<<,,,,

|

THIS FEATURE HAS BEEN COMPILED WITH THE GENEROUS

ASSISTANCE OF OUR FRIENDS AT THE ARCHIVES OF BARCLAYS, COUTTS, HSBC, LLOYDS AND THE ROYAL BANK OF SCOTLAND. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

A look at the competition…

|

Image © Martins Bank Archive Collections |

Image © Martins Bank Archive Collections |

||||||||||||||||||||||||||||||||

|

The result is a hotchpotch of computers, cash machines,

drive-in or mobile banks, but it is all a good testing ground for the

future. That no bank could predict the

demise within fifty years of the High Street Branch is not surprising at a

time when more and more branches were being opened, and existing ones rebuilt

or extended. This is also that strange point in technology history when

computerisation actually results in MORE, rather than fewer staff. A gentlemens agreement between the clearing

banks is responsible for keeping every one of them off our television screens

for most of the 1960s, with an individual bank’s advertising restricted to newspapers

and magazines, and joint initiatives such as recruitment to the banking

industry being allowed as cinema advertisements or short films available to

schools and colleges. Even a mid-sixties TV ad “The Bank Manager” is a

jointly produced affair with no individual bank featured or named. In this

feature, we take a look at the ten clearing Banks in competition with Martins

Bank in the 1960s, by looking at their history, their Branches, and at what

happened to many of them in the great banking reshuffles of 1969/1970.

|

||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

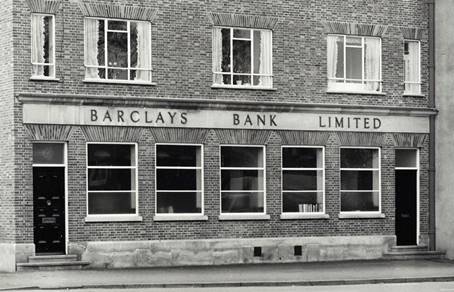

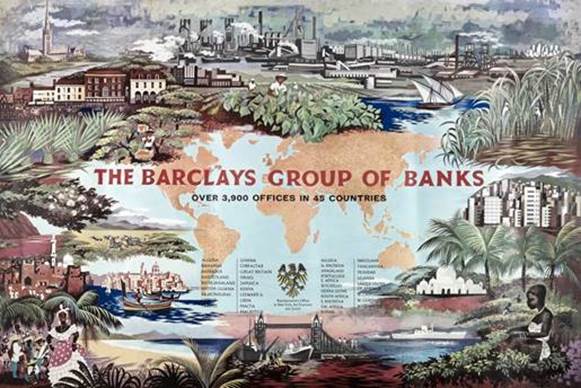

Main

text, logo and branch images reproduced by kind permission of Barclays Group

Archives

|

Click

on the Barclays logo to read much more about the history of Barclays and

its constituent Banks at Barclays Group Archives… |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

The two world wars saw women working in banks in

significant numbers for the first time. Their employment continued to

increase throughout the 1950s, until, by 1962, Barclays employed more women

than men. Increased mechanisation and technology also |

||||||||||||||||||||||||||||||||||

|

Text,

logo and branch images reproduced by kind permission of Coutts Brand

Communications

|

Click

on the Coutts logo to visit their website |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Coutts

was founded in 1692 by a Scottish goldsmith, John Campbell, who set up shop at

the sign of the Three Crowns on the Strand in London. As a goldsmith-banker

he built a distinguished clientele from the nobility and military, headed by

his kinsman the 1st Duke of Argyll. In 1708, a fellow goldsmith,

George Middleton from Aberdeen, became a partner and in 1712 married

Campbell’s daughter, Mary. Middleton took on the running of the business at

John’s death in 1712. In 1720, Middleton temporarily stopped payment due to

the 1720 financial crisis but was back in business by 1723 and took his

brother-in-law, George Campbell as a partner in 1727. Middleton’s nephew

David Bruce joined them in 1744.

The

business moved to 59 Strand in 1739 and Middleton died in 1747, by which time

the goldsmithing side had discontinued. In 1755, James Coutts married John

Campbell’s granddaughter and the Bank became known as Campbell & Coutts.

In 1761, Thomas Coutts joined his brother James and their partnership

continued until 1775, when James retired through ill-health. The Bank took

the title of Thomas Coutts & Co and by 1800 its customer list was

wide-ranging and distinguished, including royalty. The business of Davison,

Noel, Templer, Middleton & Wedgwood was acquired in 1816.

When Thomas died in 1822, his half-share in the Bank

was passed to his widow, Harriot and it was renamed Coutts & Co. In 1837,

on Harriot’s death, her fortune was left to Thomas’ youngest grandchild,

Angela Burdett, who later became Baroness Burdett-Coutts. The business of

Hammersley, Greenwood & Brooksbank was taken over in 1840 and Coutts was

by this time one of the leading private banks in London. Successive

generations of the same families became partners. In 1892, Coutts became an unlimited

liability company in response to the various banking crises. It moved to 440

Strand in 1904, where it remains today.

|

1969 – Coutts Head Office at 440 Strand, London Image reproduced by kind

permission of Coutts Brand Communications

© 1969 |

|||||||||||||||||||||||||||||||||

|

The acquisition of Robarts, Lubbock& Co of 15

Lombard Street in 1914 gave Coutts its first branch and a seat in the

Clearing House. In 1920, Coutts

affiliated with the National Provincial & Union Bank of England Ltd but

retained its identity, own Board and ways of working. Branches were opened in

the West End and in 1961 the first out-of-town office opened at Eton. At the

end of the 1960s, Coutts became part of the newly-created National

Westminster Bank and during the 1970s the old interior at 440 Strand was

remodelled, retaining the original Nash facades. The Coutts Group was formed

in 1990 from HandelsBank NatWest and Nat West International Trust Holdings

Ltd, giving Coutts more opportunities in more jurisdictions. When Nat West

was acquired by RBS in 2000, Coutts became the private banking arm of the new

Group. The strategic focus today is to provide exceptional private banking

and wealth management to clients in the UK.

