment is still a serious

business. Martins Bank needs to

replace hundreds of staff each year, those who have reached retirement,

those who are made to leave as a consequence of getting married and, sadly those who die in service.

We have combined two of our

feature pages into one and added some new detail, in order that we can look

at the benefits of working for Martins, and at the efforts the Bank goes to

offer what is described as “a career with BIG opportunities” for “the nicest

people”. By 1963 Martins is flying

high, and with the major celebrations of the Bank’s four-hundredth

anniversary in full swing, “…a career with Martins Bank” is launched – a

twelve page recruitment booklet designed to attract school leavers.

|

WHY NOT ALSO VISIT THESE PAGES

|

|

|

|

|

A little further down this page we shall look in detail at this

booklet, and see how it is clearly aimed at men, who at this point in the

Bank’s history are still the “bread-winners” of families, and upon whom all

manner of great training and other opportunities are lavished if the young

man concerned fits the bill. First, we’ll go a little futher forwards in

time to 1968, to look at two brand new leaflets – the last before Martins

and Barclays merge. We still see two

very different people, the first is dynamic, go-getting and ripe for a

fast-track system of promotions to the top of their game by the age of

32. The second is offered a

selection of jobs, from machine operator, to typist, cashier or secretary,

and even the lofty height of computer operator. The first is of course for men, and the

second is for the ladies. The weird

thing is, the only things stopping women from becoming just as successful,

were the men! Equal pay has arrived

at Martins, and at least for the first six or so years of employment, all

genders are paid the same. From then

on, the divergence is astonishing, with a man earning the equivalent today

of £46,500 by the age of 32, and a women earning £16,000! History tells us of the continued

struggles of women to be recognised as equals in the workplace, and even in

the twenty-first century, the subject has not been put to bed. See what YOU make of Peter

Jackson, and “a girl” as we shall call her, as no one has given her a name…

|

|

|

Peter Jackson joined Martins Bank

straight from school with a couple of good ‘A’ Levels and the sort of

drive that would take him to the top in quite a few different types of

business. Right from the start, he felt at home. The Manager took a keen

interest in Peter’s progress, and arranged study leave for the

all-important Banking Diploma. Very soon Peter became a cashier, handling

large sums of money, known and trusted by his regular customers. Lectures

and formal training sessions supplemented his rapidly increasing

experience of practical banking, and it wasn’t long before he was given

full responsibility for running the branch when the Manager was away. Now

in his early thirties, and earning around £2,400 a year, Peter Jackson is

a Manager in his own right, running a medium-sized branch in a busy town.

His work brings him into contact with all sorts of people-professional

men, bosses of industry, shopkeepers, harassed husbands trying to sort

out the family budget-the list is endless. What’s more, it’s no desk-bound

job. As a Manager, Peter Jackson spends a lot of his time getting out to

see and learn about his customers at first hand. That driving seat of his

is just as important as the chair behind his office desk. He’s got to be

able to size up a construction job, say, as competently as he sizes up

his various customers. Even now, he's very much boss of his own show. But

that's by no means the end of the road. Bright people like Peter Jackson

who come to Martins can, and very often do, go right to the top of the

tree in general management.

|

Banking is growing fast; technical

innovations are coming in rapidly and the scope for real management

talent grows all the time. To foster the abilities they need in senior

men, Martins send a number of them every year to various residential

business schools, including Oxford and Harvard. Experience of this type

is invaluable in broadening their knowledge not only of banking but of

business problems of every type. Peter Jackson was a shrewd young man. He

picked a career that would not only give him the scope he wanted, but

would positively help him to develop the qualities to succeed which he

already possessed. He’s got a well-paid, responsible job, plus a great

many valuable fringe benefits - a first-class pension scheme, excellent

sick pay arrangements, special low-cost loans for housing, sports and

social facilities - not to mention four-and-a-half weeks’ holiday a year.

If you’ve got the qualities of Peter Jackson, with either a degree, 2 ‘A’

Levels or a minimum of 4 ‘O’ Levels, you could enjoy the same sort of

exciting, progressive career. The first step is to write with brief

details of your achievements to the nearest address overleaf.

|

|

|

|

|

|

|

|

Working with Martins is much more

than just having a job. For a start, the work is really varied and

interesting. As machines and computers take over much of the routine

book-keeping and clerical work, more and more girls are becoming

cashiers, meeting the customers, getting to know them as individual

people in a way that's difficult in most types of business. Customers

rely on you, too. You handle important, confidential affairs and are

treated very much as a friend and confidante - again, not something that

you find in every job. Other jobs include typing and secretarial work –

and the secretary to a Branch Manager is an important person in the Bank

- as well as specialist jobs for machine operators. Another pleasant

thing about working with Martins is the friendly atmosphere you find

wherever you go. Colleagues treat you as a friend and an equal, and

customers rely on your knowledge and advice. As a Bank we have a

reputation for being friendly and helpful, and girls who join us often

say how much they value this aspect of their job. There’s a wide range of social and

sporting activities open to you as well. Inter-District hockey and tennis

matches and other sporting fixtures are arranged, and there are also

opportunities for taking part in amateur dramatics and other activities.

|

Staff dinners and dances, too, are

held regularly in each District of the Bank and are always extremely

popular and well-attended. Welfare problems are looked after by a Lady

Supervisor in each District who is always ready to discuss any personal

problems or worries which you may have. Salaries are good, with increases

above the basic rates for merit, as well as special allowances for girls

working in the London area. Holidays can amount to four-and-a-half weeks

a year, according to age and salary, and there are excellent pension,

insurance and sick pay schemes. If you are looking for a long-term career

there are excellent prospects in Martins, where women are increasingly

taking on greater responsibilities. Whatever your aim in life, you'll

find that working with Martins is more than just a job - it’s a great

deal of fun as well. If you would like to know more, and have an 'O’

Level education or are proficient at typing or shorthand, write with

brief particulars, to the nearest address overleaf.

|

|

|

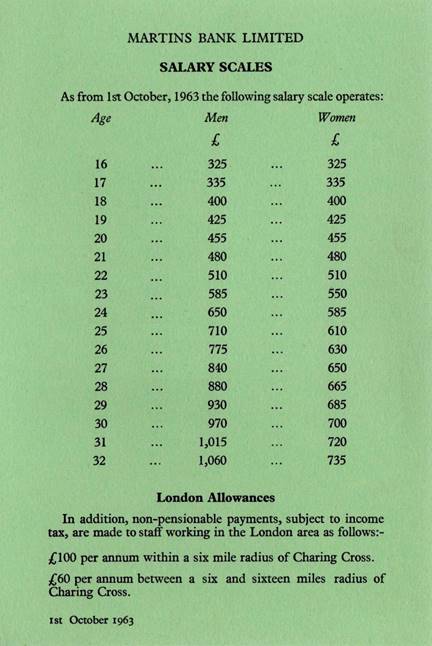

Although by this time the

starting salary for both men and women has been made equal, this is about

the only thing that is, in a career with Martins Bank. As we have seen above, men are

destined to be managers, on £2,400 by the age of 32, whereas women can

expect to have reached £870 by the age of 32 for an “above average”

performance. Men are courted with

tempting offers of extra pay for A Levels, and being sent on three month

managerial training courses. Women

are enticed by “those wonderful machines that do the donkey work” and the

scope to earn more if you work hard.

It is not, however, all about equality of the sexes, or indeed a

lack of it. A career with Martins is

an excellent proposition for the long term, and ahead of its time with

features such as a two-thirds final salary pension scheme. So just what IS on offer? Let us take a look inside our shiny,

freshly minted copy of “A career with Martins Martins Bank”…

|

|

|

When

you are faced with the difficult problem of choosing your career

there are many factors to take into consideration. The most important of

these are your own special abilities and ambitions and the opportunities

you will be given to

fulfil them; but you will, of course, be concerned with such things as pay, conditions of service,

holidays prospects of advancement and so on.For a well-educated young man

of character, banking offers a most satisfying career with excellent

prospects. It affords the widest possible scope for the exercise and reward

of talent, for remember, banking is in every sense "Big Business"

and requires intelligence, judgment, drive and tact of the highest order. If you decide

to make your career with Martins Bank you will, like everyone else who

joins the Bank, start at the bottom and then work your way up. The

prospects for new entrants have never been brighter. Approximately 50 % of

the men joining the staff can expect to reach branch manager level (many of

them do so in their early thirties) and the most able of these will go on

climbing to reach the senior management positions in the Bank. When

you are faced with the difficult problem of choosing your career

there are many factors to take into consideration. The most important of

these are your own special abilities and ambitions and the opportunities

you will be given to

fulfil them; but you will, of course, be concerned with such things as pay, conditions of service,

holidays prospects of advancement and so on.For a well-educated young man

of character, banking offers a most satisfying career with excellent

prospects. It affords the widest possible scope for the exercise and reward

of talent, for remember, banking is in every sense "Big Business"

and requires intelligence, judgment, drive and tact of the highest order. If you decide

to make your career with Martins Bank you will, like everyone else who

joins the Bank, start at the bottom and then work your way up. The

prospects for new entrants have never been brighter. Approximately 50 % of

the men joining the staff can expect to reach branch manager level (many of

them do so in their early thirties) and the most able of these will go on

climbing to reach the senior management positions in the Bank.

The

banking industry provides an essential service to the community and without

banks business could not function in the modern world. The money with which

wages are paid has to be collected from suburban banks into which it has

been paid by shopkeepers and others, and brought each week to other banks

for issue to the cashiers of firms to be made up into wage packets; silver

and copper received from transport undertakings have to be redistributed

throughout each area; the settlement by cheque of millions of personal and

commercial debts is handled daily by the banks, who also finance and handle

operations arising out of foreign trade. The

banking industry provides an essential service to the community and without

banks business could not function in the modern world. The money with which

wages are paid has to be collected from suburban banks into which it has

been paid by shopkeepers and others, and brought each week to other banks

for issue to the cashiers of firms to be made up into wage packets; silver

and copper received from transport undertakings have to be redistributed

throughout each area; the settlement by cheque of millions of personal and

commercial debts is handled daily by the banks, who also finance and handle

operations arising out of foreign trade.

On the basis of the sums

deposited with them by their customers, banks are in a position to lend

money to business, commerce and industry, and to private individuals,

too. Money can be borrowed from a

bank by anyone who is credit-worthy and can show that he has a proper need

of it. For example, a business man wishing to expand his business may need

to borrow money to buy raw materials: an exporter may require credit while

awaiting payment for goods sold abroad: a professional man may need a loan

until his fees have been paid to him: and a private person may want to

borrow from the bank for a variety of purposes. At the same time, a bank

offers its customers a range of most useful and important services from the

safe-keeping of documents and valuables, the buying of shares through a

stockbroker to its appointment as their executor or trustee.