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

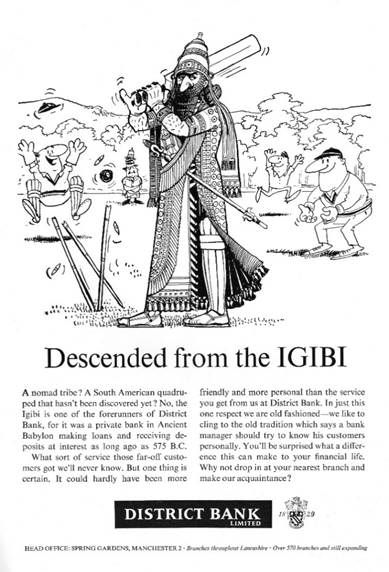

Main text and logo images

reproduced by kind permission of RBS Archives

|

Click

on the RBS logo to read more about the District Bank at

the Royal Bank of Scotland Archives, heritage section…

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

This joint stock bank

was promoted in 1829 by Joseph Macardy, a Manchester stockbroker, originally under

the name District Union Banking Co. Before it commenced business in December

1829 it was renamed Manchester & Liverpool District Banking Co and

acquired the Stockport private bank of Christy, Lloyd & Co. The bank's

Manchester office, initially in Norfolk Street, moved to Spring Gardens in

1834. Branches were opened in Oldham, Liverpool and Hanley in 1830 and by

late 1833 17 branches existed. Nantwich & South Cheshire Joint Stock Bank

was acquired upon its failure in 1844, followed by Loyd, Entwisle & Co of

Manchester in 1863 and J, J & G Alcock of Burslem in 1865.

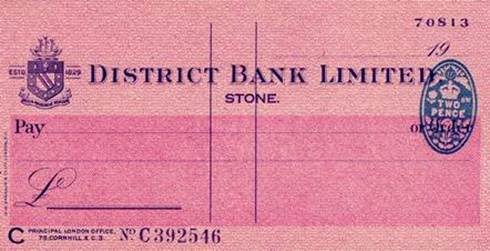

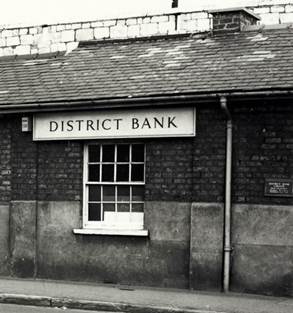

October 1946 – Cheque, District Bank Stone, Staffordshire Image © Martins Bank

Archive Collections |

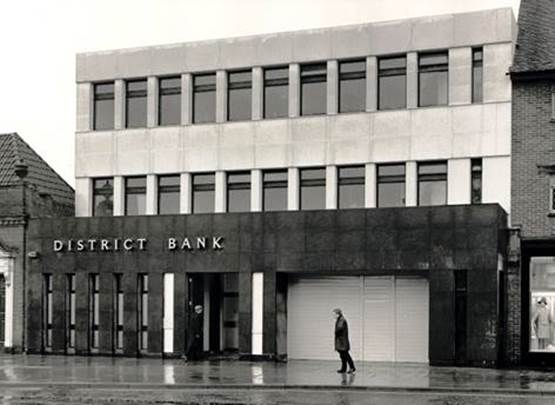

1967 - District Bank Ltd Solihull Image reproduced by kind

permission of RBS Archives © 1967

By

1880, when the bank acquired limited liability, becoming Manchester &

Liverpool District Banking Co Ltd, it had 54 branches and sub-branches in

Lancashire, Cheshire, Derbyshire, Shropshire, Staffordshire and Yorkshire. In

1881 Southport & West Lancashire Banking Co was acquired. |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

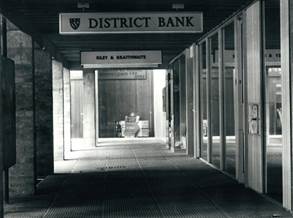

Image © Martins Bank

Archive Collections |

1968 Lancaster University Image © Martins Bank Archive

Collections 1960 York Cattle Market Image © Barclays

|

The bank opened an

office in London in 1885 and in 1891 acquired William, John & Thomas

Brocklehurst & Co of Macclesfield. Branches continued to be opened in the

north-west and Wales and Lancaster Banking Co and Bank of Whitehaven were

acquired in 1907 and 1916 respectively.

The bank was renamed

District Bank Ltd in 1924, a title by which it had long been popularly known.

A second office was opened in London in 1925. In 1935 the business

amalgamated with County Bank, a Manchester-based bank with a network of 190

branches, creating a merged bank with a paid-up capital of £3 million.

In 1936 it was admitted

to the London Clearing House. By the

late 1930s a number of branches had been opened east of the Pennines, in the

Midlands, southern England and Wales. This expansion of the network resumed

after the Second World War. In 1962

the bank was acquired by National Provincial Bank, but it continued to

operate independently until 1968, by which time it had 570 branches. |

||||||||||||||||||||||||||||||||

|

In

1968 National Provincial Bank announced plans to merge with Westminster Bank.

Extensive preparations were made, and from 1 January 1970 the three merging

banks' names disappeared from the high street, being replaced by National

Westminster Bank.