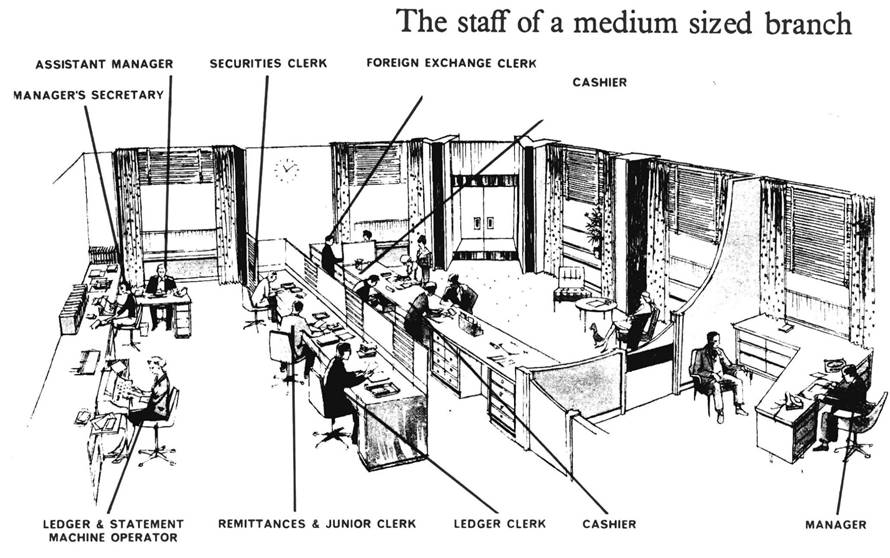

So,

as you see, to carry out all these varied functions for our customers we

must have branches widely spread over the whole country. Martins Bank has

over 600 throughout England and Wales, and these vary from quite small

country branches, which may employ less than half a dozen, to large ones in

industrial cities having staffs numbering 150 or more. Branches differ very

much, not only in size but also in the nature of their business, and

members of the staff are transferred from one to another to give them as varied

a knowledge and experience as possible. These moves are always stimulating

and exciting, as you are brought into touch with different types of

customer and learn to handle different kinds of business. So,

as you see, to carry out all these varied functions for our customers we

must have branches widely spread over the whole country. Martins Bank has

over 600 throughout England and Wales, and these vary from quite small

country branches, which may employ less than half a dozen, to large ones in

industrial cities having staffs numbering 150 or more. Branches differ very

much, not only in size but also in the nature of their business, and

members of the staff are transferred from one to another to give them as varied

a knowledge and experience as possible. These moves are always stimulating

and exciting, as you are brought into touch with different types of

customer and learn to handle different kinds of business.

If

you have the right type of enquiring mind you will find your work of

absorbing interest throughout the whole of your career. You must, of

course, first master the necessary elements of the Bank's book-keeping and

record systems covering the great number of daily transactions on behalf of

customers. As you can imagine, to deal efficiently with an ever-growing

volume of business calls for the highest degree of organisation. We

therefore use the most modern aids to accounting and we were one of the

first banks in the country to

use an electronic computer to do the bookkeeping of a branch bank. If

you have the right type of enquiring mind you will find your work of

absorbing interest throughout the whole of your career. You must, of

course, first master the necessary elements of the Bank's book-keeping and

record systems covering the great number of daily transactions on behalf of

customers. As you can imagine, to deal efficiently with an ever-growing

volume of business calls for the highest degree of organisation. We

therefore use the most modern aids to accounting and we were one of the

first banks in the country to

use an electronic computer to do the bookkeeping of a branch bank.

Later

you will act as a cashier or securities clerk. Most customers of the

smaller branches have met and know the manager but the cashier is the

person they know best, because they see him or her often and become

friendly. A cashier's job is thus very important, because he does so much

in serving the needs of customers, keeping them happy and making it a

pleasure for them to come to the bank. Later

you will act as a cashier or securities clerk. Most customers of the

smaller branches have met and know the manager but the cashier is the

person they know best, because they see him or her often and become

friendly. A cashier's job is thus very important, because he does so much

in serving the needs of customers, keeping them happy and making it a

pleasure for them to come to the bank.

The control of the branch

rests with the manager who, in larger branches, has an assistant manager or

an accountant, or both, to assist him.

In the course of your work in a bank you will have to deal with

customers drawn from almost every profession, trade and occupation. The

ability to get on well with all kinds of people is one of the

"musts" for a successful career in banking.

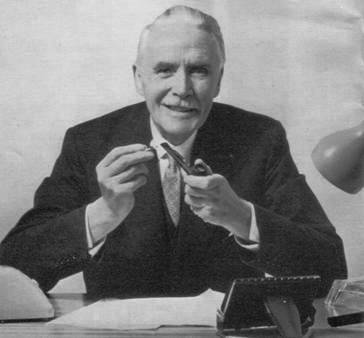

The Branch Manager…

…has

a most interesting job. He is, of course, responsible for everything that

goes on within his branch; the organisation of the work, and the training,

welfare and discipline of his staff. A good branch manager stands high in

the regard of the community he serves. He is an important servant of the

public, representing the bank whose duty is to serve the public well. The

manager meets and knows all classes of people and he must therefore be a

good student of human relations. He is bound to acquire a wide knowledge of

affairs relating to business, commerce, industry and agriculture and he has

to maintain a keen interest in the changes and problems which arise. His

customers will come to discuss their problems with him and his experience

and knowledge will be at their disposal. His technical knowledge of banking

is wide and his practical experience can only be acquired over years of

good solid hard work. Friendly, cheery, ever ready to help, the branch

manager has a business life that is never dull, a life which gives all the

opportunities one could desire for advancement.

The

Assistant Manager…

…takes

charge of the branch whenever his manager is away from the office.

Often he is a man ear-marked for promotion to the position of manager and

in the role of assistant he is able to gain the best practical experience

to fit him for his future responsibilities.

The

Accountant…

…is

responsible for the running of the routine work of the branch. It is only in the

larger offices that an accountant is appointed and the choice is made from

those who are masters of every detail of the Bank's book-keeping system.

|

|

The

Securities Clerk…

…is responsible for documents deposited by customers for safe-keeping— share certificates, deeds, policies, etc. He

arranges for the purchase or sale of stocks and shares on behalf of customers

with the branch stockbrokers, and generally attends to the recording and

perfecting of all forms of security for customers' borrowings. His job

requires technical knowledge and is essential experience in training to be

a branch manager. Most of the other members

of the staff are behind the scenes actively engaged in entering the daily

transactions in the books of account and, in short, carrying out the many

varied duties which go to make up a day's work at a branch. Where there is

a large volume of work the ledger clerks are often girls who work with the

aid of accounting machines, but you too will be required to get to know

this work as part of your early training in the Bank. In addition to branch

work there are departments which deal with overseas business, executor and

trustee work, and income tax matters.

|

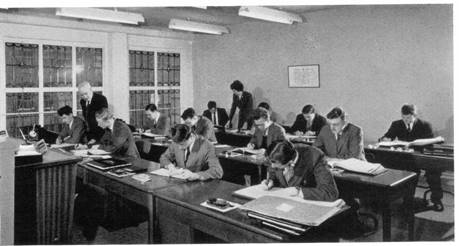

A Syndicate meeting at a

Senior Training Course

|

|

There are also the Head Office departments such as Chief

Accountant's, Share Transfer, Inspection, Premises and Staff, all of which

offer attractive opportunities. Though there is not space to go into detail

about the varied nature of employment in these departments, the work does

differ a great deal, and the many interesting positions are filled from the

rank and file of the Bank.

What

are the qualifications for entry?

For

a career in banking there are certain personal qualities which you must

have. Intelligence, drive and initiative are essential and you will also

need to be of good appearance, courteous and to have a pleasing

personality. You should have had a

good education and you will be required as a minimum to have passed the

G.C.E. at Ordinary Level in English and Mathematics and in two other

subjects. If you stay on at school

to Advanced Level you may earn exemption in certain subjects in the

examinations of the Institute of Bankers.

Where a young man has Passes in two subjects at Advanced Level in

addition, he may be entitled to a higher commencing salary. Such extended education should develop

your personality and powers of leadership.

Possession of such qualifications will accelerate your progress and

favourably influence future remuneration.

If you are accepted for

entry…

…as a new

entrant you will probably begin your career at one of our training centres.

There, working with officers who have a special flair for instruction, you

will gain practical experience of the ordinary day to day routine work of

the bank. You will find this preliminary training, usually lasting for a

few weeks, of great value to you when you come to take up your duties as a

clerk in a branch.

A

Banking Diploma…

…You will appreciate of course that

you cannot get far in a banking career until you have equipped yourself

with the necessary technical knowledge, and to do this we require you to

study for and pass the examinations of the Institute of Bankers. The usual

examination which most boys take is that for the Banking Diploma which is

in two parts. On completing Part i a bonus of £30 will be paid to you, and £60 on completing Part

2. Some boys,

particularly those who start as juniors in the Trustee Departments, prefer

to take the examination for the Trustee Diploma instead of, or before

taking, the Banking Diploma. Part I is common to both the Banking and

Trustee Diploma examinations. An additional £60 is paid for the Trustee Diploma.

|

|

|

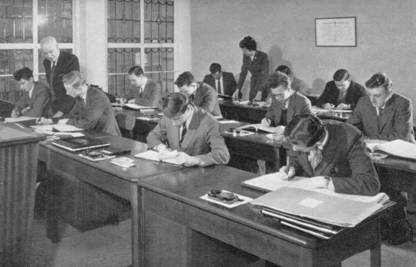

A class of new entrants at one of

our training centres. This preliminary training, usually lasting a few

weeks, is of great value to you when you come to take up your duties as a

clerk in a branch.

|

|

Training Courses

As time goes on, those who are beginning to show fitness for managerial

responsibility will be sent on a special Training Course which lasts for

several months and gives participants the opportunity of seeing something

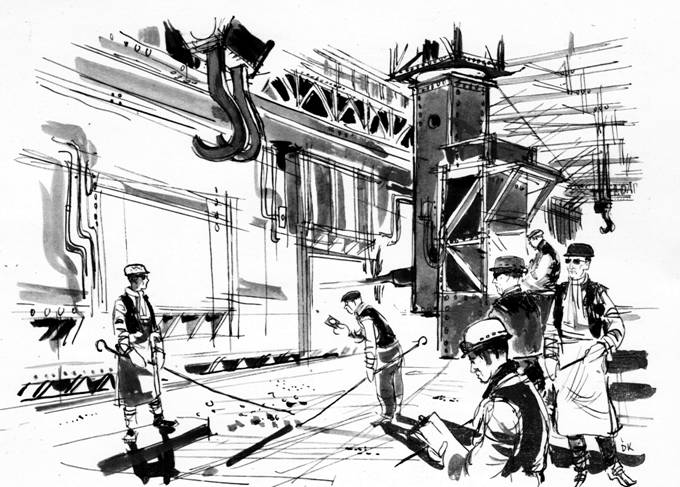

of the working of all departments of the Bank. There is also a Travelling Training

Scheme, for the younger executives, which provides a valuable means of

enlarging their experience in the various fields in which we as a bank are

interested. Factories, plants and installations of various kinds are

visited and problems of management are explained and studied. We regularly send specially chosen men to

the Administrative Staff College at Henley on Thames. This provides a

three months’ residential course for young executives from every kind of

business and a considerable broadening of the mind results from

participation in these courses of discussion and instruction. Selected men

are also sent each year to the International Banking Summer School at

Oxford or abroad, and to the Oxford University Business Summer School.

Those who are specialising in the overseas side of our business have

opportunities of enlarging their experience by travel and by working in

banks abroad.

|

|

|

|

|

Under our

Training Scheme those who are beginning to show fitness for managerial

responsibility are sent on a special Course which lasts for several months.

|

|

|

Under our

Travelling Training Scheme young executives visit factories and plants of

various kinds to gain practical experience of the problems of management.

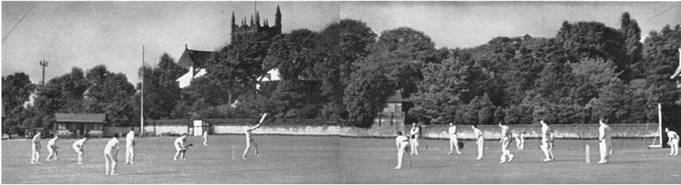

Social Activities

As a member of the staff

of Martins

Bank you will be able to join in social activities. Most of these

activities are organised by the staff themselves and, although they have

the active support of the management, you are absolutely free to decide in

which, if any, to join. Inter-District cricket, golf, hockey, soccer and

rugby matches are held from time to time and in some districts swimming,

tennis, bowling, skating, music, dramatics, operatics, art, bridge, chess

and other activities take place. Also staff dinners and dances are held

regularly in each district of the Bank.

|

|

|

|

|

Holidays

You will find that holidays at Martins

compare very favourably with those in other occupations. Two to four weeks'

holiday are given according to length of service.