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Main

text and logo images reproduced by kind permission of RBS Archives |

Click

on the RBS logo to read more about Glyn, Mills & Co at

the Royal Bank of Scotland Archives, heritage section…

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Founded by three City

gentlemen - Joseph Vere, Richard Glyn and Thomas Hallifax - this private bank

opened at 70 Lombard Street, London in 1753, trading as Vere, Glyn &

Hallifax. By 1800 the bank had moved to Birchin Lane. It prospered,

developing a large business as London agent for many of the growing

provincial banks, providing banking facilities for more than 200 of the new

railway companies and handling the important Canadian financial agency. In

1841 Glyn, Mills took over many of the customer accounts of Ladbroke & Co

upon that bank’s closure and from 1851 was known as Glyn, Mills & Co. In

1864 it acquired the business of Curries & Co, and was restyled Glyn,

Mills, Currie & Co. In 1885, with a paid-up capital of £1 million, Glyn,

Mills became the first private bank to publish a half-yearly balance sheet,

registering as a joint-stock company under the title of Glyn, Mills, Currie

& Co with a capital of £1½ million. In 1890 it played a major role in

preventing the collapse of merchant bankers Baring Brothers, thereby saving a

number of London's financial institutions from ruin. By that time the bank

had established many international links and was handling share issues for

major companies and governments at home and abroad. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

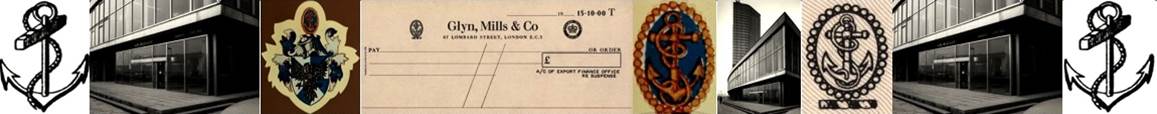

Glyn, Mills & Co’s

futuristic branch at London’s Millbank, and (below right) a cheque from the

Lombard St head Office… Images Reproduced By kind

Permission Of RBS Archive © |

|

||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

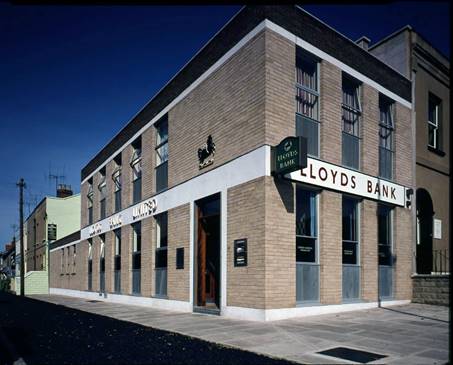

|

Main

text and logo images reproduced by kind permission of Lloyds Banking Group

Archives

|

Click

on the Lloyds logo to read more about Lloyds Bank at

Lloyds Banking Group Archives …

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

The firm of

Taylors & Lloyds opened as a private bank in Birmingham, in June 1765. It

was founded by John Taylor, Sampson Lloyd and their two sons. Taylor was a

Unitarian and a cabinet maker, Lloyd a Quaker and iron founder. The bank they

established was one of the first in Birmingham. It was essentially a town

bank, with a strong manufacturing and mercantile customer base. Under the

prudent eyes of successive partners, the business prospered for nearly 100

years from a single office. During this period, Birmingham became the

powerhouse of the Industrial Revolution, and was known as the ‘workshop of

the world’. Taylors & Lloyds played a prominent role in financing trade

and industry in the town.

|

||||||||||||||||||||||||||||||||||

|

The bank was

particularly active in the manufacturing and engineering sectors. The

association with the Taylor family ended in 1852, when John Taylor’s

great-grandsons opted for the life of country gentlemen, in preference to

banking. The firm's name was changed to Lloyds & Company. New

legislation, coupled with a need for increased capital, led Lloyds to convert

from a private bank to a joint-stock company in 1865. its name changed once

again; it was now Lloyds Banking Company Limited.

The move was

part of a general trend in banking, and provided Lloyds with a much broader financial

base. Instead of being run by the firm’s three partners, the bank now had a

board of directors. These included not only members of the Lloyd family, but

other prominent local businessmen too. Among these was a young Joseph

Chamberlain. He went on to become

Mayor of Birmingham, an MP and a member of William Gladstone’s Cabinet. He

was also the father of future Prime Minister, Neville Chamberlain. The

conversion to joint-stock status resulted in an explosion of growth. More

than 200 banks were taken over, directly and indirectly, in the next 50

years. |

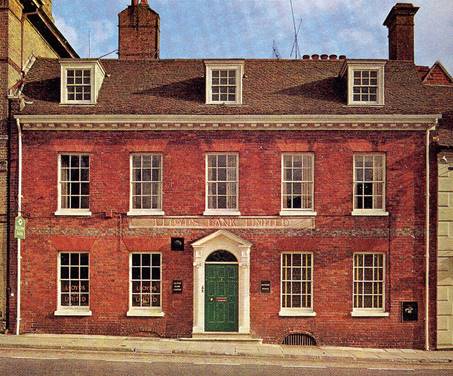

1962 Lloyds Bank

Alresford Branch Image reproduced by kind

permission of Lloyd Banking Group Archives © |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

1965 Lloyds Bank

Rochdale Branch Interior Image reproduced by kind

permission of Lloyd Banking Group Archives © |

In the 1880s, Lloyds, already a powerful

force in the Midlands, turned its attention to London. In 1884, it absorbed

the Lombard Street bank of Barnetts, Hoares, & Co. This acquisition is of

particular significance because it brought about the connection with the

black horse.Although this symbol had most recently been used by Barnetts,

Hoares & Co., its origins date back much further: the sign of the black

horse was first recorded as hanging above the shop of Humphrey Stocks, a

Lombard Street goldsmith, in 1677.

Other important London takeovers

included that of Twinings Bank, in 1892. This had grown out of the

world-famous Twinings Tea Company. The following year, Lloyds acquired

Herries, Farquhar & Co. which, in the late 18th century, had invented the

traveller’s cheque. The first half of the 20th century marked a period of

significant change for Lloyds, on many different levels. |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

It continued its domestic growth, taking

over banks large and small; it began its expansion overseas; its workforce

changed beyond recognition, with the employment of women in large numbers

during the First World War; and its accounting systems, largely unchanged

since the 17th century, were transformed by mechanisation. |

||||||||||||||||||||||||||||||||||

|

In 1918, Lloyds undertook what was to be

its biggest takeover until the merger with TSB, some 80 years later. It

acquired Capital & Counties Bank. This latter was itself the result of

the amalgamation of two banks, the Hampshire Banking Company and the North

Wilts Banking Company. Through the takeover, Lloyds gained an additional 473

branches – an increase of 53%. This secured Lloyds' position as one of the

‘Big Five’ high street banks. Two more significant acquisitions followed. In

1921, Lloyds took over the Somerset bank of Fox, Fowler & Co. This was

the last provincial bank in England and Wales to issue its own banknotes,

which it had done continuously since 1787. It only ceased with the takeover.