How

much will you earn?

Salary rates are arranged on a scale

according to your age, and details are given on the salary sheet in the

pocket at the back of this booklet. An increase in scale salary is granted

automatically as each birthday comes round, provided that the reports on

your progress are satisfactory, but special ability can also earn you

additional 'merit' rewards. We are always on the look out for special

talent and when we find it, progress is rapid. You stand a good chance of

being appointed a branch manager in your early thirties. Nearly all

managers earn more than £1,800 a year

and some of them very much more. Later, if you have exceptional qualities

of initiative and leadership you may be promoted to one of the higher

positions on the executive side which can command salaries of several

thousands a year. There is nothing to stop you from becoming Chief General

Manager except another better man!

Your Pension

A generous pension amounting to

two-thirds of the salary reached on retirement at age 60 after not less

than 40 years' service is made possible by the large contributions made by

the Bank. You, yourself, contribute towards it 5 per cent per annum of your

gross salary and this is deducted month by month from your pay.

|

|

Our

“drive-in” branch at Leicester

The

Banking Hall at Head Office

|

The

Head Office of the Bank at Liverpool

One of

our Mobile Branches

|

|

Other Benefits

A house purchase

scheme is available

to assist members of the staff in buying their homes.

Life Assurance…

…can be effected with most of the insurance companies through

the Bank's agencies, the premiums being deducted from salary at favourable

rates.

Sickness and accident

insurance cover…

…is available for members of the staff wishing to contribute.

Widows' and Orphans' Fund.

Here again, with the assistance of very generous contributions

from the Bank, members of this fund are able to ensure a pension varying

between £150 and £300 for their widows.

Membership of the fund is compulsory and 2 per cent of your salary up to a

maximum of £25 per annum is deducted each month.

Death

Benefit Fund.

Membership

of the Death Benefit Fund provides cover for dependants if death should

occur before age 60. Maximum tax

advantages accrue and in consequence the rates of contribution are

extremely low. Membership is

voluntary.

Bank

Clerks’ Orphanage

Male members of the staff may contribute to the Bank Clerks'

Orphanage which, in the event of the father's death, cares for and protects

his children during the period of their education.

|

|

|

|

|

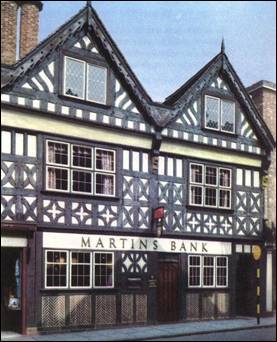

The exterior of

our Branch at Nantwich, and a typical modern interior design

at Stratford Upon

Avon – attractive, well designed buildings ensure

pleasant working

conditions.

In

this little book we have tried

to give you some idea of what a career in Martins Bank has to offer and

also what will be required of you if you are to succeed in this walk of

life. In

this little book we have tried

to give you some idea of what a career in Martins Bank has to offer and

also what will be required of you if you are to succeed in this walk of

life.

If a banking career

appeals to you there are probably a number of questions you would like to

ask before you finally make up your mind.

We would like to have the

opportunity of meeting you personally and setting your mind at rest on any

points, not covered in this booklet, about which you would like some

information.

You will find a form for

this purpose inside the back cover. Just fill it in and send it to us and

we will arrange to meet and talk matters over.

September

1965 sees the launch of a more compact careers guide that goes all out to

find “Industrious young men” and “Intelligent girls” who would like to

experience –

A

career with BIG OPPORTUNITIES

ONE

IN TWO of the men joining our staff can expect to become Branch Managers or

attain a position of equivalent status. The duties of a Branch Manager are

varied, interesting and rewarding, relating as they do to the human and

business problems of a wide cross-section of private individuals or company

customers. To prepare men to meet the tasks of management great emphasis is

placed on training. Internal schemes are supplemented by external

opportunities of attending Extra Mural Courses arranged by Universities and

Business Colleges. Selected men attend International Summer Schools and

specialists in the overseas side have opportunities to travel and work

abroad. ONE

IN TWO of the men joining our staff can expect to become Branch Managers or

attain a position of equivalent status. The duties of a Branch Manager are

varied, interesting and rewarding, relating as they do to the human and

business problems of a wide cross-section of private individuals or company

customers. To prepare men to meet the tasks of management great emphasis is

placed on training. Internal schemes are supplemented by external

opportunities of attending Extra Mural Courses arranged by Universities and

Business Colleges. Selected men attend International Summer Schools and

specialists in the overseas side have opportunities to travel and work

abroad.

Industrious young men who succeed in the Institute of Bankers'

Examinations and take advantage of the training opportunities afforded by

the Bank can achieve Branch Management at 30 years of age or earlier with a

salary of over £2,200 p.a. In the build up to Management, good performance

can earn merit awards. Progress in Branch Management can lead to salaries

of over £5,500 p.a. Commencing

income for intelligent, personable, ambitious young men with a minimum of:— 4 G.C.E. '0' Level passes at 16 years of age—£370

p.a. 2 G.C.E.'A' Level passes at 18 years of age—£525 p.a. Or a University

Degree at 21 years of age—£800 p.a. For staff working in the London area an

additional London Allowance of up to £150 a year is paid.

For

an intelligent girl a career in banking offers special attractions, and at

Martins Bank you will find that every encouragement is given to you to

progress. There are opportunities for quick advancement to responsible

positions such as secretary, cashier, machine supervisor or trust officer—all well paid posts. The basic salary for

girls rises from £370 at 16 to £830 at 32 years of age and merit increases

are added as a reward for above average performance. For

an intelligent girl a career in banking offers special attractions, and at

Martins Bank you will find that every encouragement is given to you to

progress. There are opportunities for quick advancement to responsible

positions such as secretary, cashier, machine supervisor or trust officer—all well paid posts. The basic salary for

girls rises from £370 at 16 to £830 at 32 years of age and merit increases

are added as a reward for above average performance.

For staff working in

the London area an additional London Allowance of up to £150 a year is

paid. Then there's the congenial atmosphere. You will enjoy working at

Martins Bank. The people are friendly and helpful. The work is interesting.

The working conditions are excellent. And there are special facilities for

recreation.

For a young man or woman

who has four passes at 'O' level in the G.C.E.—including English Language and

Mathematics—or, alternatively, for a girl who is proficient at shorthand

and typing, a career with Martins Bank offers excellent prospects. Why not

come and talk it over with us? Please write to the address below.

Superintendent

of Branches (Staff)

Martins

Bank Limited,

4,

Water Street, Liverpool 2.

September

1965.

|

|

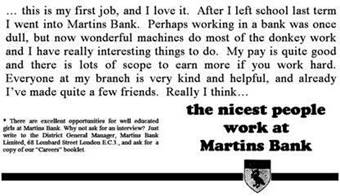

The nicest

people work at Martins Bank…

Let’s face it, the early to mid 1960s is a

DIFFERENT time. The pace of life is

altogether slower, children are allowed to be children for much longer than

today, (in fact “the teenager” is still a relatively new phenomenon), and

male and female roles are much more clearly – and stereotypically - defined.

Martins’ reputation for friendly and helpful staff comes from its

careful choice of employee, and firm regulation of the staff of the

Bank.

In return for loyalty and integrity, staff

are well looked after in practically every way APART from good pay (many

staff struggle on very low earnings), and although it is possible for women

to get on, there is a clear bias towards the care and nurture of the male

staff. Whilst our “the nicest

people…” sub-headings below are NOT produced by the Bank, they are a fair

summary of some of the rules imposed at the time…

It is only fair to remember that these are

the times when ALL employers can discriminate between the sexes, and that

Martins conditions are otherwise excellent, with a real spirit of care

being shown from above for everyone.

Former staff still speak of a family atmosphere, and managers who

were “father figures”. This

newspaper ad campaign in the 1960s on the theme of “the nicest

people work at Martins Bank”, features smiling young ladies looking happy

relaxed, and lucky to be with the bank.

In the early 1960s, the bank explores the

use of computers almost as a “replacement” for the hard-working young women

clerks many of whom work for only a few years before they have to leave to

get married. Whilst it seems today

to be a stark choice – stay at work and get on, or leave to get married and

have children, this is the choice across a wide section of British

industry. At Martins, many women do

stay on and find progression within the bank, even if they are still

several steps behind their male counterparts.

|

Image © Barclays (Re-mastered)

|

|

Abiding by the rules…

|

|

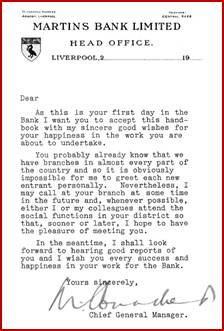

By the time

governments and employers begin to take equal pay and conditions more

seriously, Martins has all but been absorbed into Barclays, and the early

1970s will bring the necessary legislation…What better way to be welcomed

into the bosom of the Bank that goes to extremes to be helpful, than with

your own personalised induction handbook, signed by Mr Connacher (Chief

General Manager of the Bank) himself!

The booklet reminds you of the history and tradition of the bank

you are about to work for, and in case you are in any doubt of the

calibre expected of you, it continues -

“WHEN you first came for your interview, you may have felt

somewhat overpowered at the thought of working for a bank, and so the

first thing we want to say to you is that you are a very important person

in our scheme of things”}…{ Banks have come to mean strength, solidity

and uprightness in an unstable world.

They owe this reputation to the men who have guided them and

worked for them.”

- before going on

to appraise you of the salary scales, holidays and other benefits you can

expect in return for your hard work. Women in Martins face a vastly

different career path their male counterparts. Even into the mid-1960s,

women are expected to leave the bank upon marriage, and salary scales are

different according to gender.

|

|

|

In today’s world, where it is normal to stay in a job for a short

time before moving on to the next one, we love the idea that Martins Bank

thought their new entrants might feel “overpowered at the thought of

working for a bank”! All new entrants, whether male or female, are required

to sign a SERVICE AGREEMENT on entering the service of the Bank. More than an ordinary job contract,

it actually requires the new employee to think hard about the position they

are being given, and how important it is to follow and abide by the rules

in return. We have reproduced the text of Martins’ Service agreement below. It certainly leaves everyone knowing

where they stand, and, of course, what will happen if rules are bent or

broken….

MARTINS BANK LIMITED – SERVICE

AGREEMENT

{"In consideration of your taking

me into your service, I, (NAME)

of (ADDRESS) hereby undertake to serve you faithfully

during my engagement and to conform to the Staff regulations and all

general or specific directions as may from time to time be given to me by

you or on your behalf by the Chief General Manager or any other duly authorised

officer of your Bank.

My engagement is to be subject to your

right at any time forthwith to determine it on the grounds of misconduct,

or, in any other case, upon your giving me one calendar month's previous

notice in writing, or in lieu of such notice, paying to me one months

salary, and subject to my right to determine the said engagement at any

time upon giving you one calendar months previous notice in writing.