The second acquisition, in 1923, was that of army agency Cox’s & King’s. Previously known as Cox & Co.,

this firm served as banker to the armed forces. During the First World War it

had engaged in massive expansion. Its main office in Charing Cross, London,

also stayed open 24 hours a day. This allowed officers returning to and from

the Front to cash cheques, at any time of the day or night. In 1911, Lloyds

ventured overseas for the first time. It acquired the firm of Armstrong &

Co., which had offices in Paris and Le Havre. |

ca.1966 Lloyds Bank

Cheltenham Bath Road Branch Image reproduced by kind

permission of Lloyd Banking Group Archives © |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

1967 Lloyds Bank

Ashbourne Branch Image reproduced by kind

permission of Lloyd Banking Group Archives © |

This formed the basis

of what later became Lloyds Bank Europe. Seven years on, branches in

Argentina were acquired with the takeover of the London & River Plate

Bank. Lloyds merged this latter with the London & Brazilian Bank, in

1923, forming the Bank of London & South America (BOLSA). Lloyds

rationalised its overseas operations in 1971, by merging these international

subsidiaries. The integration of the two businesses, one covering Europe and

the other South America, was a major undertaking. Lloyds Bank International, as

it later became, was absorbed into Lloyds Bank itself in 1986. Mechanisation

of branch accounting procedures had begun in the late 1920s, but wasn’t

completed until 1962. Just one year later, Lloyds took its next giant step

and installed its first computer in a branch. In 1972, the first Cashpoint

machine was installed, in Brentwood, Essex. The early Cashpoints were very

similar to today’s ATMs. All the machines were online, issued variable

amounts of cash and immediately debited the amount from the customer's

account. The Cheltenham & Gloucester Building Society joined Lloyds Bank

in August 1995. |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

This was the first ever association

between a bank and a building society. Later that year, Lloyds merged with

TSB to create what was, at that time, the largest force in UK domestic

banking. The Lloyds Bank brand reappeared on the high street in 2013, when

Lloyds TSB once again became two separate banks. This followed a European

Commission ruling in 2009 which required the Group to divest part of its

business. More than 630 branches across Britain were brought together to form

the new TSB. |

Image © Martins Bank

Archive Collection |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

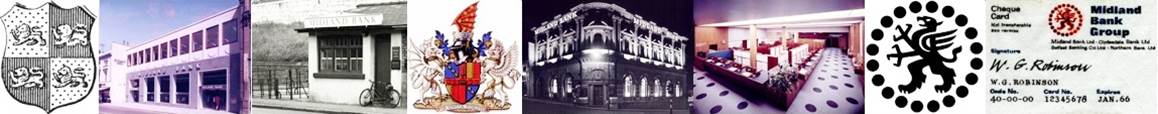

Main

text logo and some images reproduced by kind permission of HSBC Holdings PLC

(HSBC Archives)

|

Click

on the HSBC logo to read more about Midland

Bank at HSBC.com History …

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

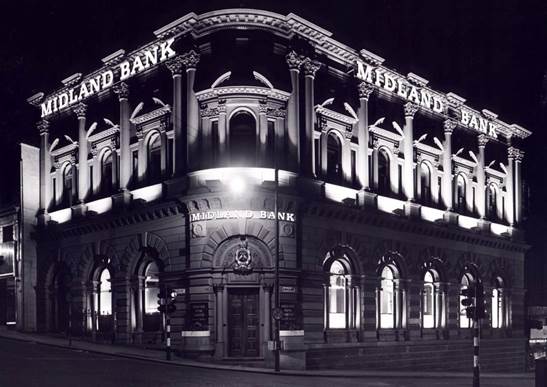

Birmingham

was a remarkable hive of enterprise in the early nineteenth century. The

region was the homeland of the industrial revolution, with hundreds of

businesses, factories and manufacturers busily creating jobs and wealth. It

was to serve this community that a new bank was born in 1836 - the Birmingham

and Midland Bank, forerunner of today’s HSBC Bank plc.

Birth of the bank

Charles Geach - then just 28 years old – spotted the

opportunity to establish a new bank. With support from the local business

community, he left his secure position at the Bank of England’s Birmingham

branch to become manager of Midland’s first office at 30 Union Street,

Birmingham on 22 August 1836. Midland prospered in its early years and the

first year’s profit totaled over £3,000. Only eighteen months later, the bank

moved to new and larger premises higher up Union Street on the corner of

Little Cherry Street. |

The Midland

Bank Coat of Arms © HSBC

Holdings PLC (HSBC Archives) |

|||||||||||||||||||||||||||||||||

|

These new premises cost £6,300 and even incorporated

a handsome house that was intended for Mr Geach’s private use. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

1962 -

Midland Bank Bradford Kirkgate © HSBC

Holdings plc (HSBC Archives)

|

Early

years and expansion The

bank forged close relationships with local businesses and developed lasting

connections with major commercial houses over the following decades. This

meant that it emerged from the successive financial crises of this period

with a strong and loyal customer base. Midland also acquired its first branch

in 1851 when it purchased the ‘Stourbridge Old Bank’ of Bate and Robbins.

With business booming, the premises at Union Street became too small to cope.