In the event of my leaving your

service, I will not, without your written consent, during a period of five

years from the time of my so leaving, accept or undertake any engagement or

service which shall involve or result in my being employed by any other

bank, banking company or banking firm, within a radius of ten miles from

any branch or office of your bank in which I shall have been employed at

any time during the last five years of my service with you, but it is

understood that my engagement or employment by any bank, banking company

or banking firm carrying on business beyond the radius aforesaid, and

having branches within the radius, shall not be deemed to be a breach of

this undertaking, provided that such engagement or employment shall not

involve my residing, or carrying on business, or exercising my employment

within such radius.

I further undertake and agree that in

the event of any breach by me of the provisions of the last preceding

clause hereof, I will pay to you on demand as and by way of liquidated

damages, the sum of £1,000, which

sum you shall be at liberty and are hereby expressly empowered to receive

against me as liquidated damages, and without prejudicing or in any way

affecting your right to restrain, by injunction or otherwise, any such

breach, or to exercise and enforce any and every other remedy which may be

available to you, either at law or in equity by reason or in respect of any

such breach.

I further agree and declare that I

will observe the strictest secrecy on the subject of all transactions of

your Bank with its customers, or with any other person or persons, or

bodies corporate or politic whatsoever, and that I will not reveal or make

known either directly or indirectly to any person whomsoever, whether a

shareholder or otherwise, the state of any account, or any other matters

or concerns of the Bank, its Customers, Shareholders, Directors and Staff,

unless required by you to do so, or by and under the direction and

authority of a Court of Justice, and I further undertake that I will

consider this declaration to be binding upon me after I shall have ceased

to hold an appointment in your Bank.

Yours faithfully…”}

x

Staff Training…

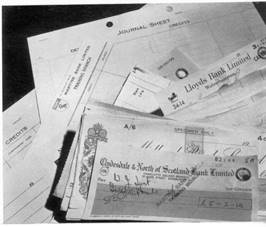

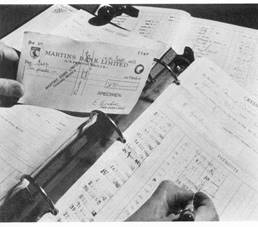

The training of staff is of extreme

importance to Martins, as it will of course create those “nice people”

whose customer  service skills are

second to none, and whose knowledge will be deep and wide. Cashiers

and Securities Clerks are trained using realistic materials such as those below. Training is seen as personal betterment,

and photographs of successful candidates are published in Martins Bank

Magazine. Whilst courses are provided for both men and women, these are

largely segrgated – the men being groomed as management of the future, and

women, bound by the Bank’s own rule that they must leave upon marriage,

being trained in the execution of day to day procedure, and the operation

of office machinery. service skills are

second to none, and whose knowledge will be deep and wide. Cashiers

and Securities Clerks are trained using realistic materials such as those below. Training is seen as personal betterment,

and photographs of successful candidates are published in Martins Bank

Magazine. Whilst courses are provided for both men and women, these are

largely segrgated – the men being groomed as management of the future, and

women, bound by the Bank’s own rule that they must leave upon marriage,

being trained in the execution of day to day procedure, and the operation

of office machinery.

|

|

|

|

|

|

For

many course Candidates, these training materials are their first contact

with the world of banking

|

|

The male managers of the

future, hard at work at

the North Eastern training

school…

|

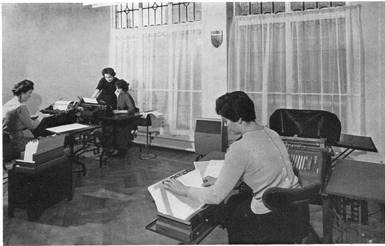

…whilst those young girls at

Machine school learn how

to make those “wonderful

machines do the donkey work”

|

|

EQUAL opportunities?

|

|

Within the extensive staff records held by

the Archive, reference to successful women in Martins is scarce, and it is

also rare to find a woman’s name that isn’t prefixed with “Miss”. There are even one or two examples where

women have been allowed to stay in the bank following marriage, but they

are using their MARRIED surname prefixed by “Miss”. Otherwise, men

feature as the preferred gender for “getting on” in the bank. In some areas of the country, staff

canteens are segregated in to men’s and girls’. All available images of

training centres feature men becoming the managers of tomorrow.

Whilst holiday entitlement is broadly

equal, the qualifying salary for four weeks’ annual leave is greater for

men than it is for women, but it will take women much longer to achieve

that particular salary which gives some idea of the disparity of pay. The smiling lady in the advert tells us “My pay

is quite good”. At age 16, it is

equivalent to £ 3.94 per week!

It seems that men and women are equal until the

magic age of 23, at which point pay for male clerks starts to rise more

each year than it does for female clerks. In addition, the men are reminded

of how special they are, with the incentive of special “merit” awards of

extra salary increase to reward good work and encourage more of the same. Men do

NOT, however, have things all their own way, (and once again the word

“marriage” comes into it) as we shall see later on…

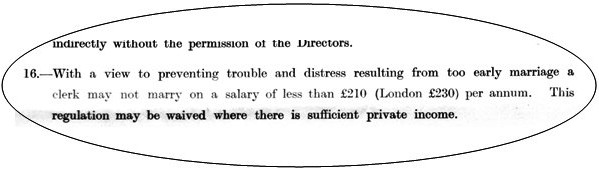

The list of rules for male clerks is long and

detailed, a sort of list of commandments that include the compulsory study

for Bank Exams, being forbidden from going overdrawn, being forbidden from

gambling in any way shape or form, AND being forbidden from getting married

until your salary has reached a certain level. The Bank’s aim is that those who marry

should not get into financial difficulty as a result. Staff with money troubles are seen as an

embarrassment, and although generous housing loans can sometimes be made

available, not everyone will qualify…

|

|

|

|

The extract shown above is from 1937. What makes regulation No 16 even more

astonishing, is that it still exists in 1965! Perhaps male clerks are spending too much

of their hard earned cash on the “Swinging London” experience, and cannot

therefore afford to keep a wife?

The waiver for the regulation – having sufficient income of your own

– is further hampered by regulation No 15, which forbids men from engaging

in any trade, profession or business, either directly or indirectly,

without the permission of the directors of the Bank.