A new head office was commissioned on the corner of New Street and Stephenson

Place and on 26 July 1869 Midland moved into its new home right in the heart

of Birmingham. By the mid-1870s Midland was the second-largest bank in

Birmingham. The strength of the local economy was an important ingredient in

its success, and in the following decade the bank opened branches across the

midlands to increase customers and business within this heartland. In 1890,

the bank was ready to expand into new pastures and acquired two Leeds-based

banks. |

|||||||||||||||||||||||||||||||||

|

This raised the total number of branch offices from

3 to 45 in the space of a decade.

Birmingham to London

|

||||||||||||||||||||||||||||||||||

|

In

the 1890s the bank took an important step with a move to the world’s leading financial

centre - the City of London. London acted as a powerful magnet in the banking

world at this time and British and European banks were all keen to be

represented there. Midland gained ten London branches in 1891 when it

acquired the Central Bank of London. However, it was the purchase of City

Bank in 1898 that transformed Midland into a leading London bank and prompted

the move to new grand headquarters in Threadneedle Street. Under the

direction of Edward Holden, Chairman and Managing Director, the bank

conducted a succession of amalgamations from its new London base over the

next two decades. By 1918 no less than 30 banks had been bought up, and

through these acquisitions, Midland had indirectly inherited the business of

over 100 banking firms across the country. Midland was now ranked the biggest

bank in the world - a position it was to hold until 1948. During the First World War the bank had to

cope with many changes in its labour force. Over 4,000 of its 9,000 staff

bravely served during the war, and to make up the shortfall behind the

counters the bank began to employ women in large numbers for the first time. |

Midland Bank

Book Style Moneybox Image ©

Martins Bank Archive Collections |

|||||||||||||||||||||||||||||||||

|

The

bank’s growth continued throughout the 1920s and 30s. Midland expanded its

branch network, concentrating particularly on fast-growing metropolitan and

suburban areas. By this time, the business had also begun to outgrow its head

office on Threadneedle Street. The bank was keen to build on a grand scale

and the architect Sir Edwin Lutyens, then at the height of his power and

reputation, was chosen to design the new building at Poultry. The result was

greeted as the outstanding City building of its time and dubbed ‘a palace of

finance’ by one contemporary expert. The onset of the Second World War halted

any further growth and brought widespread destruction to the branch network,

with over 1,350 reports of damage from aerial bombing across the UK. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

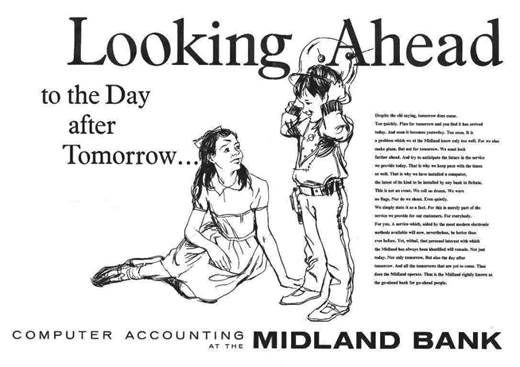

1964 –

Advertisement for the computerisation of accounts © HSBC

Holdings plc (HSBC Archives) |

1962 - Midland

Bank West End Computer Centre © HSBC

Holdings plc (HSBC Archives) |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Recovery

and innovation Following the war, Midland made gradual steps

towards recovery. Credit restrictions and exchange controls severely limited

the scope for business expansion while official controls on building meant

that repair and replacement on war-damaged branches was delayed or postponed.

The ending of credit restrictions in 1958, however, ushered in a new phase in

British banking and Midland took this opportunity to strengthen its branch

network. By 1960 it had opened a total of 150 new branches.

Much of Midland’s post-war history was dominated by

innovation in the range of banking services it provided. Gift cheques,

introduced in 1955, were the first of their kind in the UK. Midland also

became the first British bank to advertise on television in 1956. Soon

afterwards in 1958, the bank pioneered non-secured personal loans which added

to Midland’s reputation as an innovator. |

1966 –

Innovation – Midland Bank Pioneers the Cheque

Guarantee Card © HSBC

Holdings plc (HSBC Archives)

|

|||||||||||||||||||||||||||||||||

|

After the launch, requests for loans poured in. In

the first week alone, £1 million was advanced to customers. The UK’s Prime

Minister, Harold Macmillan, wrote to Midland’s chairman: ‘You certainly put

the cat among the pigeons. I shall send my application in due course.’ |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

1966 – Inside and out: Midland Bank

Bedford © HSBC

Holdings plc (HSBC Archives) |

||||||||||||||||||||||||||||||||||

|

Modernising

Midland |

||||||||||||||||||||||||||||||||||

|

By the 1970s Midland was facing much larger rivals

in its domestic markets. With the banking market growing so rapidly the bank acknowledged

that the traditional branch office was no longer the most cost-effective way

of dealing with large volumes of business. Its response was a novel approach

that came well ahead of its contemporaries - central management teams were

transferred to new area offices while smaller branches were converted to

service branches dedicated to day-to-day customer business. This process

continued into the next decades, with the bank leading the way in automation

to improve the banking experience for customers, both within the branch and

enabling them to bank from their own homes. In 1989 Midland launched a

completely new kind of bank – first direct.

This was the UK’s first telephone bank, offering a full range of

services through its 24 hour telephone lines. It continues to win awards to this day for

its excellent customer service, products and innovation. |

1968 – Side by side at Carnforth Martins and Midland (with its new modern

signage) Image - Martins Bank

Archive Collections © ITV Studios (Granada TV 1968)

|

|||||||||||||||||||||||||||||||||

|

In 1992 HSBC Holdings plc acquired full ownership of

Midland Bank, in one of the largest acquisitions in banking history. Midland

was renamed HSBC Bank plc in 1999 and in 2003 bade a fond farewell to

Poultry. Head office was transferred across to HSBCs new global headquarters

in Canary Wharf in London’s Docklands. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Main

text and logo images reproduced by kind permission of RBS Archives |

Click

on the RBS logo to read more about the National Bank Ltd at

the Royal Bank of Scotland Archives, heritage section… |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

This bank was formed

as National Bank of Ireland in 1835. It was a joint-stock bank founded by a

group of MPs and other gentlemen, including Daniel O'Connell. Frustrated by

the exclusivity of the Bank of Ireland (est. 1783), and the English

orientation of the Provincial Bank of Ireland (est. 1825), the founders aimed

to form a bank both to provide capital for Irish economic development and to

serve the needs of small traders and tenant farmers, as well as those of the

gentry. The bank's head office was located in the City of London, at 39 Old

Broad Street and, although the majority of backers were English, the banking

business was carried on entirely in Ireland. The bank’s London agents were

Barnett, Hoares & Co, bankers of Lombard Street, City of London.

|

||||||||||||||||||||||||||||||||||

|

Lamie

Murray, manager of the bank, modelled the organisation on Thomas Joplin's

Provincial Bank of Ireland - a joint-stock bank with branches operating as

subsidiary companies, the shares being held partly by the parent bank and

partly by local people. By the end of 1835 the bank had opened 11 branches

and 18 sub-branches and an unsuccessful attempt had been made to establish a

subsidiary company in Belfast, as the Belfast National Bank of Ireland. By

May 1836 the bank had a paid-up capital of £374,140, of which £133,125 was

subscribed locally in Ireland. In 1837, however, owing to administrative

problems, the principle of the semi-autonomous branch was abandoned and the

capital consolidated. |

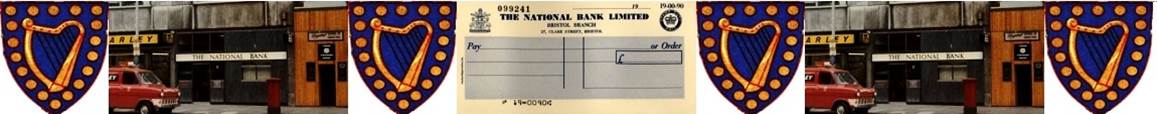

1960s National Bank – Leicester Belgrave Gate Branch Image reproduced by kind

permission of RBS Archives © |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

In 1845 the Irish

Banking Act ended the Bank of Ireland's monopoly in and around Dublin, and a

chief office of the National Bank in Ireland was immediately opened at 34 and

35 College Green, Dublin. The Act also

fixed the banknote issue of the National Bank at £852,269.In 1847 the

National Bank of Ireland also absorbed the London & Dublin Bank of

Dublin, regaining a number of branches which it had established in 1837 and

had had to dispose of because of their proximity to Dublin. In 1854 the bank

opened its first branch in England at 13 Old Broad Street in the City of

London, where the board had met since 1839. In 1856, the bank's name was

changed from National Bank of Ireland to The National Bank Ltd and, in 1859,

with a paid-up capital of £500,000, it was invited to join the London

Clearing House. The expansion of the London business continued, and, by 1888,

The National Bank was the eighth largest British bank in terms of authorised

(£7.5 million) and issued (£1.5 million) capital and only four other banks

had more branches in London. This growth was sustained with over 60 further

branches opened between 1888 and 1922. After the First World War the board,

preoccupied with warding off take-over bids and coping with problems caused

by the political and economic situation in Ireland, began to

consolidate. The depression of

agriculture had a detrimental effect on business, whilst the subsequent

establishment of the Irish Free State had implications for the bank's

shareholding, tax affairs and note issue. |

||||||||||||||||||||||||||||||||||

|

1960s National Bank Cheque – Bristol, Clare Street Image reproduced by kind

permission of RBS Archives © |

In 1922, therefore,

when a parliament was re-established in Dublin, the bank formed an Irish

board to manage the larger Irish side of the business. This did not however,

solve all of the bank's problems, rather they were further compounded by the

general economic recession of the 1920s and 1930s and the Second World War.

During the 1950s and

1960s, the expansion of the Irish economy provided much business for the

bank, but, by the mid-1960s, it was apparent that it was no longer

appropriate for such an important Irish bank to be controlled from London and

operate as a member of the London Clearing. |

|||||||||||||||||||||||||||||||||

|

In 1966, therefore,

the bank's business in Ireland was transferred to a new company, National Bank

of Ireland, and sold to Bank of Ireland (est. 1783). The 36 English and Welsh

branches passed to National Commercial Bank of Scotland, although The

National Bank, with a paid-up capital of £3 million, continued to operate its

branch network independently until 1970, when the branches became part of the

new Williams & Glyn's Bank.

Branches: The bank opened 44 English and Welsh branches and

sub-branches between 1835 and 1966, located in South Wales, London and other

key English cities such as Liverpool and Manchester. In 1970 there were 38

branches operating in England and Wales.

|

||||||||||||||||||||||||||||||||||

|

Main

text and logo images reproduced by kind permission of RBS Archives |

Click

on the RBS logo to read more about National Provincial Bank

Ltd at the Royal Bank of Scotland Archives, heritage section…

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

By 1865 the bank had

122 branches, many of which were established through the acquisition of small

private and joint stock country banks including: Rottons & Scholefields

of Birmingham in 1834; Bloxsome & Co of Dursley in 1835; Bristol City

Bank branch of Northern & Central Bank in 1835; Pyke, Scott & Co of

Barnstaple in 1836; Vye & Harris of Ilfracombe in 1836; William Skinner

& Co of Stockton in 1836; Husband & Co of Devonport in 1839;

Lichfield, Rugeley & Tamworth Banking Co in 1838; Harris & Co of

Dartmouth in 1840; Hulke, Dixon & Co of Deal in 1840; Fryer, Andrews

& Co of Wimborne in 1840; Fector & Co of Dover in 1841; Cole, Holroyd

& Co of Exeter in 1842; Pretor, Pew & Co of Sherbourne in 1843;

Loveband & Co of Torrington in 1843; Ley & Co of Bideford in 1843;