A generous package of benefits…

In 1960 Martins Bank Staff Association and the Bank

jointly issue a booklet entitled “Inside Information”, designed to help

staff understand not only the rules and regulations that go with working

for Martins, but also the various benefits that such employment

carries. This mixture of benefits

and insurance goes some way to making up for low pay. The Staff Association

is the nearest thing to a trade union the staff of Martins will ever have.

|

|

|

|

|

|

|

|

|

STAFF ASSOCIATION PERSONAL ACCIDENT SCHEME

All

staff covered at no cost to themselves are covered for the following:

In

the event of accident causing: -

|

Death

|

£1000

|

|

Loss of two limbs, two eyes, or one

of each

|

£1000

|

|

Loss of one limb or one eye

|

£500

|

|

Temporary total disablement up to 13

weeks

|

£ 1-5-0 per week (£1.25)

|

STAFF ASSOCIATION HOLIDAY SAVINGS FUND

Members

agree to pay a fixed monthly sum by standing order, and at any time in the

year they can withdraw the total of twelve payments in one go to pay for a

holiday.

The

scheme also allows payment of rates and certain other bills.

SATURDAY MORNING LEAVE

Management

are expected to allow all members of staff at least one Saturday off in

every four, and more where this can be accommodated. Time off during the week is an

alternative, but many people will never achieve a five-day working week

whilst working for Martins.

STAFF INTEREST RATES

·

SAVINGS

In return for not being allowed to

bank anywhere else, staff are paid 4% on their current account balances up

to £100), minimum of 2½% up to the next £1000, and standard deposit account

rate on anything above £2000.

·

STAFF LOANS

|

|

Ordinary Advances

|

3%

|

|

|

House Purchase loans

|

2½%

|

|

|

Personal Loan

|

4%

|

LONDON ALLOWANCE

|

|

In addition to basic salary

|

£60 pa

|

|

OVERTIME

1/6d%

on each complete £100 of salary.

Minimum

6/- (30p)

Maximum

15/- (75p)

(This

is complex by anyone’s standards today, so here’s how it works:

1/6d

= £0.075. On a salary of £460pa,

£400 will count towards the calculation: 4 x 1/6d = 6/- (30p). £460pa is around 22p per hour, and

overtime will be 30p per hour.

You

cannot not be paid overtime until you have worked more than 8½ hours. Working 8 hours 29 minutes results in NO

overtime. This situation continues until the late 1980s, when Barclays

finally relents and pays overtime after the first 20 minutes! The profit to

the bank of these 29-minute unpaid periods probably ran into tens of

thousands of pounds over the years.

INSTITUTE OF BANKERS EXAM GRATUITUES

|

Diploma Exam Part I

|

£30

|

|

Banking Diploma Part II

|

£60

|

|

Trustee Diploma Part II

|

£60

|

|

Text Book Allowance…

|

|

|

…Banking Exams

|

Six Guineas (£6.30)

|

|

…Trustee Exams

|

Six Guineas (£6.30)

|

|

Additional Relevant Exams

|

80% of total expenses incurred

|

STAFF RESTAURANTS

Subsidised

meals at nine locations in England Wales the Channel islands and the Isle

of Man

LUNCHEON ALLOWANCE

for

relief staff away from normal office 3s 6d per day tax free (17 ½p)

RAC MEMBERSHIP SCHEME

Reduced

Rate Membership

|

|

Car

|

£1. 11s. 6d. pa (£1.57½p)

|

|

|

Motor Cycle

|

£1.

5s. 6d. pa (£1.27½p)

|

|

|

Lengths

ahead!

We are indebted to

Martins Staff Member and friend of the Archive, Dave Baldwin, for

preserving the first of the following advertisements from his school

magazine. These ads are part of

Martins’ 1966 recruitment campaign…

|

|

|

|

|

|

Desperate times call for

desperate measures…

|

|

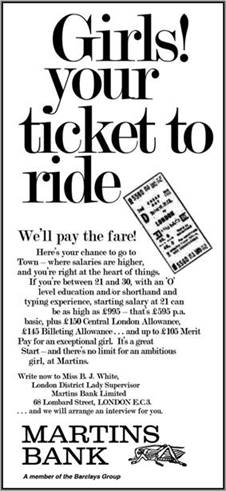

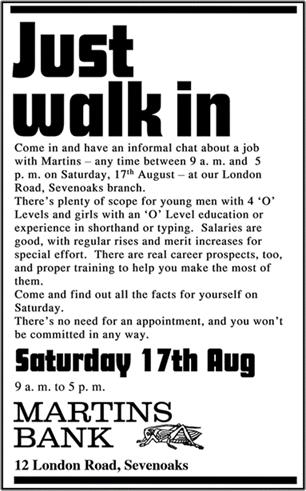

Before we leave the subject of the

recruitment and retention of staff, we wanted to include two more

advertisments – this time restored from the Martins Bank Archive Collection

– which show how sexist the jobs market still was in the late 1960s. With

almost full employment, it was difficult for companies to recruit or retain

school leavers and those in their twenties who could easily walk from one

job into another.

These ads are both from 1968.

“Ticket to Ride” gives a rather foggy nod to a Beatles hit of the same name

from three years earlier. It offers girls the chance to move to London and

to be “at the heart of things”. Today it seems that the only thing women

needed was the ability to type, and a fondness for partying. The second

advert is almost a plea from Martins Bank at Sevenoaks for young people to

come in and ask for job. Just compare what the bank expects by

way of qualifications in young men with those of women. Equal rights of

employment are still more than five years away from becoming law.

All this is, of

course more than fifty years ago, but in these more “enlightened” times of

the twenty-first century, we find the phrase “there’s no limit for an

ambitious girl at Martins” more than a little creepy…

|

|

|

|

|

|

|

|

M M

|

![]()

![]()