Isle of Wight Joint Stock Bank of Newport in 1844; Stockton & Durham

County Bank of Stockton in 1846; Thomas Kinnersly & Sons of

Newcastle-under-Lyme in 1855; William Moore of Stone in 1858; Crawshay,

Bailey & Co of Abergavenny in 1868; and David Morris & Sons of

Carmarthen in 1871. In 1866 a new head office was opened in Bishopsgate, City

of London, where the first London branch was also established, obliging the

bank to give up its note issue. Bank of Leeds Ltd was acquired in 1878

followed by County of Stafford Bank Ltd in 1899 and Knaresborough & Claro

Banking Co Ltd in 1903. |

||||||||||||||||||||||||||||||||||

|

1962 – National Provincial Ltd Portsmouth Image reproduced by kind

permission of RBS Archives © |

Limited liability was

assumed in 1880 as National Provincial Bank of England Ltd. Paid-up capital

grew from £450,000 in 1853, to £1.08 million in 1866, to £1.68 million in

1878 and to £3 million in 1905. By 1900 the bank had around 200 branches. A

half share in Lloyds Bank (France) Ltd was acquired in 1918. This bank was

renamed Lloyds & National Provincial Foreign Bank Ltd in 1919 and had

branches in London, France, Belgium and Switzerland. In 1918 National

Provincial Bank of England merged with the important Union of London &

Smiths Bank Ltd, which had over 230 branches, and was restyled National

Provincial & Union Bank of England Ltd. The new bank had over 700

branches and extended its geographical spread through the acquisition of W

& J Biggerstaffe of London in 1918; Sheffield Banking Co Ltd in 1919;

Bradford District Bank Ltd in 1918; Northamptonshire Union Bank Ltd in 1920;

Richards & Co of Llangollen in 1920; Shilson, Coode & Co of St

Austell in 1920; Dingley & Co of Launceston in 1922; Dingley, Pearse

& Co of Okehampton in 1922; and Guernsey Banking Co Ltd of the Channel

Islands in 1924. |

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

The important London

private bank of Coutts & Co was also acquired in 1920 and continued to

trade under its own name. The bank’s name was shortened to National

Provincial Bank Ltd in 1924. It continued to expand its branch network

between the wars and after 1945. It acquired North Central Wagon &

Finance Co Ltd of Rotherham, a leasing and hire purchase company, in 1958 and

Isle of Man Bank Ltd in 1961, the latter retaining its own name. In 1954

National Provincial Bank sold its holding in Lloyds & National Provincial

Foreign Bank Ltd. In 1962 it acquired District Bank Ltd, an important

regional bank which continued to trade under its own name, and in 1965 a

merchant banking subsidiary, County Bank Ltd, was formed. In 1968 the bank

announced its merger with Westminster Bank, but it continued to trade under

its own name until vesting day of National Westminster Bank in 1970.

|

||||||||||||||||||||||||||||||||||

|

Main

text and logo images reproduced by kind permission of RBS Archives |

Click

on the RBS logo to read more about Westminster Bank Ltd at

the Royal Bank of Scotland Archives, heritage section…

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

This joint stock bank

was established in Southwark in 1836 as Surrey, Kent & Sussex Banking Co.

Branches were almost immediately opened at Brighton, Canterbury, Croydon,

Lewes, Maidstone, Sevenoaks, Tonbridge, Tunbridge Wells and Woolwich. The

head office was moved to 71 Lombard Street, City of London, in 1837 and in

1839 the bank was renamed London & County Banking Co. In 1839 Jeffreys

& Co of Chatham was acquired, followed by Hopkins & Drewett of

Arundel in 1841; Hector, Lacy & Co of Petersfield in 1841; Ridge & Co

of Chichester in 1841; Halford, Baldock & Co of Canterbury in 1841;

Emmerson, Hodgson & Emmerson of Sandwich in 1841; Davenport, Walker &

Co (est. 1838) of Oxford in 1842; Wilmshurst & Co of Cranbrook in 1843; T

& TS Chapman of Aylesbury in 1844; and John Stoveld & Co of Petworth

in 1845. By 1845 the bank had over 40 branches.

|

||||||||||||||||||||||||||||||||||

|

Other acquisitions

quickly followed: Trapp, Halfhead & Co of Bedford in 1849; Berkshire

Union Banking Co of Newbury in 1852; Eddy & Squire of Berkhampsted in

1855; the business of the Western Bank of London in 1859; the business of

Robert Davies & Co of Shoreditch, London, which failed in 1860; Nunn

& Co of Manningtree in 1870; Vallance & Payne (est. 1800) of

Sittingbourne in 1888; and Hove Banking Co Ltd in 1891. By 1875 the bank had 150 branches, more

than any other British bank. Deposits grew from £84,700 in 1837 to £21.25m in

1872 and £46.16m in 1904, while paid-up capital expanded from £23,700 in 1837

to £500,000 in 1857 and £2m in 1883. Limited liability was acquired in 1866

and by 1904 there were 200 branches.

Frederick Burt &

Co Ltd of London, foreign bankers, was acquired in 1907. In August 1909 the

bank merged with London & Westminster Bank. In order to effect the

amalgamation London & County Banking Co was renamed London County &

Westminster Bank and acquired the assets and business of London &

Westminster Bank, which was then wound up. In 1909 London & County Bank

had 70 metropolitan branches and nearly 200 country branches, mostly south of

a line from Bournemouth, Dorset, to Clacton, Essex. |

1968 Westminster

Bank Stourbridge Image reproduced by kind

permission of RBS Archives ©

|

|||||||||||||||||||||||||||||||||

|

The bank's name was

shortened to Westminster Bank Ltd in 1923. The bank continued to expand

through acquisition, and its paid-up capital rose from £9m in 1923 to £40.5m

in 1935. Nottingham & Nottinghamshire Banking Co was acquired in 1919,

followed by the banks of Beckett & Co of Leeds and York in 1921, Stilwell

& Sons of London in 1923 and Guernsey Commercial Banking Co in 1924. By

1939 there were 1,100 branches. In 1968 the bank announced plans to merge

with National Provincial Bank. The two banks continued to operate separately

until 1 January 1970, when they became National Westminster Bank. In 1968 1,400 branches were operating. |

||||||||||||||||||||||||||||||||||

|

Main text and logo images reproduced by kind

permission of RBS Archives |

Click

on the RBS logo to read more about Williams Deacon’s Bank Ltd at the Royal

Bank of Scotland Archives, heritage section…

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

This joint-stock bank

was established in Manchester in 1836 as Manchester & Salford Bank by a

group of promoters keen to take advantage of recent legislation allowing the

formation of joint-stock banks outside London.

The bank had up to 15

directors and the issued capital was £1m, of which £252,100 was paid up by

December 1836. The first shareholders' meeting, in May 1836, took place in

temporary premises, but in August 1836 a banking house was rented in King

Street.

Land off Mosley Street

was later acquired and a new banking house completed in 1838. From the late

1850s the bank expanded rapidly. Branches were opened in nearby towns, a new banking

house in Mosley Street was built in 1862 and a number of local banking firms

were acquired: Heywood Brothers & Co of Manchester in 1874; Hardcastle,

Cross & Co of Bolton in 1878; and Clement Royds & Co of Rochdale in

1881. |

1964 WILLIAMS DEACON’S ADVERTISEMENT – Image © Martins Bank Archive Collections |

|||||||||||||||||||||||||||||||||

|

In July 1881 the

business was registered as a limited liability company, Manchester &

Salford Bank Ltd, and by December 1881 it had a paid-up capital of £757,480.

By the 1880s the number of private banks was declining and large clearing

banks with London head offices and nationwide branch networks had begun to

emerge. In 1890, with 47 branches, the

bank took over Williams, Deacon & Co, the bank’s London agent since 1836.

The new bank was renamed Williams Deacon & Manchester & Salford Bank

Ltd and the head office transferred to Birchin Lane, City of London, to

retain Williams, Deacon & Co's membership of the London Clearing

House. By the end of that year the

bank had a paid-up capital of £1m.

|

||||||||||||||||||||||||||||||||||

|

1969 – Williams Deacon’s Bank Ltd Swinton Image reproduced by kind

permission of RBS Archives ©

|

Profits increased

steadily during the last decade of the 19th century and, in 1901, the name of

the bank was changed to Williams Deacon's Bank Ltd, a less awkward title

which better reflected the broad geographical spread of the branches. In 1907 Sheffield & Rotherham Joint

Stock Banking Co Ltd was acquired, and after the First World War the bank's policy

of expansion was resumed and 52 new branches were opened between 1919 and

1922.

Around this time the

bank also established a new department for foreign business and was among the

subscribers to British Overseas Bank Ltd, which was set up to facilitate

British foreign trade. Facilities for trustees and executors were also

extended. The post-war boom was short-lived and swiftly followed by

widespread economic recession. Lancashire, where most of the bank's business

lay, was particularly badly affected, and during the mid-1920s the bank's

profits were severely undermined by increasing provision for bad debts. |

|||||||||||||||||||||||||||||||||

|

Williams Deacon's

urgently needed support from a larger partner, and in 1929, through the

offices of the Bank of England, The Royal Bank of Scotland made an offer for

the company's entire share capital.

Purchase terms, involving a transfer of shares, were finally agreed in

1930 and Williams Deacon's branches became the foundation of The Royal Bank

of Scotland's branch network in England. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

1960 to 1968: From Tradition to new

technology - So much can happen in a few short years…

|

||||||||||||||||||||||||||||||||||

|

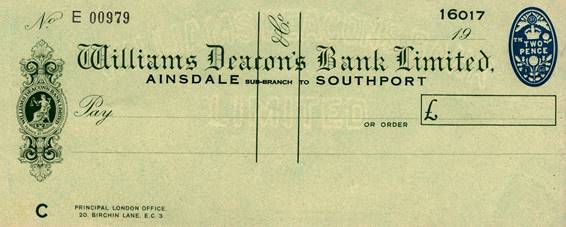

Image © Martins Bank

Archive Collections |

Left: Printed January 1960

Williams Deacon’s Bank Ainsdale Cheque |

|

||||||||||||||||||||||||||||||||

|

Right: Late 1960s Williams

Deacon’s 24 Hour Cash Card IMAGE REPRODUCED BY

KIND PERMISSION OF ROYAL BANK OF SCOTLAND ARCHIVES © |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

After 1930 Williams

Deacon's Bank continued to trade separately with its own Manchester-based

head office and board of directors. During the 1950s the directors decided to

widen the bank's geographical coverage and a number of new offices were

opened in the south, East Anglia and the Midlands. The growing importance of

the motor car was reflected in the launch of the bank's first drive-in branch

at Preston in 1959. During the following decade Williams Deacon's was amongst

the first of the clearing banks to recognise the potential of offshore

financial centres, and consequently established a number of offices and

subsidiary companies in the Channel Islands. |

Image © Martins Bank

Archive Collections |

Left: 17 July 1968,

Williams Deacon’s own “Bank on Wheels” at the Carlisle Show IMAGE KINDLY

DONATED BY DAVE J WATSON |

||||||||||||||||||||||||||||||||

|

A new head office

building was opened in Manchester in 1963.

By 1969 the bank had a paid-up capital of £5m. In 1969 The Royal Bank

of Scotland was restructured and Williams Deacon's became a direct subsidiary

of a new holding company, National & Commercial Banking Group. The

following year the holding company's subsidiaries in England and Wales -

Williams Deacon's Bank, Glyn, Mills & Co and the English and Welsh

branches of The National Bank - merged to form Williams & Glyn's Bank.

Branches: The bank opened 293 branches and sub-branches between 1836 and 1970,

located throughout England and Wales, but until the 1950s particularly

focused on the north west of England. In 1970 288 branches were operating. |

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

<,

,